Reconcile Stripe Billing & Payment Transactions

Remove the complexity and time consuming work of deciphering Stripe data to connect all the relevant inputs required to reconcile payments and invoices

Unify Stripe Data in Leapfin

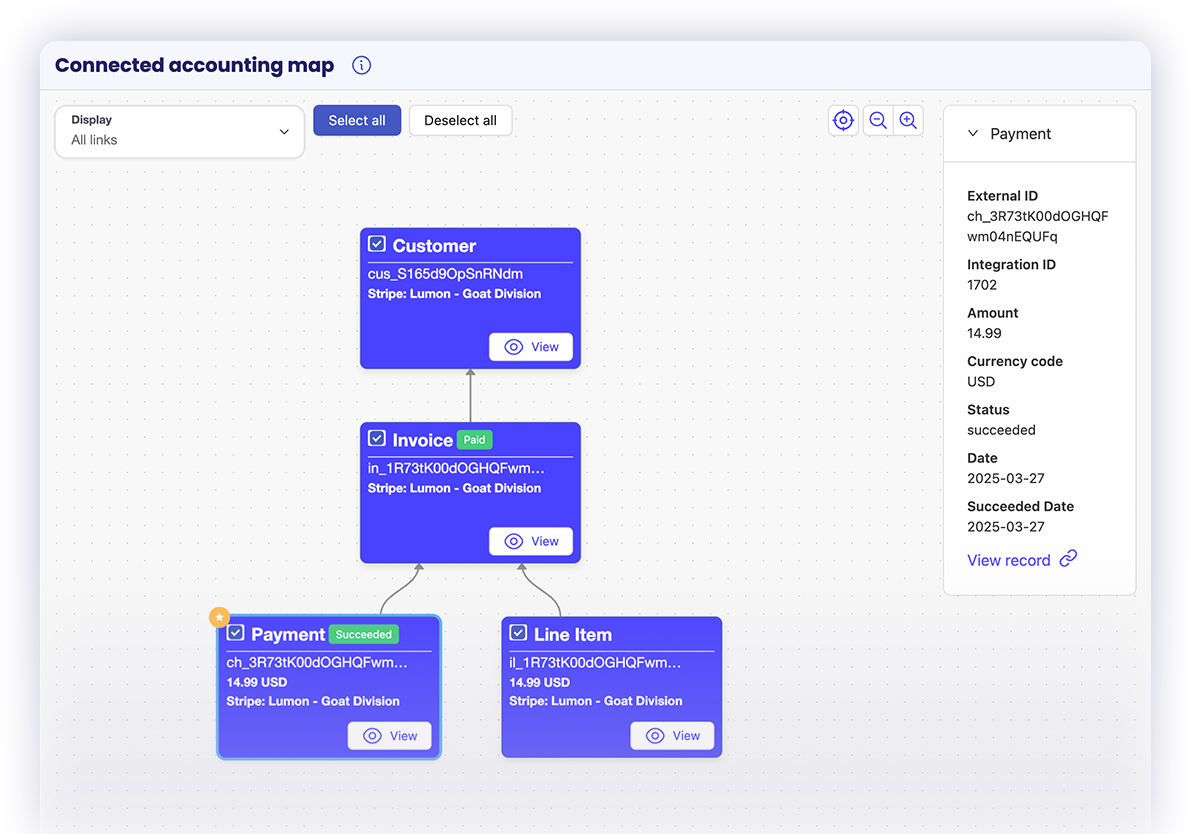

Matching Stripe invoices to payments then to cash in the bank involves multiple tedious steps: extract data from Stripe, connect payments to invoices, account for adjustments, credits, refunds, and link to corresponding payouts received. Leapfin automatically streamlines the order-to-cash reconciliation process while also giving you full visibility into connections between every transaction type.

Benefits of integrating Leapfin with Stripe

Native integration with Stripe API

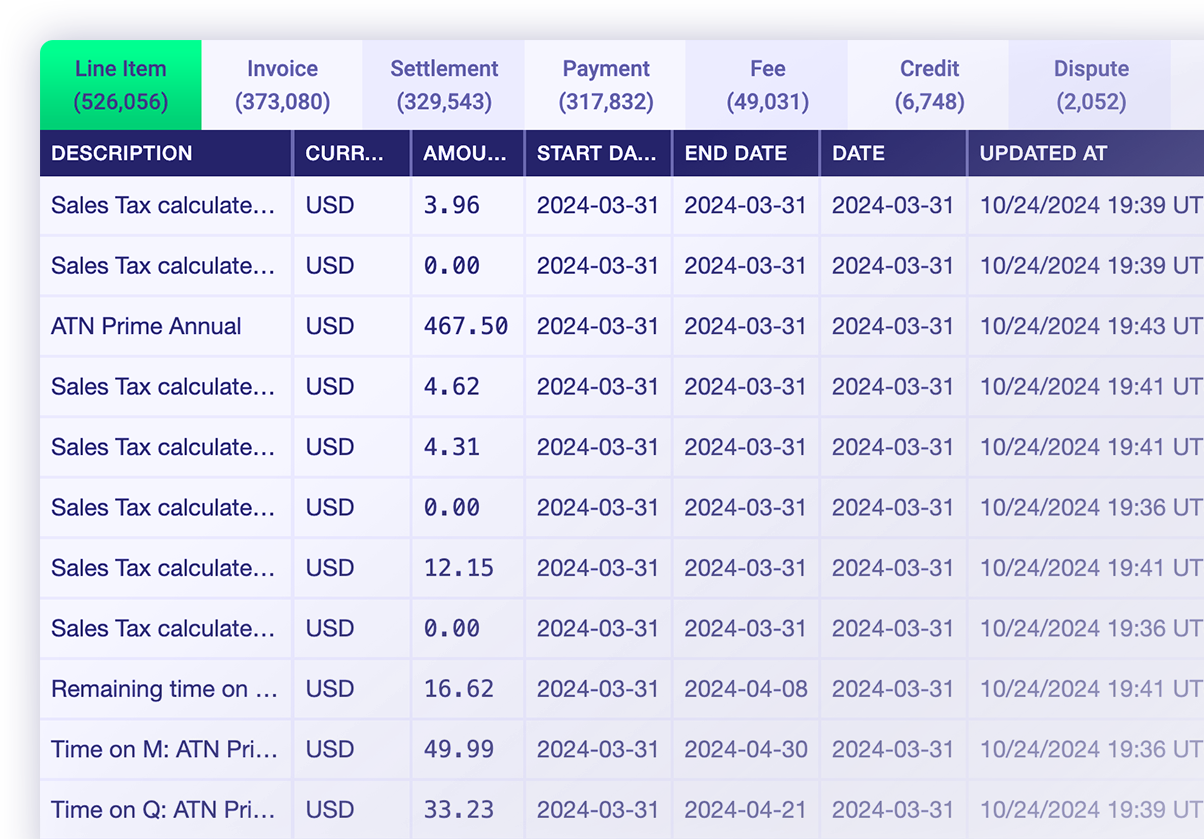

Avoid the monotonous work of manually downloading multiple Stripe reports from multiple locations by accessing all your Stripe transaction data in a single system.

Expertise developed from years working with Stripe data

Access critical transaction details that exposes payment sources, refunds, credits, and disputes to clearly trace order-to-cash journey and reconcile revenue faster.

Raw data automatically transformed into accounting-friendly format

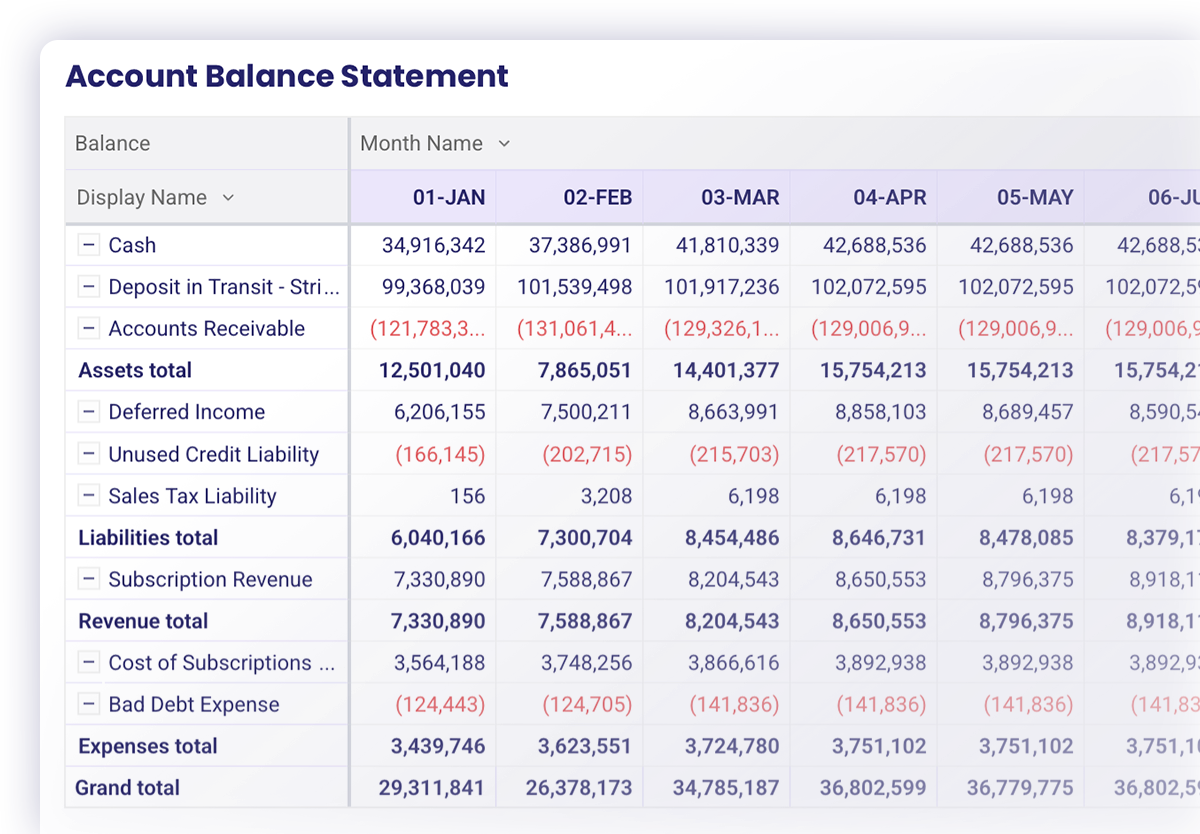

Create clean journal entries that can be used to easily analyze results, summarize for your ERP, or share with other systems across your organization.

Integrate Stripe with Leapfin to Gain Control of Your Revenue Data

Resources for Managing Revenue Data from Stripe

FAQs

Stripe payment reconciliation is the process of matching invoices, payments, refunds, and payouts from Stripe to your accounting records and bank deposits. Without automation, it often requires downloading multiple reports, manually tying them together, and adjusting for credits or disputes. Leapfin automates this process so your finance team can reconcile faster with fewer errors.

Leapfin connects directly to the Stripe API to pull in raw transaction data. It then automatically transforms that data into an accounting-friendly format, linking invoices, payments, refunds, and payouts in a single system. This eliminates manual report downloads and ensures reconciliation is always complete and accurate.

Yes. Many subscription businesses use Stripe Billing to manage recurring payments, but recognizing revenue correctly is still complex because you have to account for refunds, credits, discounts, cancellations, and other adjustments. Leapfin gives you a clear order-to-cash view by tying invoices to payments and cash received. That makes subscription revenue recognition easier, faster, and audit-ready.

Manual Stripe reconciliation is time-consuming and error-prone. Leapfin automates the process, saving your team hours each month. Benefits include: native Stripe integration, clear visibility into refunds, credits, and disputes, and clean journal entries that can flow into your ERP or other reporting systems.

Absolutely. Many high-growth companies operate across multiple entities and currencies, and Stripe data can quickly get complicated. Leapfin centralizes and normalizes this data, so you can reconcile transactions across entities and currencies without duplicating work or creating reporting gaps. And Leapfin is built to scale with your business as you evolve your products, pricing, geographies, etc.

Yes, but usually with limitations. While ERPs can import Stripe data, the raw format often requires heavy manual adjustments. That’s why many finance teams use dedicated reconciliation tools or automation - like Leapfin - to bridge the gap between Stripe’s raw data and their ERP’s accounting requirements.

A payment in Stripe is money collected from a customer, while a payout is the transfer of those funds from Stripe to your business’s bank account. Because there can be delays, refunds, and adjustments between payments and payouts, reconciling the two requires careful tracking. Leapfin helps by automating the data consolidation and preparation process making it much easier to reconcile payments and close the books.

Stripe generates multiple reports for invoices, payments, refunds, and payouts, and they don’t always appear to align one-to-one because of several factors including timing. Reconciling means stitching these together, adjusting for disputes or credits, and matching everything back to bank deposits. It’s a time-consuming process that many Finance and Accounting teams execute manually, but high-performing teams have implemented automated revenue recognition and reconciliation solutions like Leapfin.

Real-world examples of improving revenue visibility and accounting efficiency

-

This isn’t just about automation. It’s about giving our team a system we trust, and the time and space to focus on higher-value work. I’m such a fan. I can’t say enough good things about Leapfin. It has been a huge win for us.Alicia Arntson, CPA VP, Controller, Eight Sleep

This isn’t just about automation. It’s about giving our team a system we trust, and the time and space to focus on higher-value work. I’m such a fan. I can’t say enough good things about Leapfin. It has been a huge win for us.Alicia Arntson, CPA VP, Controller, Eight Sleep -

I finally feel like I can fully support the numbers I’m posting to NetSuite every month. If someone asks, I don’t need to explain assumptions – I just pull the report in Leapfin.Brian Cheung Sr. Manager, Accounting, GoodRx

I finally feel like I can fully support the numbers I’m posting to NetSuite every month. If someone asks, I don’t need to explain assumptions – I just pull the report in Leapfin.Brian Cheung Sr. Manager, Accounting, GoodRx -

Leapfin is like our digital glue. It connects all of our financial data sources together so our team isn’t spending time manually tying everything out.Rebecca Wang VP Finance Corporate Controller, Guideline

Leapfin is like our digital glue. It connects all of our financial data sources together so our team isn’t spending time manually tying everything out.Rebecca Wang VP Finance Corporate Controller, Guideline -

With Leapfin, we are faster, we are more accurate, and we are drama-free. It's transformed our close process. No surprises, no last-minute scrambles. Everything just runs smoothly.Rodrigo Brumana CFO, Poshmark

With Leapfin, we are faster, we are more accurate, and we are drama-free. It's transformed our close process. No surprises, no last-minute scrambles. Everything just runs smoothly.Rodrigo Brumana CFO, Poshmark -

The feed from Leapfin to NetSuite works seamlessly. It's something that we don't have to worry about anymore.Lindsay Remigio Sr. Manager, Revenue Accounting, Reddit

The feed from Leapfin to NetSuite works seamlessly. It's something that we don't have to worry about anymore.Lindsay Remigio Sr. Manager, Revenue Accounting, Reddit -

The consolidated view of our revenue in Leapfin is fantastic. In literally one click we can easily see change month to month. And, because every single transaction is right there, we can dig into details for any explanation we may need.Melissa Tuttle Director of Accounting Systems, Outside

The consolidated view of our revenue in Leapfin is fantastic. In literally one click we can easily see change month to month. And, because every single transaction is right there, we can dig into details for any explanation we may need.Melissa Tuttle Director of Accounting Systems, Outside -

Leapfin helped parse out and make sense of the data that already existed. Simple searches in Leapfin make it easy to track things like refunds, revenue stream trends, and month-to-month movements. Without reporting bottlenecks, Canva is no longer vulnerable to surprises at month-end.Melissa Lee Corporate Controller, Canva

Leapfin helped parse out and make sense of the data that already existed. Simple searches in Leapfin make it easy to track things like refunds, revenue stream trends, and month-to-month movements. Without reporting bottlenecks, Canva is no longer vulnerable to surprises at month-end.Melissa Lee Corporate Controller, Canva -

With Leapfin, we didn’t need to increase headcount significantly to account for our growth. We were able to double transactions, especially during peak seasons, without growing the accounting team.Ian Booler VP of Finance, Altitude Sports

With Leapfin, we didn’t need to increase headcount significantly to account for our growth. We were able to double transactions, especially during peak seasons, without growing the accounting team.Ian Booler VP of Finance, Altitude Sports -

Before Leapfin, our reporting processes relied heavily on Excel, and close took up to 90 days. Now, we can close in just 5 days because Leapfin automates our entire data process and revenue reporting so that we can report accurate, validated financials at the end of the month.Minnie Luo CPA, Director of Revenue Operations, Top Hat

Before Leapfin, our reporting processes relied heavily on Excel, and close took up to 90 days. Now, we can close in just 5 days because Leapfin automates our entire data process and revenue reporting so that we can report accurate, validated financials at the end of the month.Minnie Luo CPA, Director of Revenue Operations, Top Hat -

If you’re a high complexity high transaction volume business, Leapfin is a no brainer.Damien Singh CFO, Canva

If you’re a high complexity high transaction volume business, Leapfin is a no brainer.Damien Singh CFO, Canva -

Leapfin has completely transformed our month-end close process, eliminating 4 days of manual work, with its ability to handle hundreds of millions of transactions and transform them into a subledger.Joe Blanchett Director, Business Systems, SeatGeek

Leapfin has completely transformed our month-end close process, eliminating 4 days of manual work, with its ability to handle hundreds of millions of transactions and transform them into a subledger.Joe Blanchett Director, Business Systems, SeatGeek -

The consistency and quality of data we get with Leapfin is excellent. The reduction in our month-end close time has freed up our team to focus on meaningful analysis, driving better business decisions.Jason Grenier CFO, Altitude Sports

The consistency and quality of data we get with Leapfin is excellent. The reduction in our month-end close time has freed up our team to focus on meaningful analysis, driving better business decisions.Jason Grenier CFO, Altitude Sports