TL;DR: Stripe wasn’t built for accounting. But now, Accounting teams are using AI to automate reconciliation, surface anomalies, and close faster – without writing a single line of SQL.

Here are the top takeaways from our recent webinar, Stripe is a Black Box: How Finance Teams Are Finally Cracking It Open With AI. Watch it on-demand now.

Stripe makes billing easy – but accounting hard

Stripe is brilliant at making payments work. It was built to empower engineers and product teams to handle billing logic, capture payments, and scale subscription infrastructure.

But for finance and accounting? Stripe is often a source of spreadsheet sprawl, late nights, and endless detective work.

Stripe data is powerful, but it’s also not natively accounting-ready. The operational structure, event sequencing, and product design simply weren’t built to support journal entry creation, audit trails, or reconciliation workflows.

We’ve covered this in-depth in 3 reasons Stripe data isn’t built for accounting, but here are just a few of the recurring issues we see:

Common Stripe pain points for Accounting teams:

- Opaque event logic – Stripe’s "status = paid" doesn’t guarantee actual cash was received.

- Overlapping systems – Stripe Billing and Stripe Payments are separate products that don’t always line up cleanly.

- Data overload – Stripe's CSV exports get huge fast, and the reporting tools aren’t optimized for transaction-level accuracy.

- Stripe Sigma ≠ Accounting tool – Sigma performs well for common questions about billing and payment data, but it requires SQL fluency, assumes engineering support, and struggles mightily with accounting questions and use cases.

And when it comes to reconciling key data points – like payments to invoices, or credits to original charges – the challenge only intensifies. Our post on how to reconcile billing and payments in Stripe dives into this more deeply, as does our guide to solving the Stripe credits headache.

TL;DR (again): Stripe is built for scale, speed, and flexibility – not for audit-ready financial operations or data exploration (a.k.a. investigating for problems and insights).

What Finance teams actually need from Stripe data

To do your job, you don’t just need any data, you need accounting-quality data. That means:

- Clear mappings between invoices, payments, refunds, and disputes

- Fully reconciled journal entries, not just statuses or summaries

- The ability to detect anomalies, double refunds, and disconnected transactions

- Audit trails that hold up to scrutiny

Enter AI: your new Stripe reconciliation sidekick

AI isn’t just for writing accounting memos anymore. AI is now capable of adding tremendous value to your accounting workflow, particularly around use cases that involve the following:

- Contextual understanding of complex data relationships

- Precise mapping between billing and cash

- Natural language input (no SQL, no coding)

AI is really, really good at:

- Writing code (yes, even better than some engineers. We said it.)

- Automating repeatable workflows

- Reconciling massive sets of transactions

- Surfacing edge cases, exceptions, and mismatches

And that’s exactly why we built Luca, Leapfin’s AI-powered accounting assistant.

Real-world AI-powered accounting use cases: Stripe reconciliation, without the spreadsheet spiral

Here are three Stripe-specific workflows that Luca can now automate or accelerate. No engineering help required.

AI for Accounting Use Case 1: Reconcile Stripe invoices with actual payments

You’d think a paid invoice always has a corresponding payment. But with Stripe, that’s not guaranteed.

Between platform logic quirks, account balances, credit notes, and time-based proration, a “paid” status can be misleading. Luca identifies invoices that claim to be paid but have no associated cash, and flags those exceptions before your auditors do.

AI for Accounting Use Case 2: Uncover potentially erroneous and costly adjustments (a.k.a. margin leaks)

Stripe makes it easy for support teams to issue refunds, credits, or discounts. Sometimes too easy. Luca can analyze:

- Number of refunds per line item

- Credits and disputes tied to individual invoices

- Adjustments that stack up in suspicious ways (e.g., refund + credit on the same charge)

If you've ever refunded someone after giving them a credit and lost the dispute… ouch. We’ve seen it happen. AI can surface it before it becomes a trend.

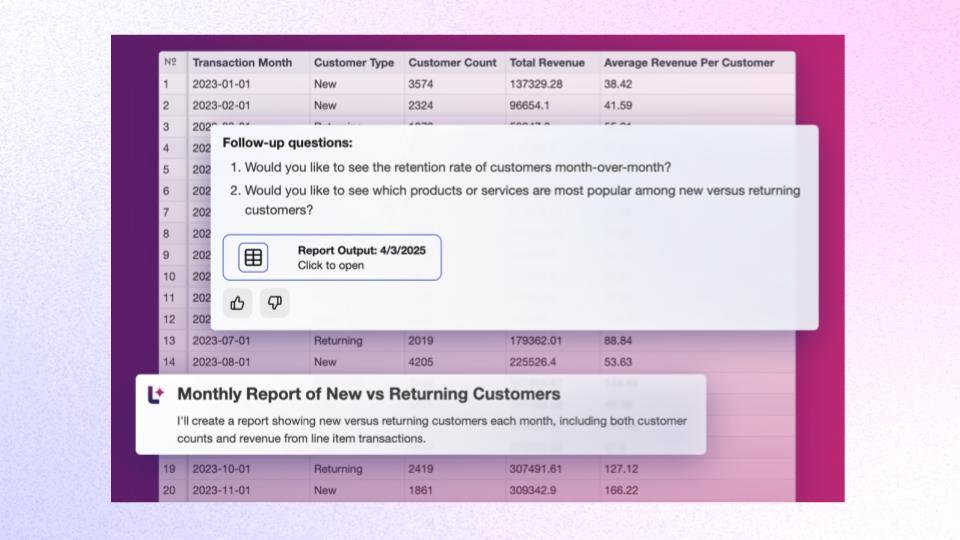

AI for Accounting Use Case 3: Analyze new vs. returning customers

Stripe doesn’t give you built-in cohort reporting. But your billing data does contain all the signals, if you know how to extract them.

Luca can break down:

- Monthly revenue from new customers vs. returning customers

- Retention trends across billing periods

- Indicators of loyalty (or churn risk) based on purchase frequency

How to begin using AI in your monthly accounting workflow

You don’t have to overhaul your tech stack to start using AI. Start small and strategic.

3 ideas to start using AI in your accounting workflow today

- Start small – Pick one "basic" task to prototype, like pulling a report or answering a common audit question.

- Start with research – Ask Gemini or ChatGPT to summarize a complex accounting memo or recent FASB guidance. Test the accuracy to build comfort and trust with the results.

- Start with what hurts – Pick a high-friction process or something you're spending the most manual hours on each month and build a prototype with AI to help you start simplifying or accelerating that work.

3 best practices to get high quality results with AI

- Provide the proper toolset so AI can do its job

- Access to database

- Tools to validate results

- Checkpoints with user to "oversee" the process

- Context is everything – Better context equals better results. This includes teaching AI like Luca to work with you personally. You can train it to help understand how you like information presented, your preferred metric labels and terminology, etc.

- Lastly, if you're not sure what or how to ask AI for things, use AI to help create prompts for itself. Don't be intimidated by the chat box. AI can literally teach you how to talk to itself.

The secret weapon: accounting-first data modeling

The real magic behind Luca isn’t the the AI, meaning it isn't the language model (LLM) – it’s the data model it runs on.

Luca can instantly answer complex accounting questions because the data has already been standardized, structured, and translated for finance in Leapfin.

Leapfin transforms raw operational events from Stripe and other sources into a Connected Accounting Map – a purpose-built structure that makes all the relationships between billing, payments, refunds, credits, and payouts crystal clear.

Ready to try AI-powered Stripe reconciliation?

If you’re curious what Luca could do with your own data, we’re offering a free personalized test drive.

What’s included:

- We’ll pull in a few months of your Stripe data (read-only)

- You’ll get a 1:1 session with Leapfin’s CTO Erik Yao to explore reconciliations live

- We’ll walk through your exceptions and insights together

No commitment. No engineering work. Just answers.

Request yours at leapfin.com/show-me-how

FAQs about AI and Stripe data reconciliation

Q: Why is Stripe data so difficult to reconcile?

A: Stripe was designed for developers, not accountants. Its billing and payment data are structured around API events, not financial reporting. That leads to mismatches, hidden adjustments, and data that’s hard to translate into journal entries.

Q: Can AI really handle revenue reconciliation accurately?

A: Yes – when trained on accounting-specific data models (like Leapfin’s), AI can automatically match invoices to payments, surface discrepancies, and prepare audit-ready reports using natural language commands.

Q: How is Luca different from ChatGPT or Stripe Sigma?

A: Luca is purpose-built for accounting workflows. Unlike generic AI or SQL-based tools like Stripe Sigma, Luca understands accounting terms, knows how to interact with structured financial data, and writes queries specific to your monthly-close and reconciliation process.

Q: Does this work for companies using Stripe + NetSuite?

A: Absolutely. Many of our customers use both. Luca helps reconcile Stripe transaction data and map it cleanly to your NetSuite GL. No more manual uploads or error-prone Excel transformations.

Q: Is Leapfin secure and audit-compliant?

A: Yes. Leapfin includes full audit trails, version history, and access controls to support SOX compliance and audit requirements. All changes made by AI or humans are logged.

Did you know?

- 72% of companies still aren’t using AI for accounting tasks – meaning early adopters have a huge head start.

- Yet 71% of C‑suite execs already trust AI to assist finance workflows.

- 46% of Controllers say automation and AI skills are “very important” for career growth – so accountants who learn AI first win.

This data is from our State of Accounting Automation report.

See all top takeaways and analysis | See the full report

See how Leapfin works

Get a feel for the ease and power of Leapfin with our interactive demo.