AI-powered revenue recognition

Quickly and easily adapt to operational changes by consolidating your revenue transaction data into a single system that is built to grow with your business.

Easier reconciliation and faster revenue reporting

As companies grow, it gets more difficult to keep up with changes in the business – more systems, larger volumes of data, billing, payment, and compliance complexity. Leapfin consolidates your revenue transaction data into a single purpose-built system, powered by automation and AI, giving you access to complete, real-time revenue data for faster, easier reconciliation and reporting.

Benefits of Leapfin for financial compliance

Automatically prepared data that meets compliance requirements

Consolidate fragmented revenue data into a single, configurable system that ensures compliance with ASC 606, GAAP, and SOX, and prepares accounting-ready data for faster reconciliation and reporting at any time.

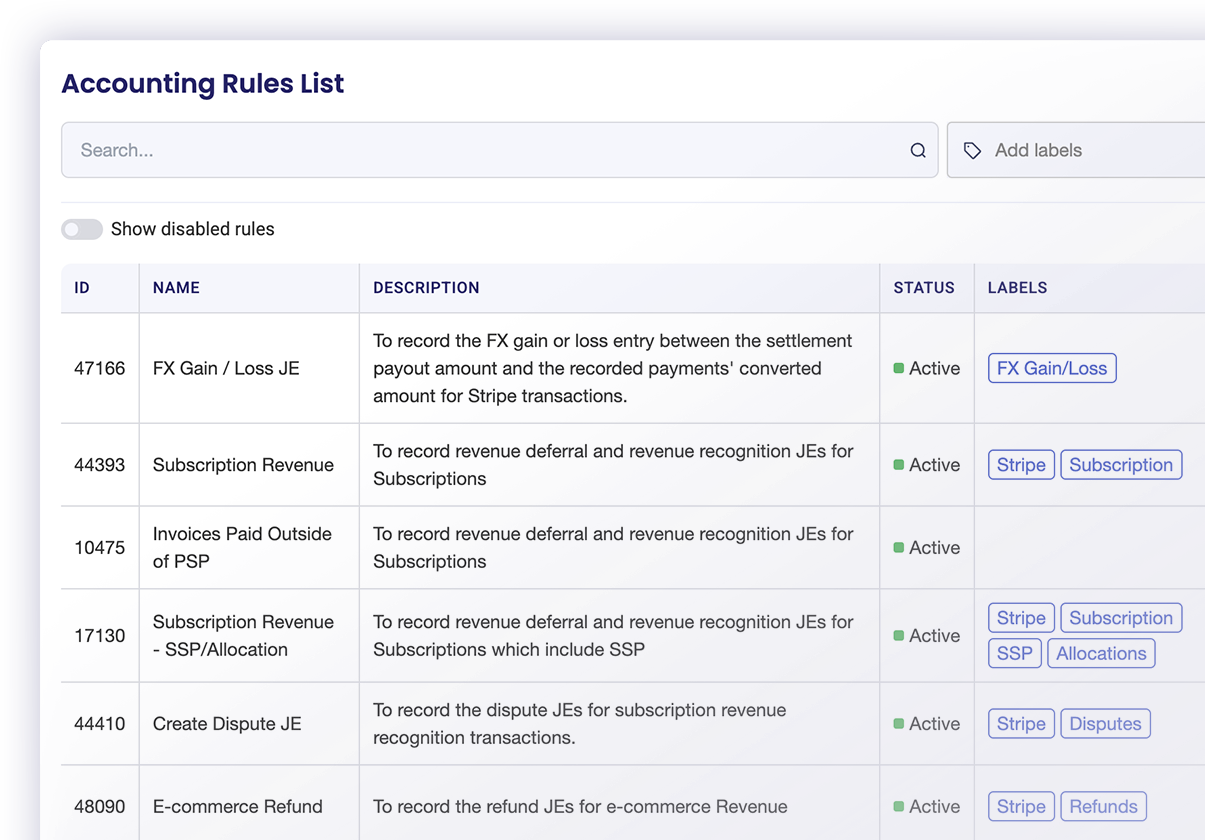

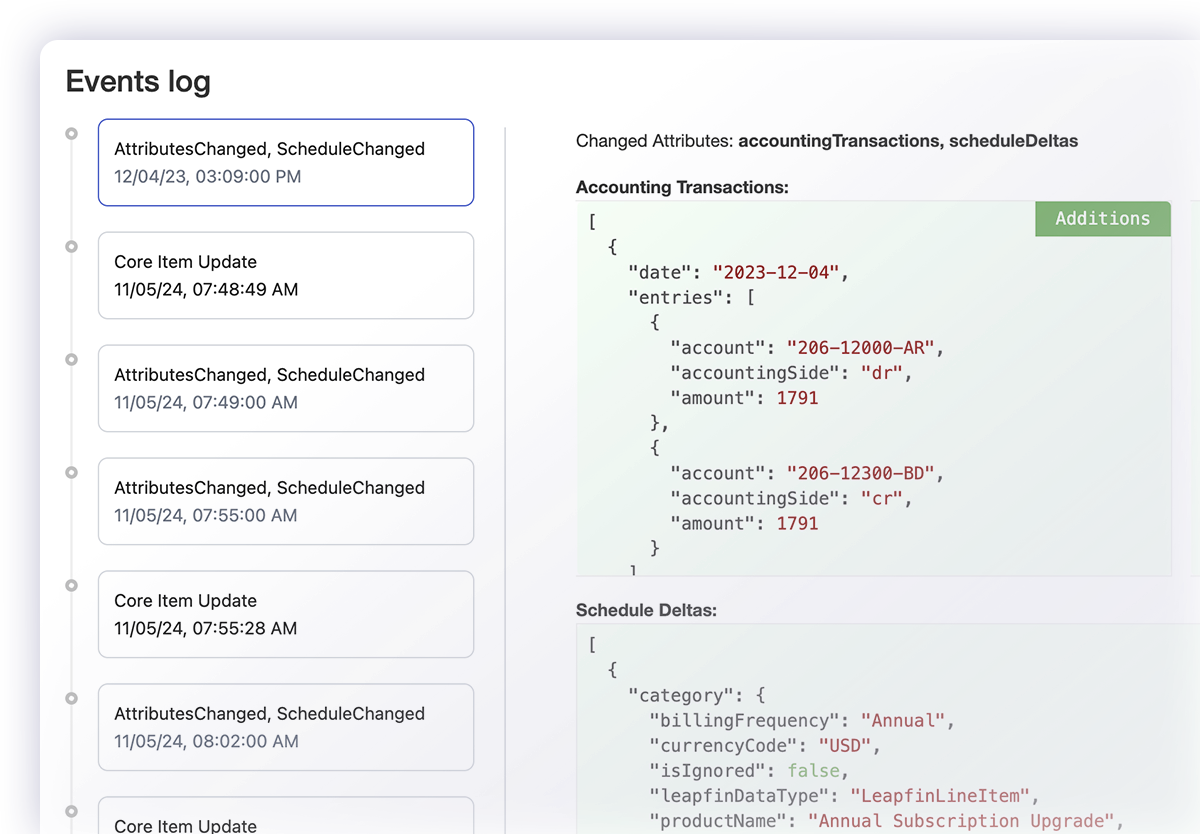

Easily adjust and track how your data is managed and enriched

As your business grows, Leapfin’s flexible data management and enrichment rules enable you to make adjustments to ensure business and industry compliance, plus track and audit any changes to data or rules.

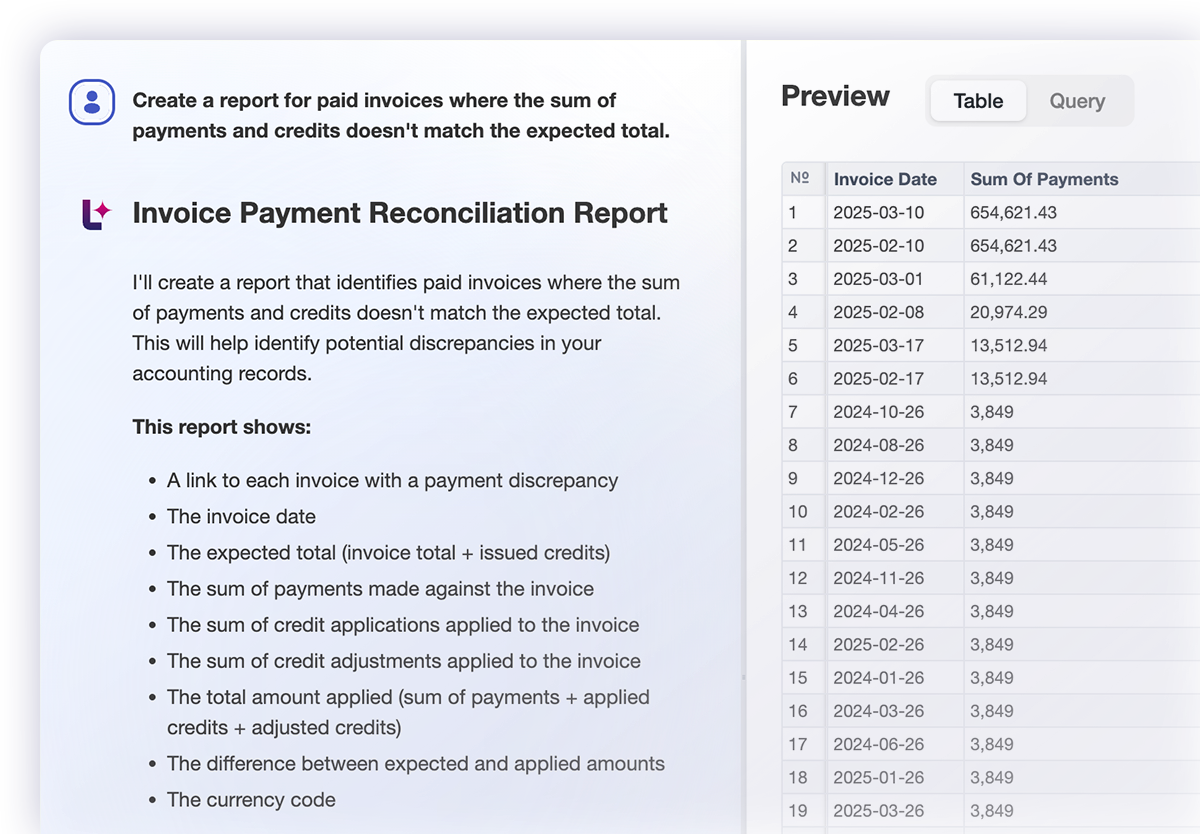

Explore data and keep up with operational changes

Use natural language prompts to uncover anomalies, identify trends, and resolve issues. Then use AI to update rules to account for new data types and transactions.

Empowering Finance and Accounting teams to account for and report on revenue at scale

Automatically ingest data from multiple sources

Raw data automatically prepared for accounting

Anytime access to your most valuable data

Track and link every type of revenue transaction

Streamline revenue reconciliation and reporting

Share reliable revenue data across your business

Resources for AI-powered revenue recognition

Real-world examples of improving reconciliation and revenue recognition

-

This isn’t just about automation. It’s about giving our team a system we trust, and the time and space to focus on higher-value work. I’m such a fan. I can’t say enough good things about Leapfin. It has been a huge win for us.Alicia Arntson, CPA VP, Controller, Eight Sleep

This isn’t just about automation. It’s about giving our team a system we trust, and the time and space to focus on higher-value work. I’m such a fan. I can’t say enough good things about Leapfin. It has been a huge win for us.Alicia Arntson, CPA VP, Controller, Eight Sleep -

I finally feel like I can fully support the numbers I’m posting to NetSuite every month. If someone asks, I don’t need to explain assumptions – I just pull the report in Leapfin.Brian Cheung Sr. Manager, Accounting, GoodRx

I finally feel like I can fully support the numbers I’m posting to NetSuite every month. If someone asks, I don’t need to explain assumptions – I just pull the report in Leapfin.Brian Cheung Sr. Manager, Accounting, GoodRx -

Leapfin is like our digital glue. It connects all of our financial data sources together so our team isn’t spending time manually tying everything out.Rebecca Wang VP Finance Corporate Controller, Guideline

Leapfin is like our digital glue. It connects all of our financial data sources together so our team isn’t spending time manually tying everything out.Rebecca Wang VP Finance Corporate Controller, Guideline -

With Leapfin, we are faster, we are more accurate, and we are drama-free. It's transformed our close process. No surprises, no last-minute scrambles. Everything just runs smoothly.Rodrigo Brumana CFO, Poshmark

With Leapfin, we are faster, we are more accurate, and we are drama-free. It's transformed our close process. No surprises, no last-minute scrambles. Everything just runs smoothly.Rodrigo Brumana CFO, Poshmark -

The feed from Leapfin to NetSuite works seamlessly. It's something that we don't have to worry about anymore.Lindsay Remigio Sr. Manager, Revenue Accounting, Reddit

The feed from Leapfin to NetSuite works seamlessly. It's something that we don't have to worry about anymore.Lindsay Remigio Sr. Manager, Revenue Accounting, Reddit -

The consolidated view of our revenue in Leapfin is fantastic. In literally one click we can easily see change month to month. And, because every single transaction is right there, we can dig into details for any explanation we may need.Melissa Tuttle Director of Accounting Systems, Outside

The consolidated view of our revenue in Leapfin is fantastic. In literally one click we can easily see change month to month. And, because every single transaction is right there, we can dig into details for any explanation we may need.Melissa Tuttle Director of Accounting Systems, Outside -

Leapfin helped parse out and make sense of the data that already existed. Simple searches in Leapfin make it easy to track things like refunds, revenue stream trends, and month-to-month movements. Without reporting bottlenecks, Canva is no longer vulnerable to surprises at month-end.Melissa Lee Corporate Controller, Canva

Leapfin helped parse out and make sense of the data that already existed. Simple searches in Leapfin make it easy to track things like refunds, revenue stream trends, and month-to-month movements. Without reporting bottlenecks, Canva is no longer vulnerable to surprises at month-end.Melissa Lee Corporate Controller, Canva -

With Leapfin, we didn’t need to increase headcount significantly to account for our growth. We were able to double transactions, especially during peak seasons, without growing the accounting team.Ian Booler VP of Finance, Altitude Sports

With Leapfin, we didn’t need to increase headcount significantly to account for our growth. We were able to double transactions, especially during peak seasons, without growing the accounting team.Ian Booler VP of Finance, Altitude Sports -

Before Leapfin, our reporting processes relied heavily on Excel, and close took up to 90 days. Now, we can close in just 5 days because Leapfin automates our entire data process and revenue reporting so that we can report accurate, validated financials at the end of the month.Minnie Luo CPA, Director of Revenue Operations, Top Hat

Before Leapfin, our reporting processes relied heavily on Excel, and close took up to 90 days. Now, we can close in just 5 days because Leapfin automates our entire data process and revenue reporting so that we can report accurate, validated financials at the end of the month.Minnie Luo CPA, Director of Revenue Operations, Top Hat -

If you’re a high complexity high transaction volume business, Leapfin is a no brainer.Damien Singh CFO, Canva

If you’re a high complexity high transaction volume business, Leapfin is a no brainer.Damien Singh CFO, Canva -

Leapfin has completely transformed our month-end close process, eliminating 4 days of manual work, with its ability to handle hundreds of millions of transactions and transform them into a subledger.Joe Blanchett Director, Business Systems, SeatGeek

Leapfin has completely transformed our month-end close process, eliminating 4 days of manual work, with its ability to handle hundreds of millions of transactions and transform them into a subledger.Joe Blanchett Director, Business Systems, SeatGeek -

The consistency and quality of data we get with Leapfin is excellent. The reduction in our month-end close time has freed up our team to focus on meaningful analysis, driving better business decisions.Jason Grenier CFO, Altitude Sports

The consistency and quality of data we get with Leapfin is excellent. The reduction in our month-end close time has freed up our team to focus on meaningful analysis, driving better business decisions.Jason Grenier CFO, Altitude Sports

FAQs

Leapfin automatically consolidates and enriches transaction-level data from Stripe (as well as any other data source), normalizes and enriches the data, and automatically creates journal entries based on your business requirements. Accounting and Finance teams can recognize revenue accurately and reconcile payments faster, even as billing complexity increases, by eliminating manual spreadsheets and more easily complying with ASC 606.

Absolutely. Leapfin is specifically designed to handle the complexities of subscription billing models including usage-based pricing, tiered plans, and multiple revenue streams all while ensuring GAAP-compliant revenue recognition. And as your business grows and evolves, Leapfin’s flexibility allows you to make necessary adjustments and ingest and explore large volumes of data without skipping a beat.

Yes! Leapfin is built for teams that want to automate a simple revenue recognition schedule, but it’s especially effective for companies that have added complexity that comes from multiple billing or payment systems, product and pricing models, geographies, or other variables. By giving users control over their implementation and configuration they can apply – and change – rules that meet the specific requirements subscription businesses face when it comes to recurring billing and deferred revenue.

Leapfin uses native AI to help users surface trends, anomalies, and new transaction types using natural language prompts without requiring SQL or other query language skills. It helps Finance teams stay ahead of changes, troubleshoot issues faster, and adapt enrichment rules without waiting on engineering or BI teams.

Automating revenue recognition reduces tedious manual work, speeds up month-end close, and improves reporting accuracy across large volumes of transactions. It also helps Finance teams stay audit-ready, and ensures compliance with standards like ASC 606. And with Leapfin, users also benefit from having complete, reliable revenue data in real-time, giving leadership more timely visibility into revenue performance well before month-end close.

Key features to look for include the ability to handle high transaction volumes, flexible data transformation and enrichment, real-time reconciliation, and integrations with multiple billing systems and ERPs. Increasingly, finance leaders are also prioritizing AI capabilities that promote team efficiency, increased ROI, and adaptability to keep up as the business changes without having to hire additional people.

As companies scale, they adopt more systems to handle different pieces of the billing and payment experience, expand into new geographies, introduce varied product and pricing models, and have added layers of internal and external compliance requirements. This results in fragmented operational data across the business, managed by multiple functional teams (engineering, product, etc.), making it harder for Finance teams to track, reconcile, and recognize revenue in a timely and compliant way.