Report on Growing Demands With Daily Reporting

Operate like your business, close revenues on demand, and automate revenue accounting across multiple systems and millions of complex transactions.

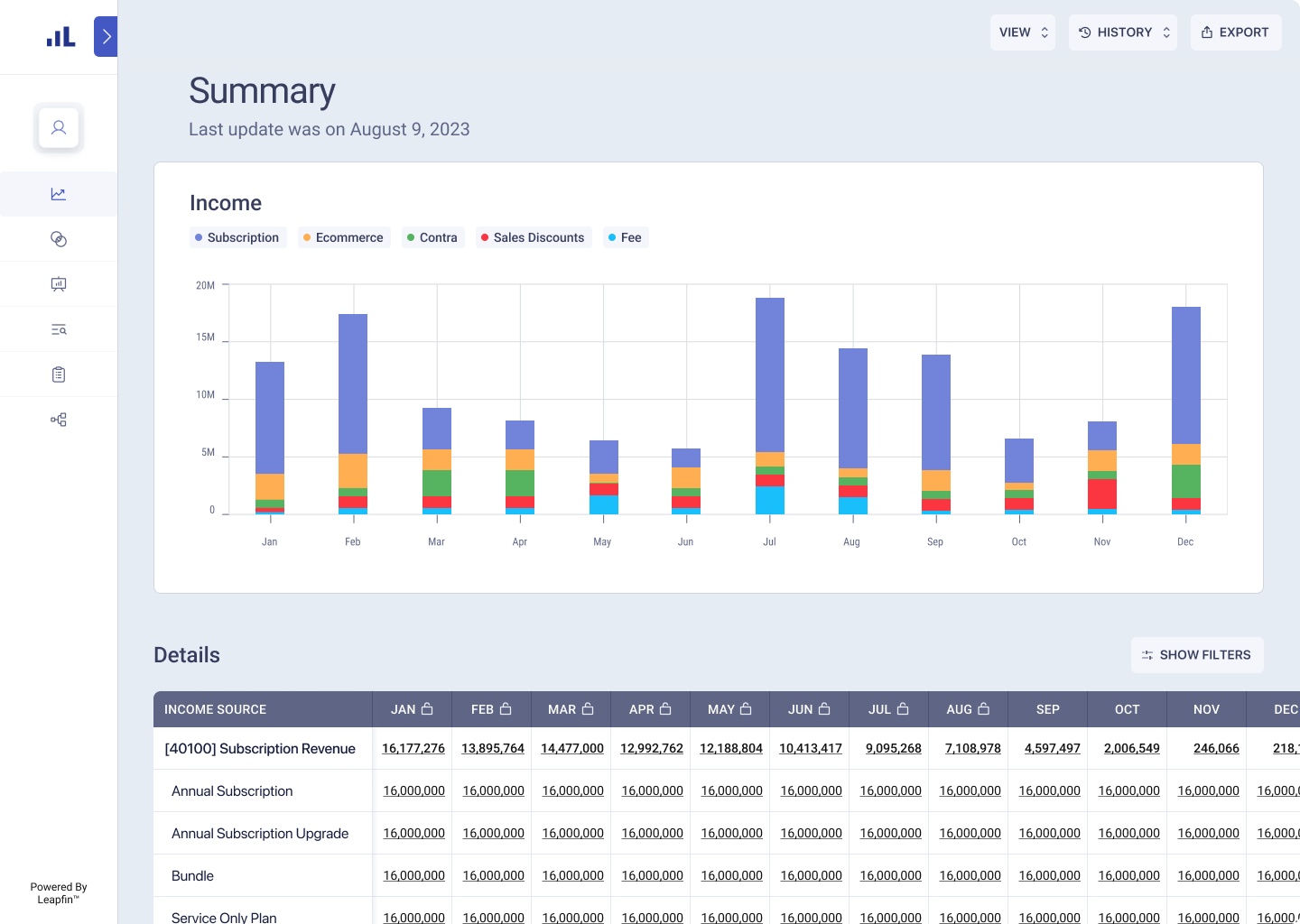

View accurate revenues daily to stay on top of your business

Properly accounting for transactions that come with increasing customer demands, new channels, and payment methods, can be challenging. Leapfin takes the burden off your team by automatically consolidating and augmenting transactions into detailed revenue accounting records, then layers revenue recognition and journal entry automation on top. View accurate revenues daily, just like your bank.

Report compliant numbers every time

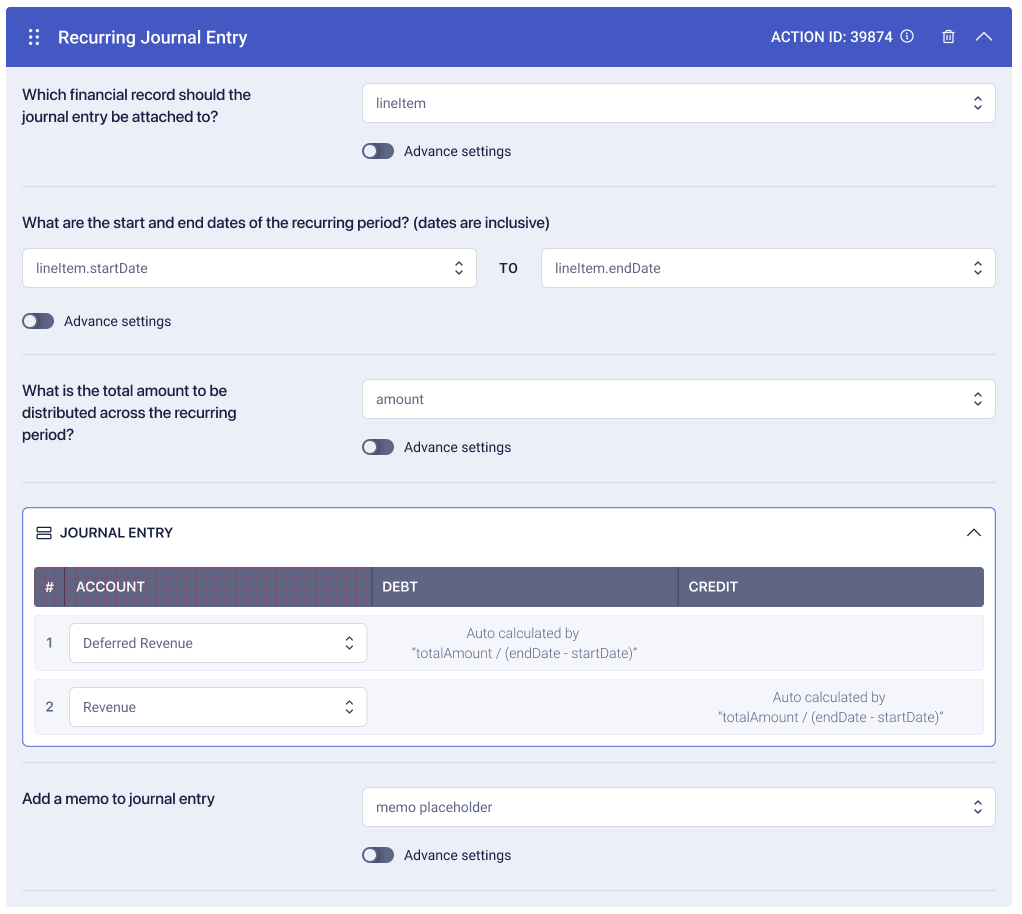

Explore the future of revenue accounting with Leapfin, enabling you to report compliant, accurate revenues across millions of transactions. Apply pre-built ASC-606 and IFRS-15 compliant revenue rules to transaction records and check for subledger compliance by drilling in to see the rules applied. Leapfin automates revenue recognition so you can focus on helping your business deliver better customer service.

Fast-track audits with traceable financials

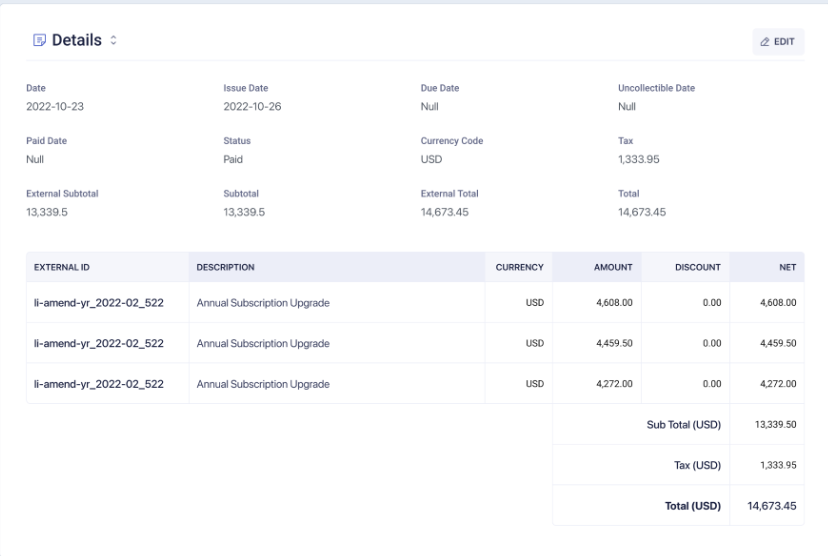

Help auditors get the data they need quickly by giving them access to Leapfin. Leapfin provides easy-to-validate, traceable, and accurate revenue numbers by centralizing the entire accounting process and your transactions in one place. Auditors can click into aggregated subledger accounts and view the source transaction, calculations involved, and revenue rules applied. Streamline audits with Leapfin as your single source of accounting truth.

Scale services and offerings without re-engineering your ERP

Balancing agile accounting with growing customer demands, channels, payment methods or service offerings can push your ERP past its limits. Leapfin takes the data processing and transformation burden off your ERP with a flexible architecture that scales with your business without extra storage fees or downtime. Run efficient accounting processes without feeling limited by your systems with Leapfin.

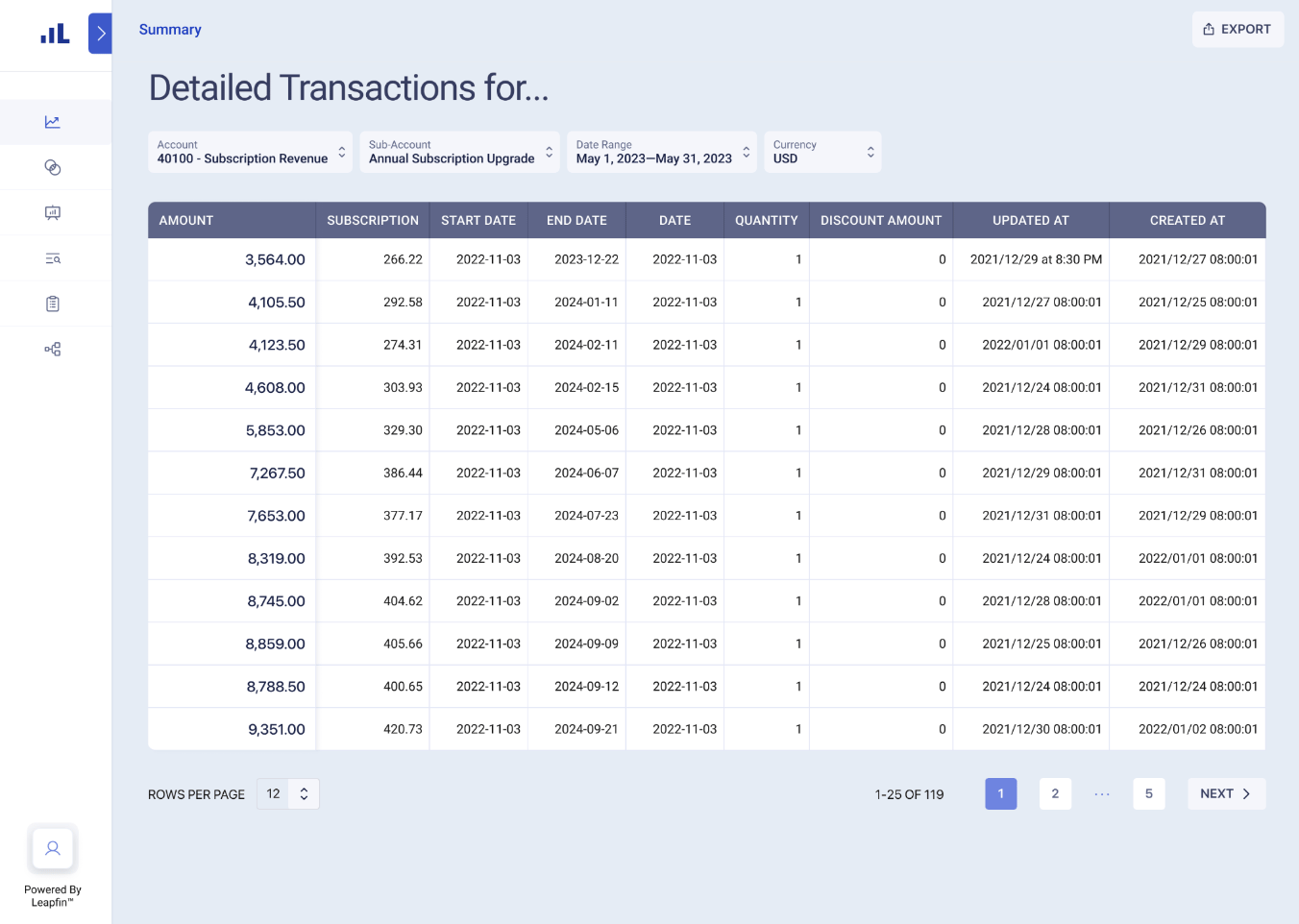

Increase visibility into transaction activities

Consolidate transactions across multiple systems including payment providers, point-of-sale, and invoicing tools into a single source of truth – Leapfin – for increased transparency into transaction details and to own your accounting data. Uncover novel insights, faster to better serve your customers with disaggregated data that can be filtered along any dimension. Make better decisions and tailor experiences to your customers with accurate, detailed, real-time data at your fingertips.

-

This isn’t just about automation. It’s about giving our team a system we trust, and the time and space to focus on higher-value work. I’m such a fan. I can’t say enough good things about Leapfin. It has been a huge win for us.Alicia Arntson, CPA VP, Controller, Eight Sleep

This isn’t just about automation. It’s about giving our team a system we trust, and the time and space to focus on higher-value work. I’m such a fan. I can’t say enough good things about Leapfin. It has been a huge win for us.Alicia Arntson, CPA VP, Controller, Eight Sleep -

I finally feel like I can fully support the numbers I’m posting to NetSuite every month. If someone asks, I don’t need to explain assumptions – I just pull the report in Leapfin.Brian Cheung Sr. Manager, Accounting, GoodRx

I finally feel like I can fully support the numbers I’m posting to NetSuite every month. If someone asks, I don’t need to explain assumptions – I just pull the report in Leapfin.Brian Cheung Sr. Manager, Accounting, GoodRx -

Leapfin is like our digital glue. It connects all of our financial data sources together so our team isn’t spending time manually tying everything out.Rebecca Wang VP Finance Corporate Controller, Guideline

Leapfin is like our digital glue. It connects all of our financial data sources together so our team isn’t spending time manually tying everything out.Rebecca Wang VP Finance Corporate Controller, Guideline -

With Leapfin, we are faster, we are more accurate, and we are drama-free. It's transformed our close process. No surprises, no last-minute scrambles. Everything just runs smoothly.Rodrigo Brumana CFO, Poshmark

With Leapfin, we are faster, we are more accurate, and we are drama-free. It's transformed our close process. No surprises, no last-minute scrambles. Everything just runs smoothly.Rodrigo Brumana CFO, Poshmark -

The feed from Leapfin to NetSuite works seamlessly. It's something that we don't have to worry about anymore.Lindsay Remigio Sr. Manager, Revenue Accounting, Reddit

The feed from Leapfin to NetSuite works seamlessly. It's something that we don't have to worry about anymore.Lindsay Remigio Sr. Manager, Revenue Accounting, Reddit -

The consolidated view of our revenue in Leapfin is fantastic. In literally one click we can easily see change month to month. And, because every single transaction is right there, we can dig into details for any explanation we may need.Melissa Tuttle Director of Accounting Systems, Outside

The consolidated view of our revenue in Leapfin is fantastic. In literally one click we can easily see change month to month. And, because every single transaction is right there, we can dig into details for any explanation we may need.Melissa Tuttle Director of Accounting Systems, Outside -

Leapfin helped parse out and make sense of the data that already existed. Simple searches in Leapfin make it easy to track things like refunds, revenue stream trends, and month-to-month movements. Without reporting bottlenecks, Canva is no longer vulnerable to surprises at month-end.Melissa Lee Corporate Controller, Canva

Leapfin helped parse out and make sense of the data that already existed. Simple searches in Leapfin make it easy to track things like refunds, revenue stream trends, and month-to-month movements. Without reporting bottlenecks, Canva is no longer vulnerable to surprises at month-end.Melissa Lee Corporate Controller, Canva -

With Leapfin, we didn’t need to increase headcount significantly to account for our growth. We were able to double transactions, especially during peak seasons, without growing the accounting team.Ian Booler VP of Finance, Altitude Sports

With Leapfin, we didn’t need to increase headcount significantly to account for our growth. We were able to double transactions, especially during peak seasons, without growing the accounting team.Ian Booler VP of Finance, Altitude Sports -

Before Leapfin, our reporting processes relied heavily on Excel, and close took up to 90 days. Now, we can close in just 5 days because Leapfin automates our entire data process and revenue reporting so that we can report accurate, validated financials at the end of the month.Minnie Luo CPA, Director of Revenue Operations, Top Hat

Before Leapfin, our reporting processes relied heavily on Excel, and close took up to 90 days. Now, we can close in just 5 days because Leapfin automates our entire data process and revenue reporting so that we can report accurate, validated financials at the end of the month.Minnie Luo CPA, Director of Revenue Operations, Top Hat -

If you’re a high complexity high transaction volume business, Leapfin is a no brainer.Damien Singh CFO, Canva

If you’re a high complexity high transaction volume business, Leapfin is a no brainer.Damien Singh CFO, Canva -

Leapfin has completely transformed our month-end close process, eliminating 4 days of manual work, with its ability to handle hundreds of millions of transactions and transform them into a subledger.Joe Blanchett Director, Business Systems, SeatGeek

Leapfin has completely transformed our month-end close process, eliminating 4 days of manual work, with its ability to handle hundreds of millions of transactions and transform them into a subledger.Joe Blanchett Director, Business Systems, SeatGeek -

The consistency and quality of data we get with Leapfin is excellent. The reduction in our month-end close time has freed up our team to focus on meaningful analysis, driving better business decisions.Jason Grenier CFO, Altitude Sports

The consistency and quality of data we get with Leapfin is excellent. The reduction in our month-end close time has freed up our team to focus on meaningful analysis, driving better business decisions.Jason Grenier CFO, Altitude Sports