Reconcile complex payments and fees for Stripe Connect

Overcome the accounting challenges of Stripe Connect by using an automated solution that handles massive transaction volume and complex reconciliation scenarios

Transform Stripe Connect transactions into accounting-ready data

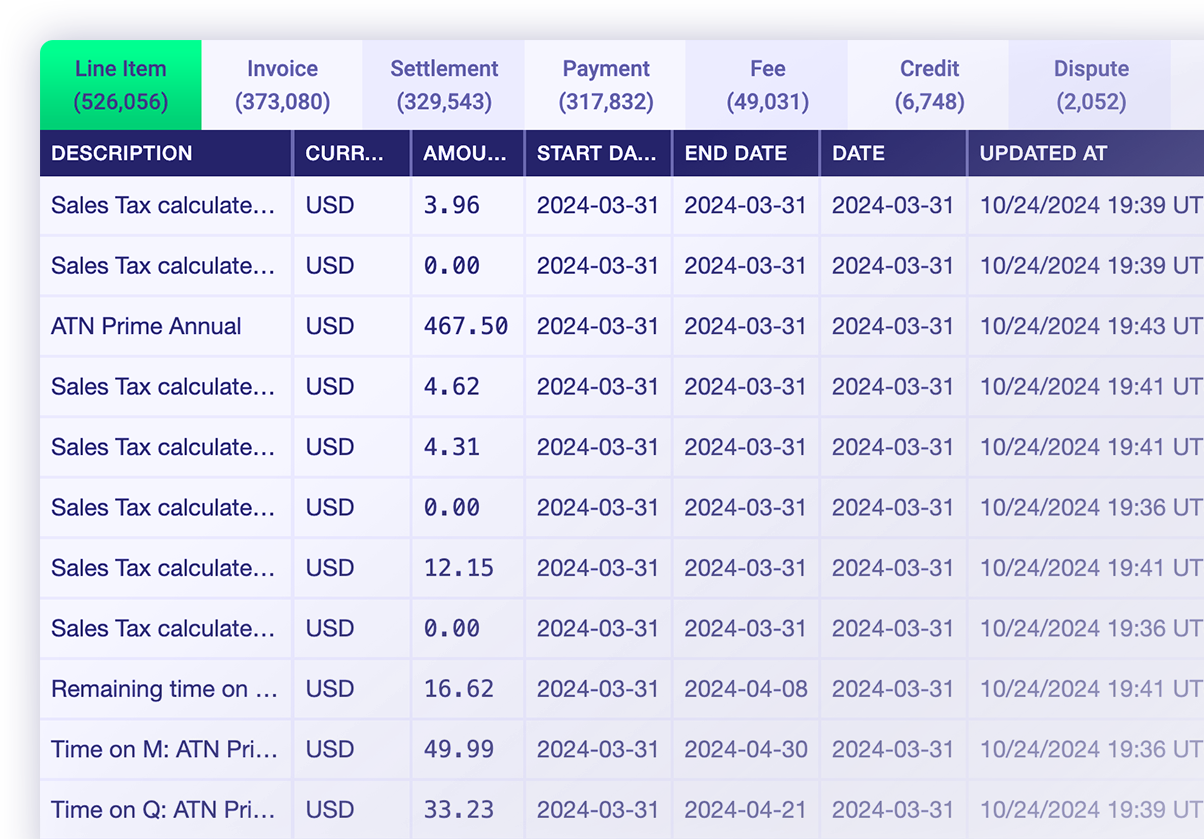

Stripe Connect is widely adopted by SaaS providers and marketplace businesses because of its fast deployment, global payouts capability, scalability, and more. Unfortunately, one of the downsides is that Accounting teams inherit a massive amount of transaction data and complex scenarios when it comes to payments, fees, multi-tiered payouts, etc. – which makes reconciliation incredibly challenging. Leapfin helps by automating the preparation of data so Finance teams can scale operations as the business grows.

Benefits of using Leapfin with Stripe Connect

Scalable data management solution for massive transaction volume

Accurately account for payments, multi-tiered payouts, and fees

Easily explore Stripe Connect data with the help of Luca

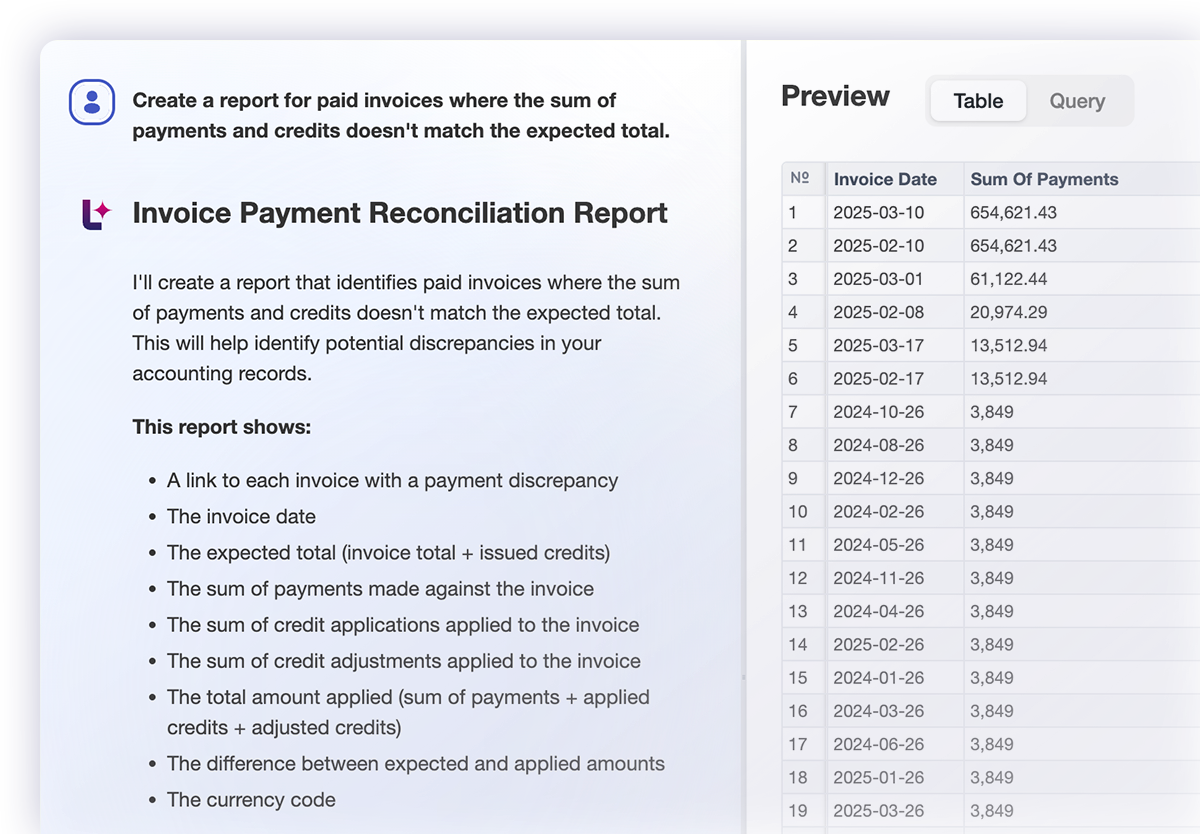

Drill into detailed Stripe Connect transactions to explore and understand anomalies using natural language prompts in Luca – Leapfin’s AI agent

Integrate Stripe Connect with Leapfin to gain control of your revenue data

Resources for managing revenue data from Stripe

FAQs

Yes, Leapfin has a powerful native integration with Stripe - which includes Stripe Connect. It has evolved from years of experience working with Stripe, and it’s available to all customers.

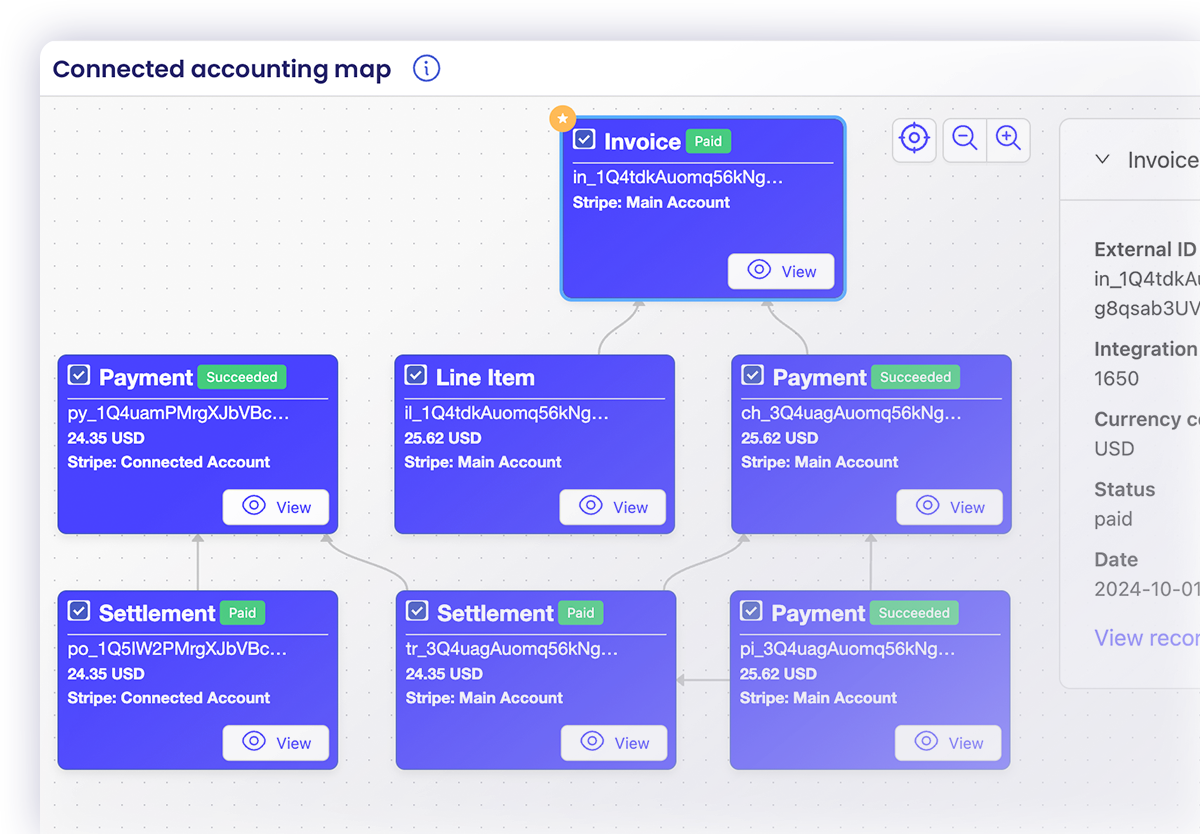

Yes, within Leapfin users access the Connected Accounting Map that allows them to easily see how all of their Stripe Connect transactions – payments, payouts, fees, etc. – are linked, which provides complete visibility and traceability into every detail of their revenue data.

Stripe Connect is a payment processing solution that enables businesses to manage and route payments or payouts between sellers, customers, service providers, etc. It works as a main platform account that accepts payments and also controls multiple Connect accounts that can be individually configured including ultimately where it pays out to.

Yes, the combined power of Leapfin’s automated data management and mapping capabilities, along with the Connected Accounting Map empower users with full visibility into every single transaction type created with Stripe Connect. This gives users the ability to quickly reconcile data, as well as resolve any anomalies or issues that arise.

Yes, but oftentimes it produces incomplete results, and doesn’t present data in an accounting-friendly format. Luca – Leapfin’s AI agent – is purpose-built to support anyone in the Finance or Accounting organization, by offering them the ability to easily explore data with natural language prompts. There are also dozens of templated prompts to cover many common requests making it even easier to work with. The results can be easily saved as reports for future reference and shared within your team’s Leapfin workspace.

Real-world examples of improving revenue visibility and accounting efficiency

-

This isn’t just about automation. It’s about giving our team a system we trust, and the time and space to focus on higher-value work. I’m such a fan. I can’t say enough good things about Leapfin. It has been a huge win for us.Alicia Arntson, CPA VP, Controller, Eight Sleep

This isn’t just about automation. It’s about giving our team a system we trust, and the time and space to focus on higher-value work. I’m such a fan. I can’t say enough good things about Leapfin. It has been a huge win for us.Alicia Arntson, CPA VP, Controller, Eight Sleep -

I finally feel like I can fully support the numbers I’m posting to NetSuite every month. If someone asks, I don’t need to explain assumptions – I just pull the report in Leapfin.Brian Cheung Sr. Manager, Accounting, GoodRx

I finally feel like I can fully support the numbers I’m posting to NetSuite every month. If someone asks, I don’t need to explain assumptions – I just pull the report in Leapfin.Brian Cheung Sr. Manager, Accounting, GoodRx -

Leapfin is like our digital glue. It connects all of our financial data sources together so our team isn’t spending time manually tying everything out.Rebecca Wang VP Finance Corporate Controller, Guideline

Leapfin is like our digital glue. It connects all of our financial data sources together so our team isn’t spending time manually tying everything out.Rebecca Wang VP Finance Corporate Controller, Guideline -

With Leapfin, we are faster, we are more accurate, and we are drama-free. It's transformed our close process. No surprises, no last-minute scrambles. Everything just runs smoothly.Rodrigo Brumana CFO, Poshmark

With Leapfin, we are faster, we are more accurate, and we are drama-free. It's transformed our close process. No surprises, no last-minute scrambles. Everything just runs smoothly.Rodrigo Brumana CFO, Poshmark -

The feed from Leapfin to NetSuite works seamlessly. It's something that we don't have to worry about anymore.Lindsay Remigio Sr. Manager, Revenue Accounting, Reddit

The feed from Leapfin to NetSuite works seamlessly. It's something that we don't have to worry about anymore.Lindsay Remigio Sr. Manager, Revenue Accounting, Reddit -

The consolidated view of our revenue in Leapfin is fantastic. In literally one click we can easily see change month to month. And, because every single transaction is right there, we can dig into details for any explanation we may need.Melissa Tuttle Director of Accounting Systems, Outside

The consolidated view of our revenue in Leapfin is fantastic. In literally one click we can easily see change month to month. And, because every single transaction is right there, we can dig into details for any explanation we may need.Melissa Tuttle Director of Accounting Systems, Outside -

Leapfin helped parse out and make sense of the data that already existed. Simple searches in Leapfin make it easy to track things like refunds, revenue stream trends, and month-to-month movements. Without reporting bottlenecks, Canva is no longer vulnerable to surprises at month-end.Melissa Lee Corporate Controller, Canva

Leapfin helped parse out and make sense of the data that already existed. Simple searches in Leapfin make it easy to track things like refunds, revenue stream trends, and month-to-month movements. Without reporting bottlenecks, Canva is no longer vulnerable to surprises at month-end.Melissa Lee Corporate Controller, Canva -

With Leapfin, we didn’t need to increase headcount significantly to account for our growth. We were able to double transactions, especially during peak seasons, without growing the accounting team.Ian Booler VP of Finance, Altitude Sports

With Leapfin, we didn’t need to increase headcount significantly to account for our growth. We were able to double transactions, especially during peak seasons, without growing the accounting team.Ian Booler VP of Finance, Altitude Sports -

Before Leapfin, our reporting processes relied heavily on Excel, and close took up to 90 days. Now, we can close in just 5 days because Leapfin automates our entire data process and revenue reporting so that we can report accurate, validated financials at the end of the month.Minnie Luo CPA, Director of Revenue Operations, Top Hat

Before Leapfin, our reporting processes relied heavily on Excel, and close took up to 90 days. Now, we can close in just 5 days because Leapfin automates our entire data process and revenue reporting so that we can report accurate, validated financials at the end of the month.Minnie Luo CPA, Director of Revenue Operations, Top Hat -

If you’re a high complexity high transaction volume business, Leapfin is a no brainer.Damien Singh CFO, Canva

If you’re a high complexity high transaction volume business, Leapfin is a no brainer.Damien Singh CFO, Canva -

Leapfin has completely transformed our month-end close process, eliminating 4 days of manual work, with its ability to handle hundreds of millions of transactions and transform them into a subledger.Joe Blanchett Director, Business Systems, SeatGeek

Leapfin has completely transformed our month-end close process, eliminating 4 days of manual work, with its ability to handle hundreds of millions of transactions and transform them into a subledger.Joe Blanchett Director, Business Systems, SeatGeek -

The consistency and quality of data we get with Leapfin is excellent. The reduction in our month-end close time has freed up our team to focus on meaningful analysis, driving better business decisions.Jason Grenier CFO, Altitude Sports

The consistency and quality of data we get with Leapfin is excellent. The reduction in our month-end close time has freed up our team to focus on meaningful analysis, driving better business decisions.Jason Grenier CFO, Altitude Sports