Revenue recognition and reconciliation for subscription businesses

Automatically consolidate, normalize, and reconcile fragmented subscription revenue data in a single system that scales as your business grows.

Overcome subscription complexity with AI-powered revenue recognition

Revenue recognition for subscription businesses seems like a straightforward task, however, it becomes much more complex when accounting for atypical discount structures, credits, refunds, cancellations, or multiple plan types, geos, or currencies. Manually working through thousands of transactions each month is unmanageable and inefficient, not to mention just hard to do. And the risk for non-compliant reporting or missed revenue is exponentially higher. AI-powered revenue recognition and reconciliation with Leapfin removes manual processes and delivers complete, fully auditable revenue data in real-time.

Benefits of Leapfin for subscription businesses

Automatically consolidated and prepared revenue data

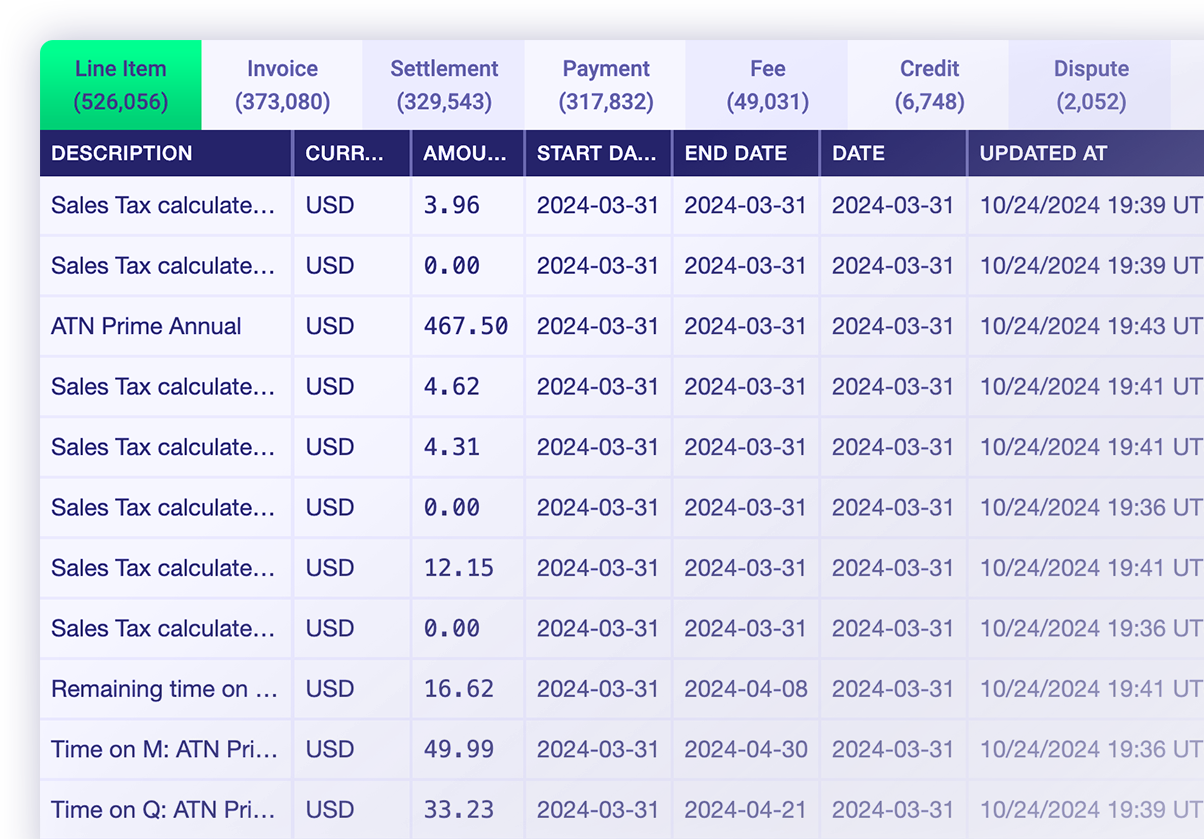

Leapfin automatically aggregates and normalizes revenue data fragmented across multiple systems, so it’s prepared for reconciliation and reporting at any time.

Meet industry compliance standards and reduce audit risk

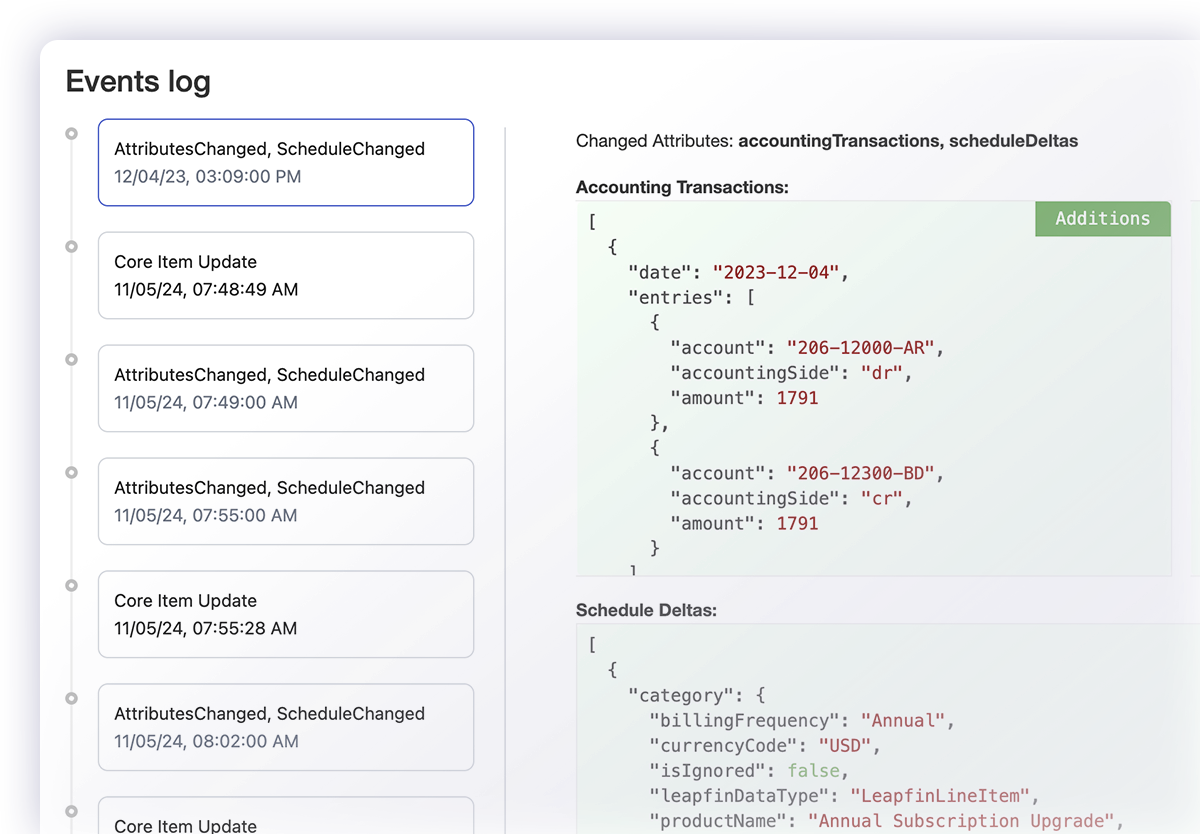

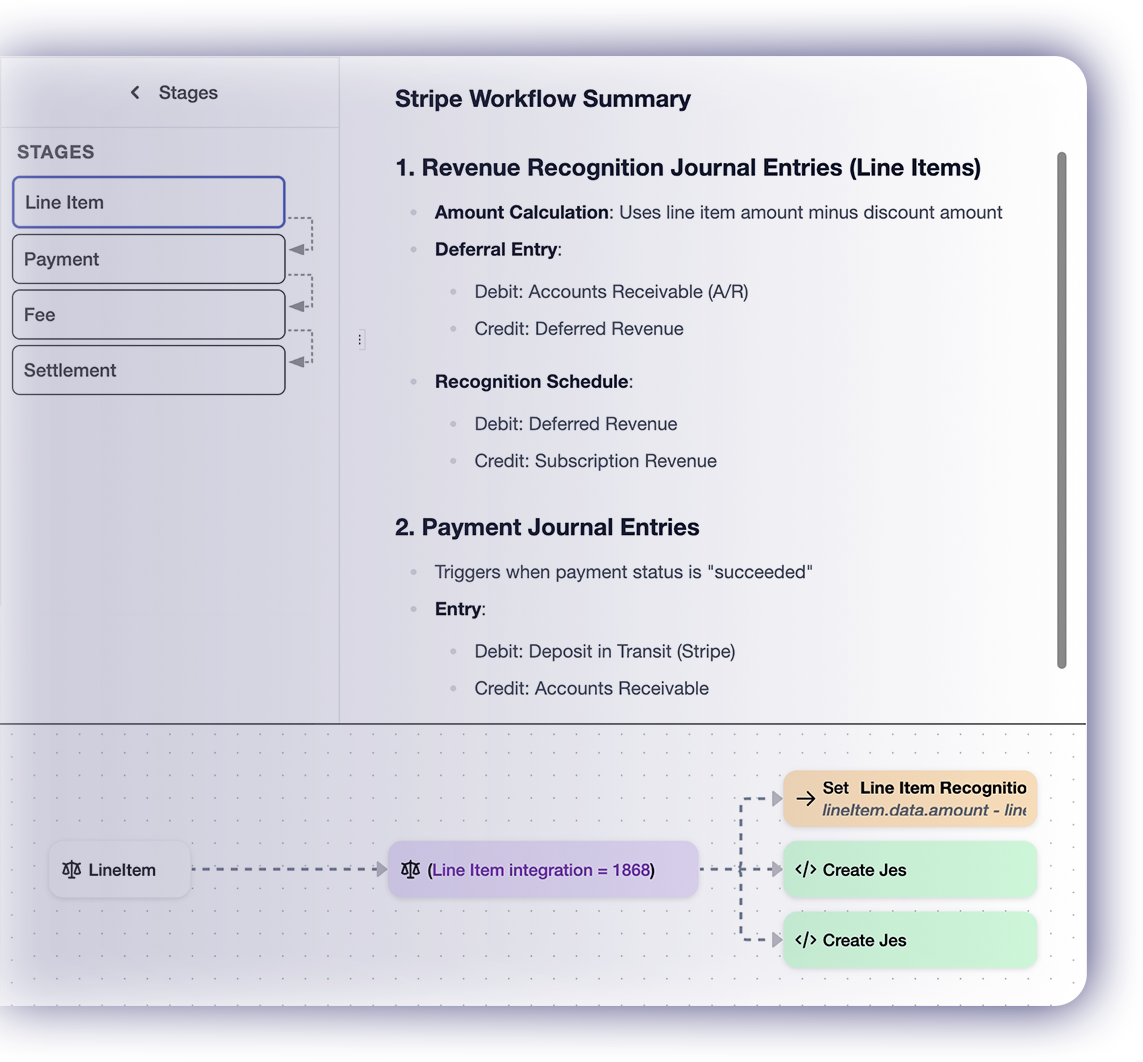

Leapfin makes it easy to build automated workflows to meet ASC 606 and IFRS standards – as well as your internal policies – to ensure compliance and auditability of your revenue data.

Adapt to policy changes as your business evolves

Retain full control over how your revenue data is managed and treated with flexible automation workflows that are created, updated, and documented with the help of a native AI agent.

Empowering Finance and Accounting teams to account for and report on revenue at scale

Automatically ingest data from multiple sources

Raw data automatically prepared for accounting

Anytime access to your most valuable data

Track and link every type of revenue transaction

Streamline revenue reconciliation and reporting

Share reliable revenue data across your business

Resources for improving rev rec and reconciliation of subscription revenue

FAQs

Manual processes increase the risk of errors, inconsistencies, and create organization inefficiencies. As subscription companies grow, there are more factors to consider – more systems, high volume of transactions, changing business model, new products and pricing – that increase complexity of revenue recognition and reconciliation. Accounting automation software – like Leapfin – helps overcome these challenges so Finance and Accounting teams can account for and report on subscription revenue at scale without significantly increasing headcount.

Finance and Accounting teams can adapt to subscription pricing changes by implementing flexible systems and processes that can be easily adjusted to account for changes, but also adhere to critical business and compliance policies. Leapfin empowers you with the ability to automate the preparation of subscription revenue for easy revenue reconciliation and recognition regardless of how simple or complex your pricing model is. Leapfin’s native AI agent, Luca, enables your team to adapt to changes quickly, detect and resolve anomalies, and easily report on revenue in real-time.

Yes, Leapfin supports ASC 606, GAAP, SOX, and IFRS 15 compliance. Leapfin customers have full control over how revenue data is accounted for by using automated workflows that are validated and fully documented for auditability. Workflows can be easily updated to meet evolving industry standards, as well as internal policies.

Yes, automation makes rev rec for usage based billing subscriptions substantially easier. Consolidating fragmented revenue data into a single system like Leapfin enables you to normalize and enrich the data and take advantage of automation workflows so your team does not have the manual burden of managing the volume and complexity of transactions generated with usage-based billing.

Leapfin is purpose-built for Accounting and Finance teams to consolidate all revenue transaction data in a single system – regardless of where the data is originally sourced. It doesn’t matter if you’re using Stripe, Airwallex, Metronome, Apple, Google, or any other system, data can be ingested and normalized. Additionally, Leapfin is more than a consolidated database of revenue data, it is accounting automation that helps with reconciliation, revenue recognition, reporting, and the creation of journal entries and a revenue subleger for your GL.

Real-world examples of improving subscription rev rec and reconciliation

-

Rodrigo Brumana CFO

Rodrigo Brumana CFOWith Leapfin, we are faster, more accurate, and drama-free. It’s transformed our close. No surprises or last-minute scrambles.

-

Minnie Luo, CPA Director of Revenue OperationsRead story

Minnie Luo, CPA Director of Revenue OperationsRead storyBefore, close took up to 90 days. Now we close in 5. Leapfin automates our entire data process so we can report accurate, validated financials.

-

Travis Millard VP Finance

Travis Millard VP FinanceBest in class revenue recognition software, and fantastic customer support.

-

Melissa Tuttle Director of Accounting SystemsRead story

Melissa Tuttle Director of Accounting SystemsRead storyThe consolidated view of our revenue is fantastic. And with every transaction right there, we can dig into details for any explanation we may need.

-

Lindsay Remigio Sr. Manager, Revenue AccountingRead story

Lindsay Remigio Sr. Manager, Revenue AccountingRead storyThe feed from Leapfin to NetSuite works seamlessly. It’s something that we don’t have to worry about anymore.

-

Brian Hebert VP Revenue

Leapfin provides great insight into your past, current and future revenue stream from your subscriptions. And the new Luca AI feature is really amazing!

-

Alicia Arntson, CPA VP ControllerRead story

Alicia Arntson, CPA VP ControllerRead storyLeapfin gives our team a system we trust, and the time to focus on higher-value work. I’m such a fan. It has been a huge win for us.

-

Jason Grenier Altitude SportsRead story

Jason Grenier Altitude SportsRead storyThe consistency and quality of data we get with Leapfin is excellent. The reduction in our close time frees us up to focus on meaningful analysis.

-

Katsu Matsuyama, CPA, MST Financial Controller

Katsu Matsuyama, CPA, MST Financial ControllerExcellent support. And their new AI feature has truly been a game-changer, saving us a significant amount of time. Highly recommended.

-

Brian Cheung Sr. Manager, AccountingRead story

Brian Cheung Sr. Manager, AccountingRead storyI can’t imagine going back, and I don’t want to. We now have a future-proof system that scales with us.

-

Rebecca Wang VP Finance Corporate ControllerRead story

Rebecca Wang VP Finance Corporate ControllerRead storyWhat used to take multiple reports and reconciliations can now be surfaced in seconds.

-

Joe Blanchett Director, Business Systems

Joe Blanchett Director, Business SystemsLeapfin is a mission-critical part of our finance stack.