Why finance feels stuck in an impossible cycle

Key points:

- Finance leaders know automation works, but most can’t fully realize its value due to technical barriers.

- The tension between speed and accuracy defines every finance-related decision.

- AI offers the only proven way to achieve both while staying lean and maintaining control.

Finance teams today are asked to do the impossible. Every month, they are expected to deliver real-time business insights, measure business changes that were just made yesterday, and close faster – all at once. And they are being asked to do it with fewer people, less resources, and more accuracy.

Automation should have solved this years ago. The problem isn’t whether automation works. We know it does. The problem is that finance is often dependent on other parts of the business for their data.

Through all of my conversations with CFOs, their greatest frustration comes from the team having to wait around and feeling helpless because you can’t do what you want to do.

Every financial analysis you want to perform requires a data analyst to help you pull the data set from your data warehouse.

Every new product launch, pricing experiment, or business model change requires a technical admin or engineer to update your financial system. The process is full of bottlenecks.

So finance leaders end up choosing between two bad options: move fast and risk errors, or be accurate and fall behind. Neither serves the business well. The truth is, speed without accuracy is reckless – and accuracy without speed is irrelevant.

The only real solution to achieve both while staying lean is to direct an AI workforce that does things for you – with precision and speed – and empowers you to accomplish everything you need with no technical know-how.

That’s what we’ve been building toward at Leapfin.

Why we built AI workflows: Empowering finance to act fast and with confidence while staying lean

Key points:

- Traditional systems force dependence on engineering or technical admins.

- The new AI workflows remove that dependency entirely – empowering self-sufficiency and agility.

Our mission at Leapfin has always been simple: give Finance teams control of their data and confidence in their numbers.

When I talk with customers, they often describe a shared frustration: they know the data they need for their analysis, but they can’t get it. And they know what business logic needs to change but they can’t make that change themselves. Every data request or logic change requires them to file a JIRA ticket. The dependency loop kills momentum and confidence.

The greatest frustration is having to wait, unable to do what you want yourselves.

With our new AI workflows, that technical barrier disappears. Every Finance team member is now a technical expert.

This is what empowerment looks like in practice: speed and accuracy, achieved through control.

Our AI journey: From skepticism to everyday value

Key points:

- When ChatGPT appeared in 2022, everyone in Finance was skeptical – including us.

- We approached AI from first principles: and how could AI genuinely improve finance and accounting work?

- Luca began as an experiment for data exploration – and quickly became indispensable.

When ChatGPT emerged in late 2022, we all knew it was a significant moment, but no one knew exactly what it meant for them. In finance and accounting, the reaction was mostly skepticism – how could AI possibly apply to work that requires precision and carries such high stakes?

We felt that same uncertainty, but we also saw potential. So instead of chasing hype, we went back to first principles. We asked:

- What is the purpose of accounting?

- Why does finance and accounting work look the way it does today?

- Why are financial software solutions built the way they are?

- Where could AI meaningfully help?

First, a significant amount of finance work is simply managing data. In most companies, when finance wants to analyze a specific trend, or accounting wants to understand why certain accounts don’t reconcile, they can’t start the work without data engineering or BI support. So we built Luca, our specialized AI agent, which is essentially a “data analyst-in-a-box”. What used to require weeks of back and forth with a data analyst and deep SQL expertise, our customers can now do in seconds themselves.

At first, Luca was an experiment. But almost immediately, we saw customers engaging deeply. What started as one query a week turned into fifteen queries a day. Today, teams are using Luca to investigate anomalies, identify trends, and build new reports – all without any technical know-how. They are equipped with the superpower of decades of technical and data engineering training without ever having to get an engineering degree.

Our customers’ repeat engagement with Luca was the clearest sign we’d seen that Finance teams were ready for AI, as long as it solved a real problem.

From reporting to workflows: Expanding AI to where it matters most

Key points:

- Rules are basically code that execute specific logic; they exploded in number as businesses evolved.

- Rigid rule configurations have been the hardest part of leveraging automation.

- Luca eliminates the complexity of managing rules with natural language and super-intelligence.

After seeing how Luca changed reporting, the next question came naturally: could AI also help build automation itself?

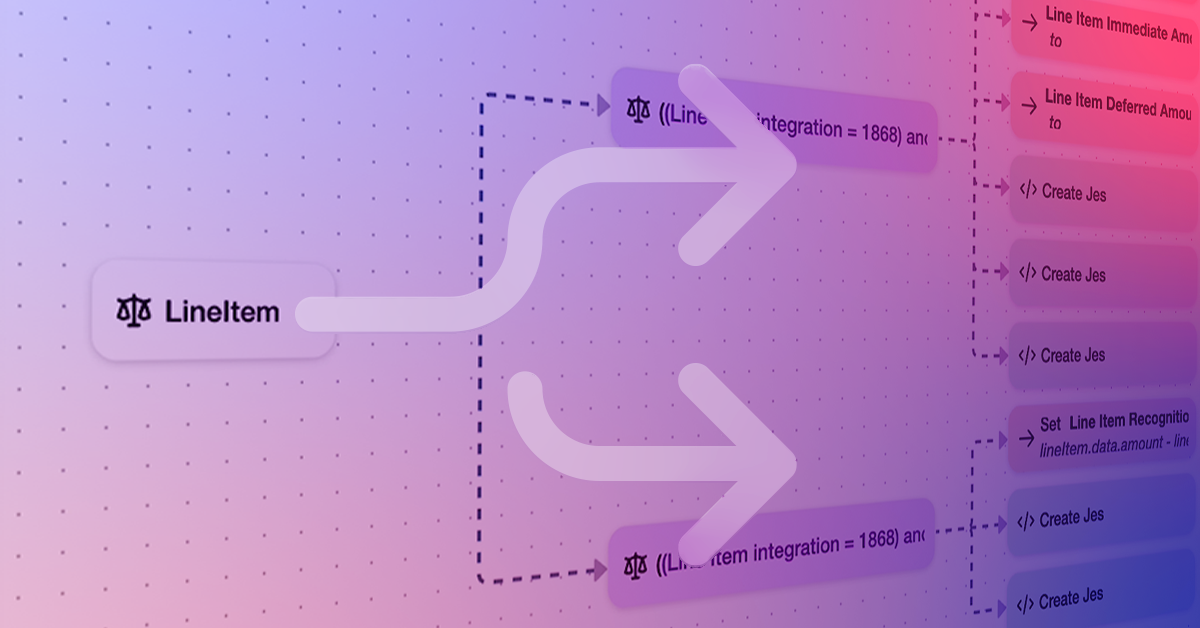

In accounting, rules are everywhere – they tell the system what to do with each transaction. But as businesses grow, those rules multiply into the hundreds. Each new product, bundle, or pricing change adds another layer. Maintaining them becomes its own full-time job.

Rules were supposed to simplify automation, but at scale, they became another source of complexity.

That’s what we set out to change.

With Leapfin’s new workflows, powered by Luca, Finance teams can now build and maintain automation using plain English. Luca understands your intent, constructs the underlying logic, and ensures that logic is accurate and auditable. Accounting automation isn’t just easier, it’s fundamentally faster and more resilient to change.

This is AI doing what it should: making the hard things simple, without sacrificing control.

Why workflows change the game: Speed and accuracy, together at last

Key points:

- Finance can now move at the same rhythm as the business.

- Speed and accuracy are no longer trade-offs – they reinforce each other.

- Do more with less, whether you have technical resources or not

For too long, finance has lived in lag. Data takes too long to clean, validate, and report. By the time revenue numbers are finalized, the next month is already half over – and leaders are forced to plan based on already stale data.

AI workflows eliminate that lag. Finance can now adapt instantly to changes in products, pricing, or business models, without compromising accuracy or compliance.

This is what I call continuous confidence – knowing your numbers are always right, always current, and always actionable.

Speed and accuracy are no longer opposing forces. They now move together, in real time.

Closing: From skepticism to standard

Key points:

- Leapfin’s AI evolution mirrors the industry’s own learning curve – from curiosity to necessity.

- This isn’t a feature; it’s a redefinition of how finance operates.

When we first started experimenting with AI, we didn't even know how far it could go. Today, it’s clear: this isn’t an experiment anymore. It’s the future of finance.

Our AI journey began with curiosity. Now it’s about capability. Luca started by helping teams explore their data. Today, it helps them automate it. And tomorrow, we will continue to equip you with an AI workforce that helps you do more with less without ever sacrificing accuracy and confidence.

If you are curious about how we are able to technically deliver on such a promise, Erik Yao (Leapfin co-founder and CTO) will be sharing a new blog post tomorrow on how we built Luca here.

Register for our upcoming live webinar on October 30

Save your seat forStop Coding, Start Closing: AI-Powered Accounting Workflows for Modern Finance. We’ll walk through the latest Leapfin product updates and share automation best practices.

See how Leapfin works

Get a feel for the ease and power of Leapfin with our interactive demo.