AI agent for automating revenue recognition and reconciliation

Luca, Leapfin’s native AI agent, helps Finance and Accounting teams explore, analyze, and report on revenue data, build automation workflows, and document processes using natural language prompts.

How Luca works

Luca is a native, specialized AI agent built specifically for Leapfin that allows you to interact with your revenue data using natural language prompts. No coding, engineering, or analytical expertise required. Luca does the heavy lifting of writing queries and workflows based on the combined expert accounting context built into Leapfin and your professional expertise in the form of prompts. Luca’s agentic capabilities are rapidly expanding.

Today, Luca enables your Finance team to...

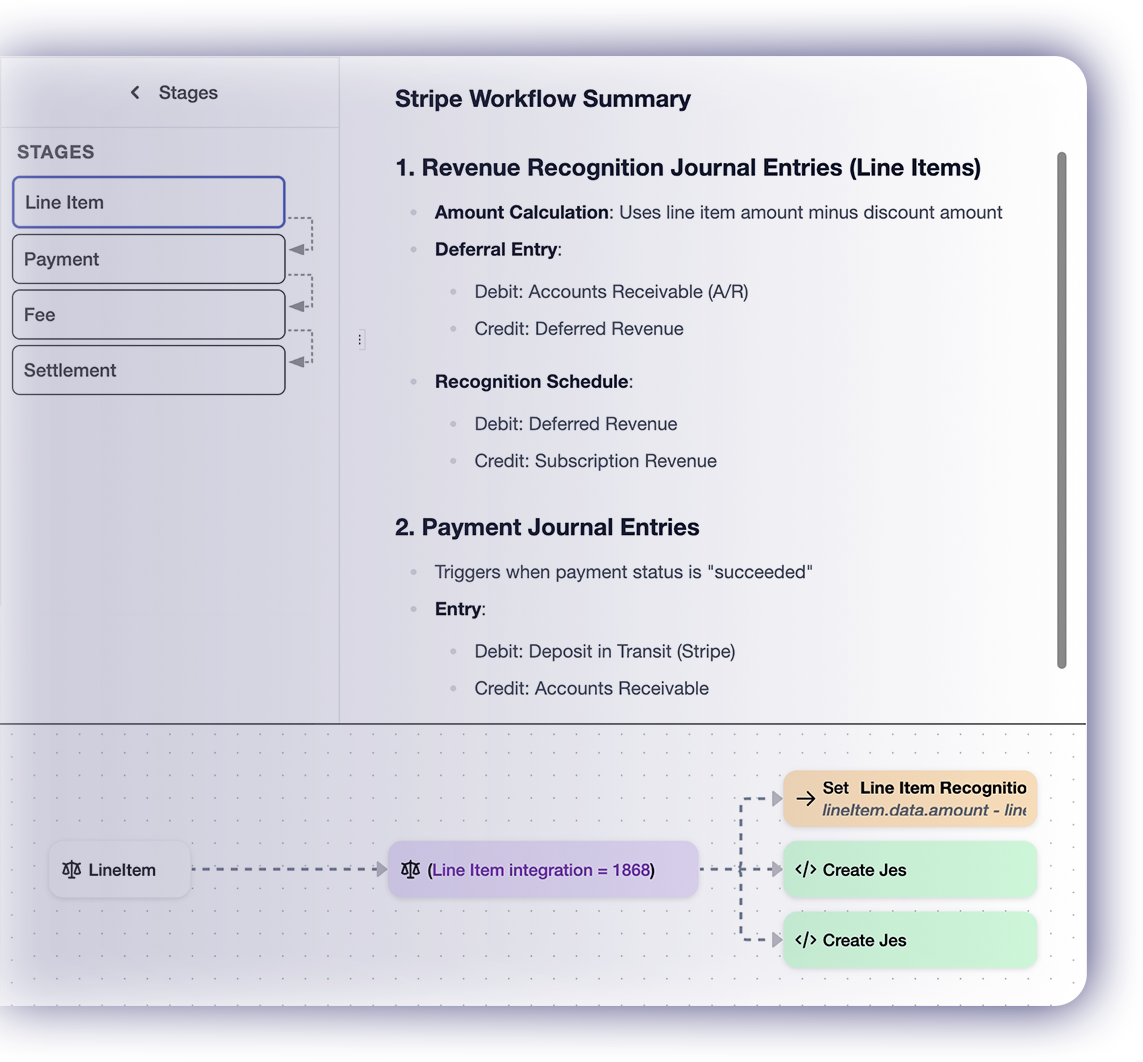

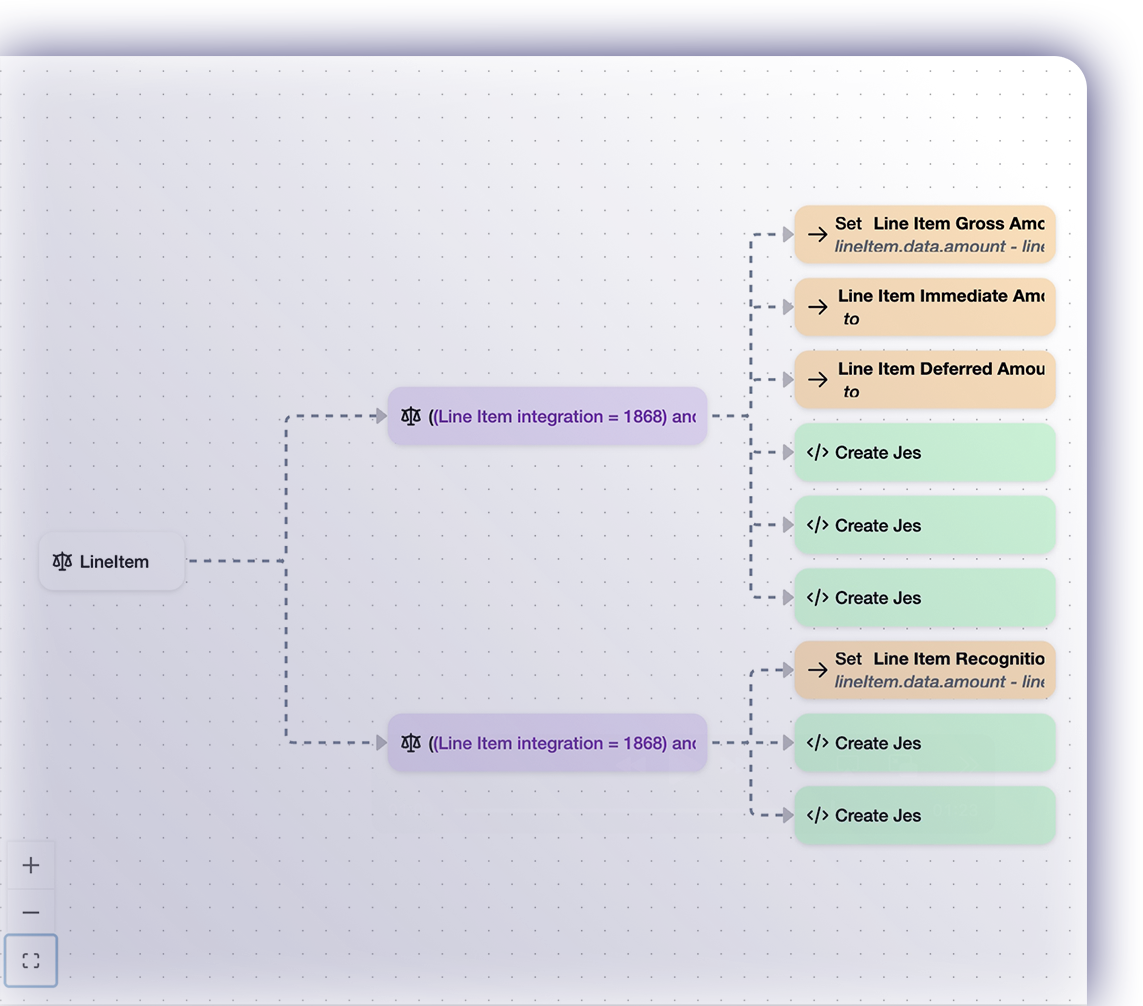

Manage workflows

Build, manage, and maintain precise automated accounting workflows that ensure accurate, deterministic results so you can deliver revenue reports anytime you need them.

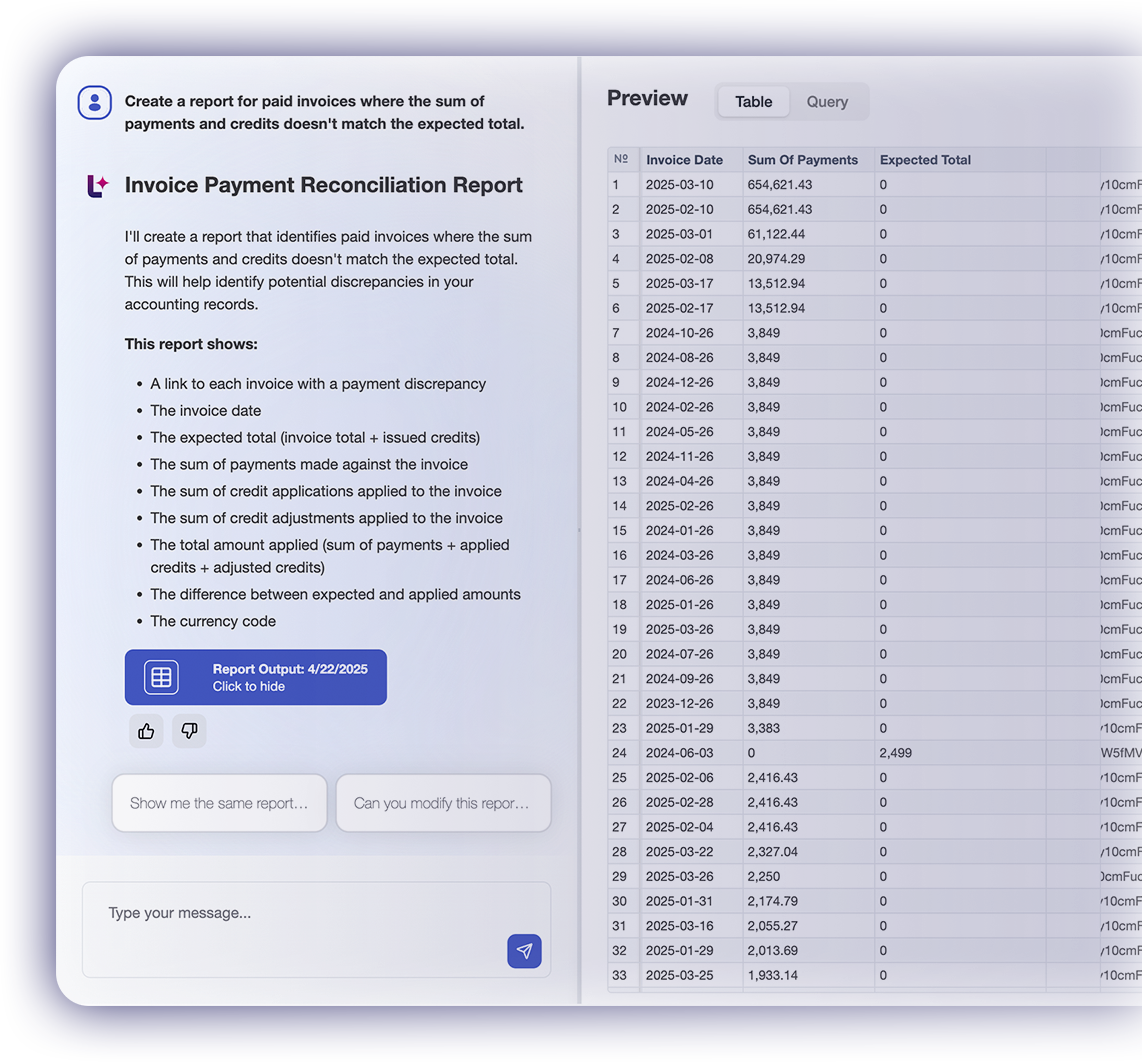

Explore data

Easily drill into transaction details to analyze anomalies or performance trends across all of your consolidated revenue data in Leapfin.

Overcome complexity

In seconds, create workflows that handle your most challenging scenarios – from blended revenue recognition schedules and multi-currency FX to complex refund logic.

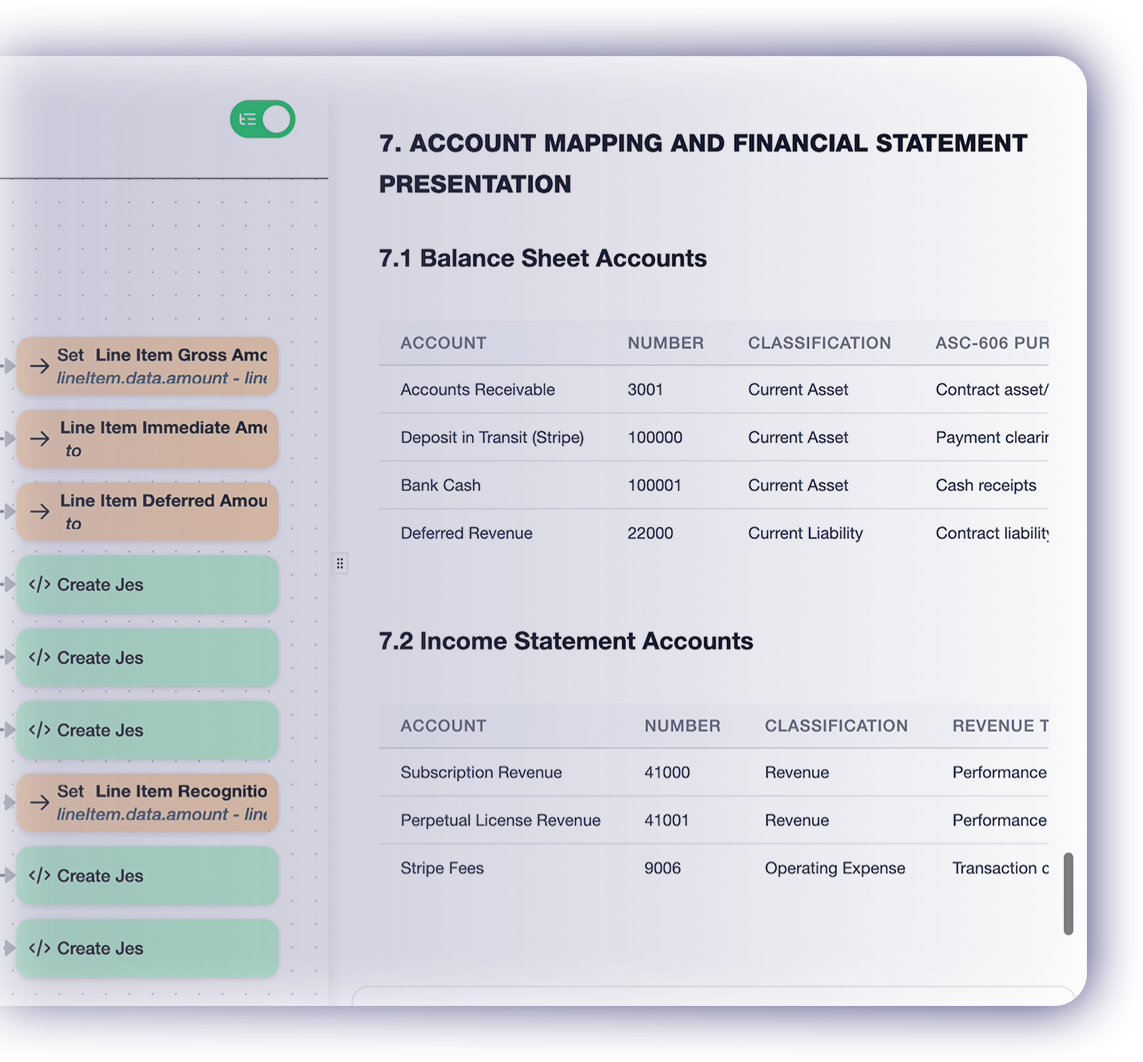

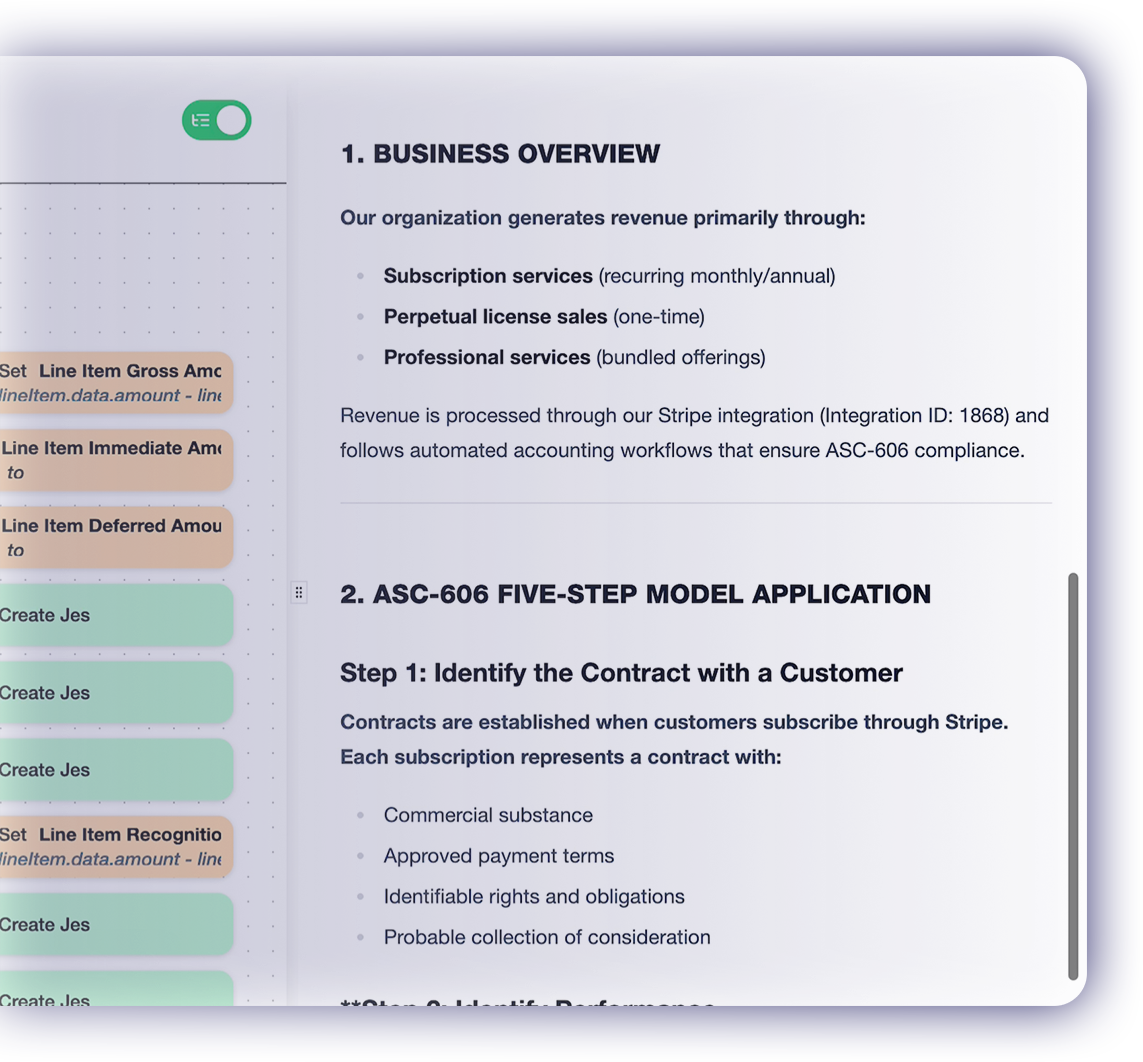

Create documentation

Give your team and your auditors clear visibility into your process by instantly generating documentation based on the workflows.

Ensure audit compliance

Review your workflows against industry standards like ASC 606 and IFRS 15; flag audit risks and generate multi-point remediation plans to ensure compliance.

Benefits of a native AI agent for revenue recognition

Simple

Luca makes creating and maintaining automated accounting workflows fast and easy, regardless of how complex your revenue reconciliation or recognition requirements are.

Control

Leapfin harnesses the power of AI to deliver intentional solutions that empower Finance and Accounting teams with full control over their revenue data.

Secure

Leapfin’s AI agent is given a specific set of rules and guardrails within the software architecture. It never interacts with or shares customer data with public or private LLMs.

Fast

The processing power of Luca allows you to complete tasks and answer questions faster allowing your team to truly do more with less, while keeping pace with the rest of the business.

FAQs

AI is being applied across finance functions to automate repetitive tasks, identify anomalies, and generate insights from large datasets. In accounting, AI is especially valuable for revenue recognition, reconciliation, audit preparation, and financial reporting, where accuracy and compliance are critical.

Yes. AI agents can be used to create workflows that automatically apply complex ASC 606 rules to revenue contracts, flag exceptions, and generate audit-ready documentation. With Leapfin, accounting professionals can use AI to create and audit those workflows to identify and resolve compliance gaps.

AI-powered reconciliation tools can help eliminate manual matching across systems, quickly detect anomalies, and handle high transaction volumes. By using a solution like Leapfin, you can use AI to reconcile revenue easier and accelerate the close process ultimately giving finance leaders access to real-time results and confidence in reported numbers.

AI agents like Luca can streamline audit preparation by automatically documenting workflows, highlighting compliance gaps, and creating transparent records of revenue recognition and reconciliation processes. This can reduce audit prep time and lower the risk of costly findings.

Security depends on the architecture of the AI solution. Enterprise-grade AI agents, like Luca in Leapfin, are designed with strict rules and guardrails to protect sensitive financial data, ensuring it is never exposed to public large language models (LLMs) or external systems.

Generic AI tools are not designed with accounting rules or compliance standards in mind, which can create risks. When using a finance-specific AI agent like Luca, it is purpose-built with guardrails that understand accounting workflows, compliance requirements, and revenue recognition logic making it more reliable than generic AI tools.