Order-to-cash reconciliation

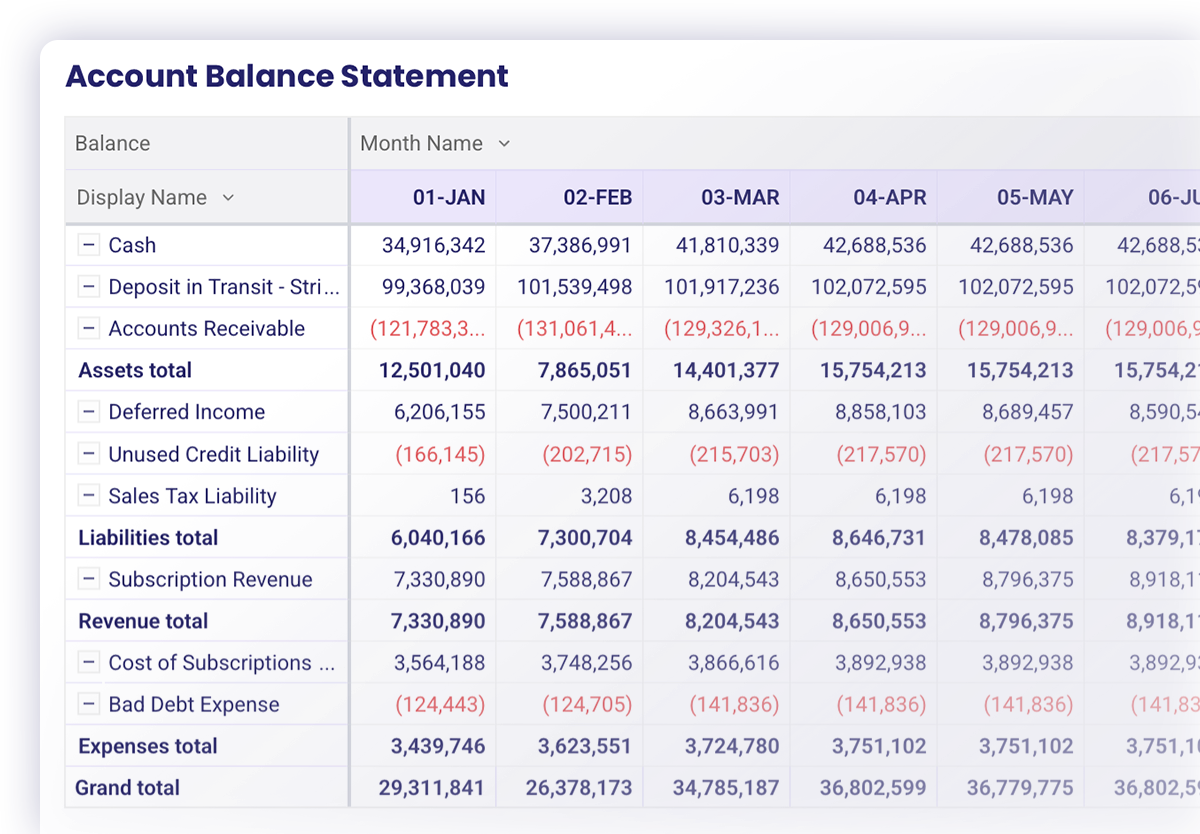

Take the pain out of revenue reconciliation with access to real-time operational data that’s automatically prepared as journal entries ready to be checked for accuracy and completeness.

Fast, accurate reconciliation with Leapfin

Order-to-cash reconciliation can be time-consuming and error-prone, especially when you’re generating high volumes of transactions with varied levels of discounts, products and plans, refunds, chargebacks, multiple payment and billing processors, etc. Adding more people and more spreadsheets will not solve the problem. Using a solution like Leapfin will help you automatically centralize and prepare all of this transactional data required to properly reconcile revenue and accelerate monthly close as your business grows.

Benefits of using Leapfin for reconciliation

Automatically consolidate operational data in a single system

Avoid the tedious work of reconciling every transaction with spreadsheet lookups and formulas. Instead, review consolidated, clean, automatically prepared journal entries in a single system whenever you need to.

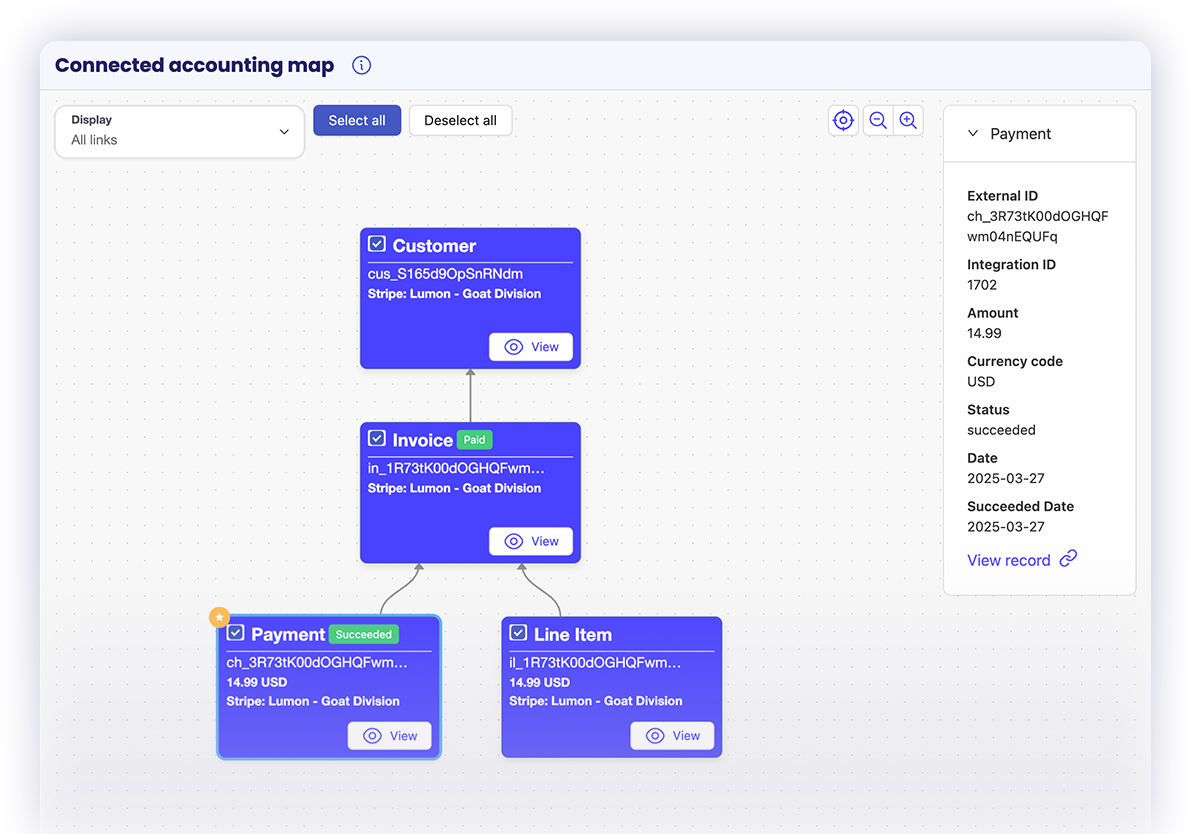

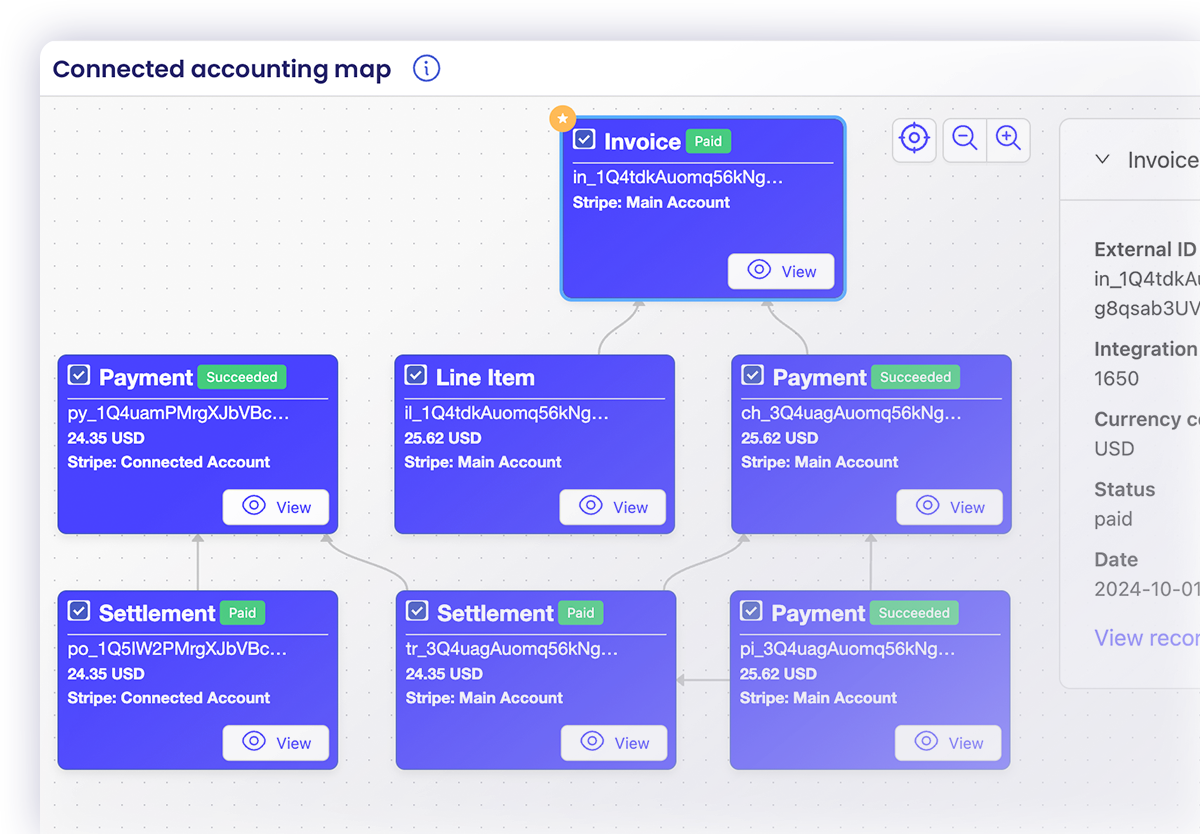

Easily see links between every transaction type

Clear links between all your transactions, regardless of source and type, allow you to access complete details resulting in faster, easier reconciliation

Efficiently scale finance operations as your business grows

Reconciliation gets harder as your business grows and changes. More systems, larger transaction volumes, increased billing and payment complexity, etc. Leapfin is purpose-built to scale with you.

Empowering Finance and Accounting teams to account for and report on revenue at scale

Automatically ingest data from multiple sources

Raw data automatically prepared for accounting

Anytime access to your most valuable data

Track and link every type of revenue transaction

Streamline revenue reconciliation and reporting

Share reliable revenue data across your business

Resources for revenue accounting & payment reconciliation

Real-world examples of improving revenue visibility and accounting efficiency

-

This isn’t just about automation. It’s about giving our team a system we trust, and the time and space to focus on higher-value work. I’m such a fan. I can’t say enough good things about Leapfin. It has been a huge win for us.Alicia Arntson, CPA VP, Controller, Eight Sleep

This isn’t just about automation. It’s about giving our team a system we trust, and the time and space to focus on higher-value work. I’m such a fan. I can’t say enough good things about Leapfin. It has been a huge win for us.Alicia Arntson, CPA VP, Controller, Eight Sleep -

I finally feel like I can fully support the numbers I’m posting to NetSuite every month. If someone asks, I don’t need to explain assumptions – I just pull the report in Leapfin.Brian Cheung Sr. Manager, Accounting, GoodRx

I finally feel like I can fully support the numbers I’m posting to NetSuite every month. If someone asks, I don’t need to explain assumptions – I just pull the report in Leapfin.Brian Cheung Sr. Manager, Accounting, GoodRx -

Leapfin is like our digital glue. It connects all of our financial data sources together so our team isn’t spending time manually tying everything out.Rebecca Wang VP Finance Corporate Controller, Guideline

Leapfin is like our digital glue. It connects all of our financial data sources together so our team isn’t spending time manually tying everything out.Rebecca Wang VP Finance Corporate Controller, Guideline -

With Leapfin, we are faster, we are more accurate, and we are drama-free. It's transformed our close process. No surprises, no last-minute scrambles. Everything just runs smoothly.Rodrigo Brumana CFO, Poshmark

With Leapfin, we are faster, we are more accurate, and we are drama-free. It's transformed our close process. No surprises, no last-minute scrambles. Everything just runs smoothly.Rodrigo Brumana CFO, Poshmark -

The feed from Leapfin to NetSuite works seamlessly. It's something that we don't have to worry about anymore.Lindsay Remigio Sr. Manager, Revenue Accounting, Reddit

The feed from Leapfin to NetSuite works seamlessly. It's something that we don't have to worry about anymore.Lindsay Remigio Sr. Manager, Revenue Accounting, Reddit -

The consolidated view of our revenue in Leapfin is fantastic. In literally one click we can easily see change month to month. And, because every single transaction is right there, we can dig into details for any explanation we may need.Melissa Tuttle Director of Accounting Systems, Outside

The consolidated view of our revenue in Leapfin is fantastic. In literally one click we can easily see change month to month. And, because every single transaction is right there, we can dig into details for any explanation we may need.Melissa Tuttle Director of Accounting Systems, Outside -

Leapfin helped parse out and make sense of the data that already existed. Simple searches in Leapfin make it easy to track things like refunds, revenue stream trends, and month-to-month movements. Without reporting bottlenecks, Canva is no longer vulnerable to surprises at month-end.Melissa Lee Corporate Controller, Canva

Leapfin helped parse out and make sense of the data that already existed. Simple searches in Leapfin make it easy to track things like refunds, revenue stream trends, and month-to-month movements. Without reporting bottlenecks, Canva is no longer vulnerable to surprises at month-end.Melissa Lee Corporate Controller, Canva -

With Leapfin, we didn’t need to increase headcount significantly to account for our growth. We were able to double transactions, especially during peak seasons, without growing the accounting team.Ian Booler VP of Finance, Altitude Sports

With Leapfin, we didn’t need to increase headcount significantly to account for our growth. We were able to double transactions, especially during peak seasons, without growing the accounting team.Ian Booler VP of Finance, Altitude Sports -

Before Leapfin, our reporting processes relied heavily on Excel, and close took up to 90 days. Now, we can close in just 5 days because Leapfin automates our entire data process and revenue reporting so that we can report accurate, validated financials at the end of the month.Minnie Luo CPA, Director of Revenue Operations, Top Hat

Before Leapfin, our reporting processes relied heavily on Excel, and close took up to 90 days. Now, we can close in just 5 days because Leapfin automates our entire data process and revenue reporting so that we can report accurate, validated financials at the end of the month.Minnie Luo CPA, Director of Revenue Operations, Top Hat -

If you’re a high complexity high transaction volume business, Leapfin is a no brainer.Damien Singh CFO, Canva

If you’re a high complexity high transaction volume business, Leapfin is a no brainer.Damien Singh CFO, Canva -

Leapfin has completely transformed our month-end close process, eliminating 4 days of manual work, with its ability to handle hundreds of millions of transactions and transform them into a subledger.Joe Blanchett Director, Business Systems, SeatGeek

Leapfin has completely transformed our month-end close process, eliminating 4 days of manual work, with its ability to handle hundreds of millions of transactions and transform them into a subledger.Joe Blanchett Director, Business Systems, SeatGeek -

The consistency and quality of data we get with Leapfin is excellent. The reduction in our month-end close time has freed up our team to focus on meaningful analysis, driving better business decisions.Jason Grenier CFO, Altitude Sports

The consistency and quality of data we get with Leapfin is excellent. The reduction in our month-end close time has freed up our team to focus on meaningful analysis, driving better business decisions.Jason Grenier CFO, Altitude Sports

FAQs

Some of the ways AI can help with reconciliation include identifying patterns, flagging anomalies, and auto-matching transactions, all of which can be done faster and more accurately than by using spreadsheets – especially when handling large volumes of data. Leapfin includes Luca – a native AI agent – to empower users with the ability to easily explore data to resolve issues, explain anomalies, and provide critical supporting evidence for audits.

Automated payment reconciliation uses software to match payments from processors like Stripe or PayPal with invoices and cash. Leapfin aggregates all the transaction data – including funds, fees, chargebacks, payments, and invoices – into a single system where it can match this data in real time, so your team doesn’t waste hours in spreadsheets chasing down missing or mismatched transactions. Automated order-to-cash reconciliation can lead to faster closes, fewer errors, and more scalable financial operations.

Trying to reconcile every transaction in your ERP, like NetSuite, may seem like the answer to your problem. But more often than not, it leads to very expensive implementation, high storage costs, slower process, and ultimately fails to deliver an efficient solution for high-volume reconciliation. Leapfin complements your ERP by automating data consolidation and reconciliation before it hits NetSuite. As a result, you have clean, accurate, explorable financial data available in real-time in Leapfin, and everything you need for your GL in a matter of hours – not days – at month end.

Yes! Leapfin is built for teams that have to be agile as their business grows and changes. By giving users control over their implementation and configuration they can apply – and change – rules to handle the complexity that subscription businesses face when it comes to recurring billing and deferred revenue. Leapfin automates reconciliation across billing cycles and aligns revenue recognition with accounting standards, so you don’t have to hack together custom rules in spreadsheets or overwork your ERP. And every data treatment and rule change is tracked to ensure a smooth audit when the time comes.

For many companies, the answer is it’s never too soon. Automating reconciliation offers the direct benefits of efficiency and reduction in human error, but it’s also a forcing function to ensure that your organization is planning for the impact of changes in volume and detail of operational data on the preparation of financial statements. The sooner your organization is taking a holistic approach to operational data – including the need to reconcile and complete compliant revenue recognition – the easier it will be to scale operations as your business grows. Learn more here: What's Holding Back Your Automation Strategy?