Confidently meet evolving compliance standards

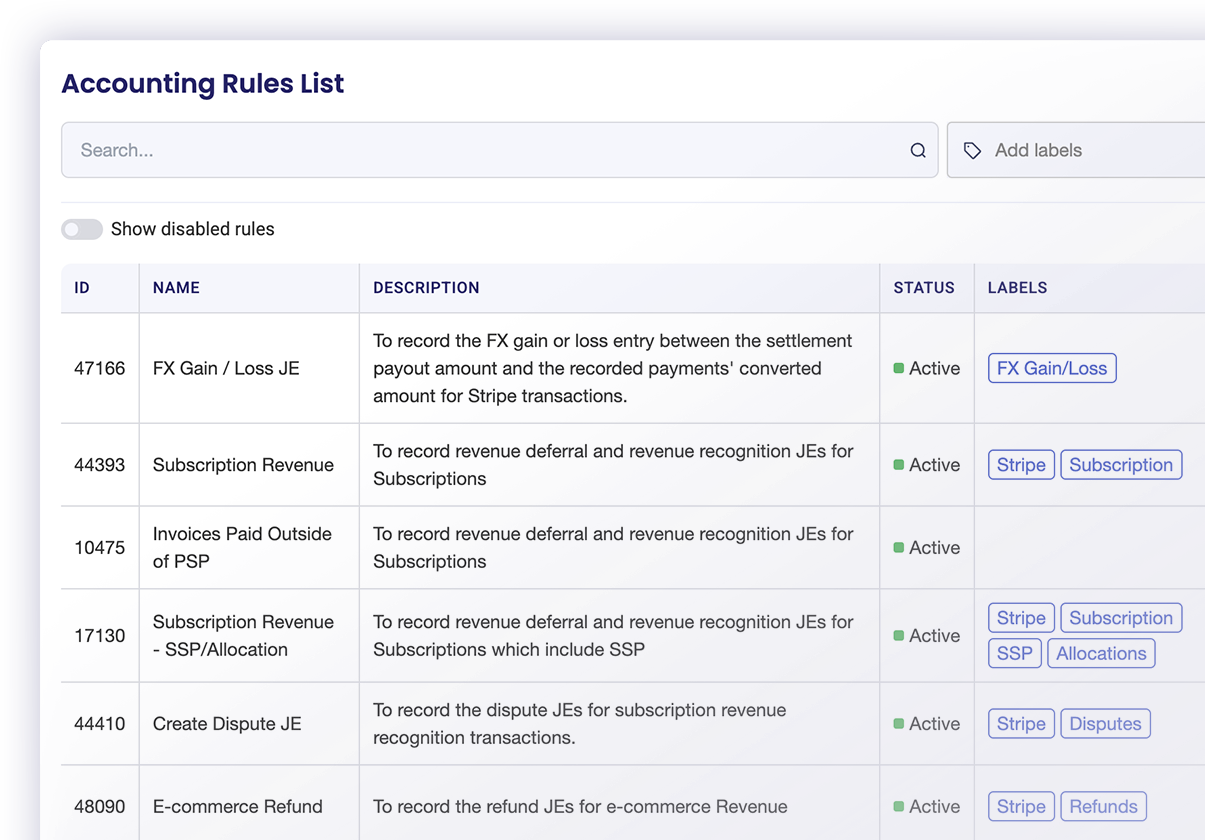

Automate the preparation of transactions based on industry and individual business requirements to deliver accurate, compliant revenue reports.

Overcome compliance challenges with AI-powered revenue recognition

One of the biggest challenges for Finance and Accounting teams is keeping up with changes in the business. When coupled with the always expanding compliance requirements of standards like ASC 606 and IFRS 15, the challenge is exponentially harder, especially for teams that rely on manual reconciliations, error-prone spreadsheets, and disconnected data trails. AI-powered revenue recognition and reconciliation with Leapfin provides the confidence and relief of accurate, fully auditable, and compliant revenue data at any time, not just at the end of the month.

Benefits of using Leapfin for revenue recognition

Automatically prepared data that meets compliance requirements

Consolidate fragmented revenue data into a single, configurable system that ensures compliance with ASC 606, GAAP, and SOX, and prepares accounting-ready data for faster reconciliation and reporting at any time.

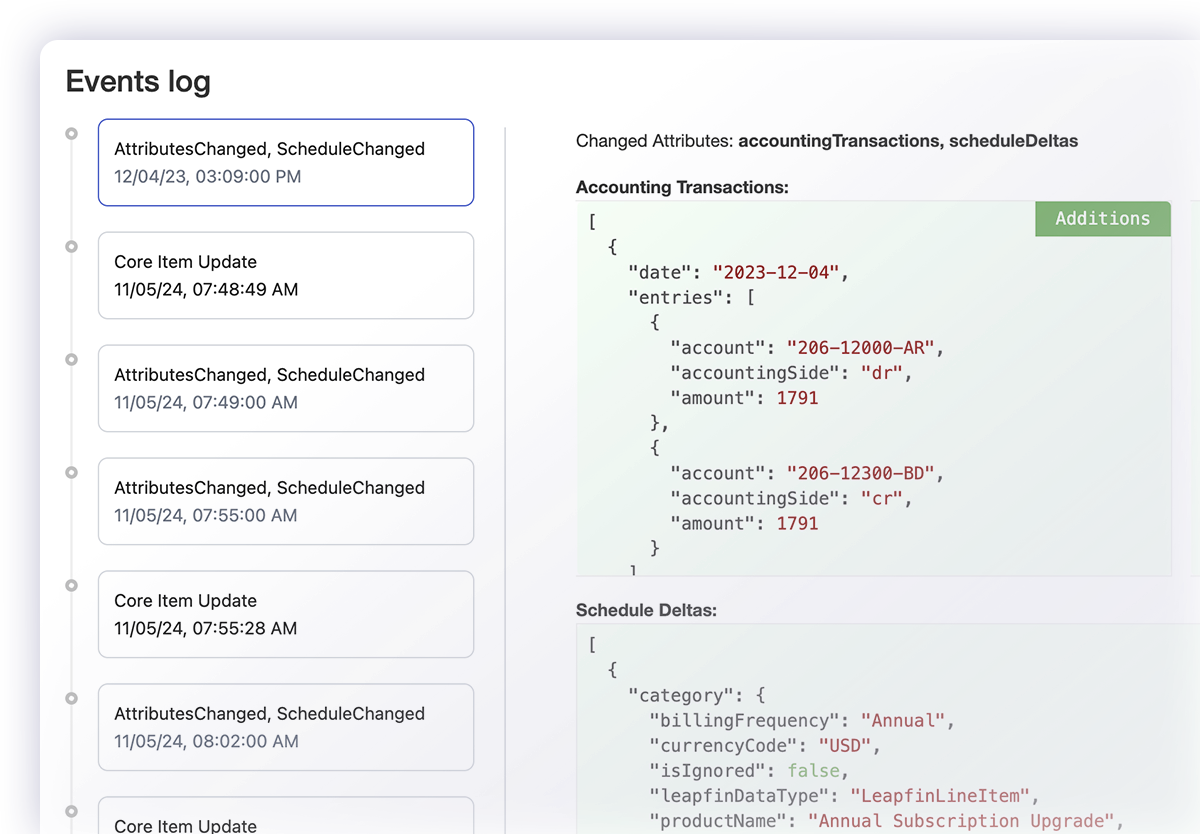

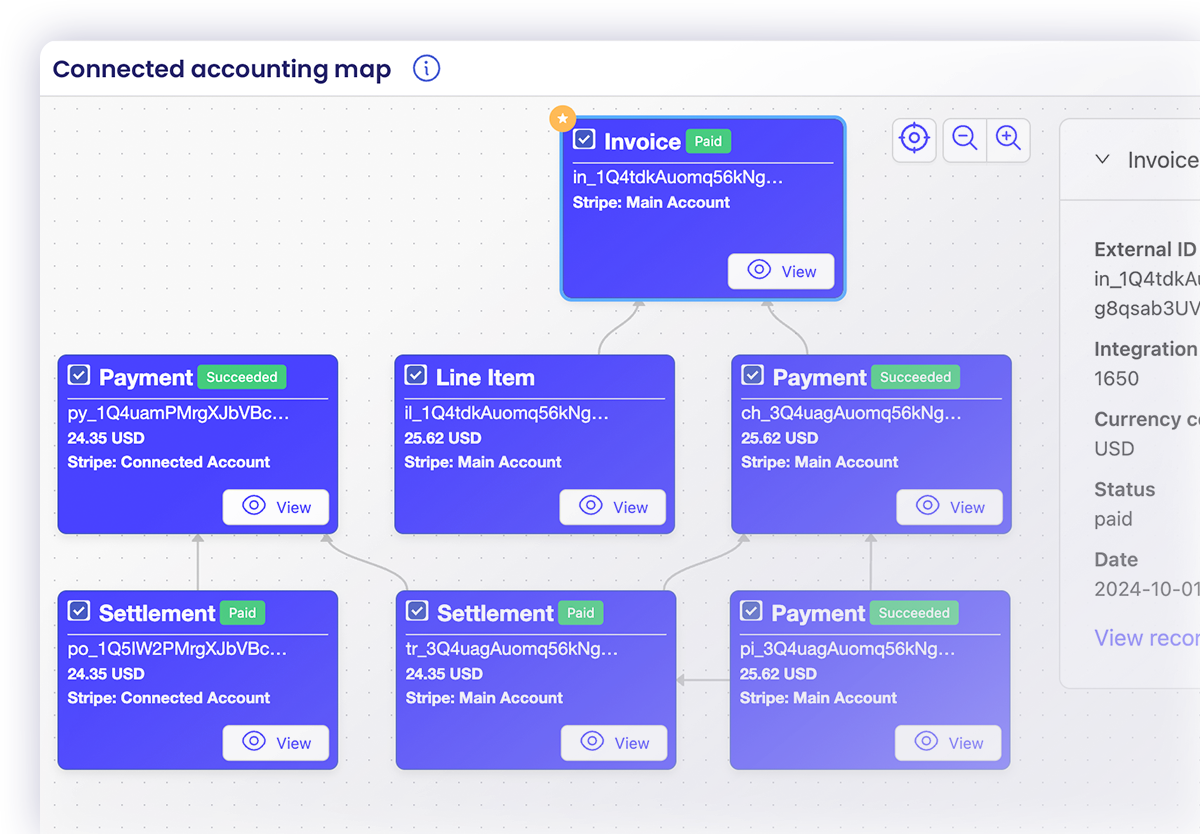

Full traceability of every transaction and accounting treatment

Clearly see and trace every transaction, links to related transactions, and any changes or treatment of transaction data – all in a single system – to make investigations easier and audits run significantly smoother.

Reduce the audit risk of error-prone manual processes

Remove the risk of human error with automation that helps scale finance operations as your business evolves and requires more systems, generates higher transaction volumes, and introduces billing and payment complexity.

Empowering Finance and Accounting teams to account for and report on revenue at scale

Automatically ingest data from multiple sources

Raw data automatically prepared for accounting

Anytime access to your most valuable data

Track and link every type of revenue transaction

Streamline revenue reconciliation and reporting

Share reliable revenue data across your business

Resources for improving auditability and compliance

Real-world examples of improving reconciliation and revenue recognition

-

This isn’t just about automation. It’s about giving our team a system we trust, and the time and space to focus on higher-value work. I’m such a fan. I can’t say enough good things about Leapfin. It has been a huge win for us.Alicia Arntson, CPA VP, Controller, Eight Sleep

This isn’t just about automation. It’s about giving our team a system we trust, and the time and space to focus on higher-value work. I’m such a fan. I can’t say enough good things about Leapfin. It has been a huge win for us.Alicia Arntson, CPA VP, Controller, Eight Sleep -

I finally feel like I can fully support the numbers I’m posting to NetSuite every month. If someone asks, I don’t need to explain assumptions – I just pull the report in Leapfin.Brian Cheung Sr. Manager, Accounting, GoodRx

I finally feel like I can fully support the numbers I’m posting to NetSuite every month. If someone asks, I don’t need to explain assumptions – I just pull the report in Leapfin.Brian Cheung Sr. Manager, Accounting, GoodRx -

Leapfin is like our digital glue. It connects all of our financial data sources together so our team isn’t spending time manually tying everything out.Rebecca Wang VP Finance Corporate Controller, Guideline

Leapfin is like our digital glue. It connects all of our financial data sources together so our team isn’t spending time manually tying everything out.Rebecca Wang VP Finance Corporate Controller, Guideline -

With Leapfin, we are faster, we are more accurate, and we are drama-free. It's transformed our close process. No surprises, no last-minute scrambles. Everything just runs smoothly.Rodrigo Brumana CFO, Poshmark

With Leapfin, we are faster, we are more accurate, and we are drama-free. It's transformed our close process. No surprises, no last-minute scrambles. Everything just runs smoothly.Rodrigo Brumana CFO, Poshmark -

The feed from Leapfin to NetSuite works seamlessly. It's something that we don't have to worry about anymore.Lindsay Remigio Sr. Manager, Revenue Accounting, Reddit

The feed from Leapfin to NetSuite works seamlessly. It's something that we don't have to worry about anymore.Lindsay Remigio Sr. Manager, Revenue Accounting, Reddit -

The consolidated view of our revenue in Leapfin is fantastic. In literally one click we can easily see change month to month. And, because every single transaction is right there, we can dig into details for any explanation we may need.Melissa Tuttle Director of Accounting Systems, Outside

The consolidated view of our revenue in Leapfin is fantastic. In literally one click we can easily see change month to month. And, because every single transaction is right there, we can dig into details for any explanation we may need.Melissa Tuttle Director of Accounting Systems, Outside -

Leapfin helped parse out and make sense of the data that already existed. Simple searches in Leapfin make it easy to track things like refunds, revenue stream trends, and month-to-month movements. Without reporting bottlenecks, Canva is no longer vulnerable to surprises at month-end.Melissa Lee Corporate Controller, Canva

Leapfin helped parse out and make sense of the data that already existed. Simple searches in Leapfin make it easy to track things like refunds, revenue stream trends, and month-to-month movements. Without reporting bottlenecks, Canva is no longer vulnerable to surprises at month-end.Melissa Lee Corporate Controller, Canva -

With Leapfin, we didn’t need to increase headcount significantly to account for our growth. We were able to double transactions, especially during peak seasons, without growing the accounting team.Ian Booler VP of Finance, Altitude Sports

With Leapfin, we didn’t need to increase headcount significantly to account for our growth. We were able to double transactions, especially during peak seasons, without growing the accounting team.Ian Booler VP of Finance, Altitude Sports -

Before Leapfin, our reporting processes relied heavily on Excel, and close took up to 90 days. Now, we can close in just 5 days because Leapfin automates our entire data process and revenue reporting so that we can report accurate, validated financials at the end of the month.Minnie Luo CPA, Director of Revenue Operations, Top Hat

Before Leapfin, our reporting processes relied heavily on Excel, and close took up to 90 days. Now, we can close in just 5 days because Leapfin automates our entire data process and revenue reporting so that we can report accurate, validated financials at the end of the month.Minnie Luo CPA, Director of Revenue Operations, Top Hat -

If you’re a high complexity high transaction volume business, Leapfin is a no brainer.Damien Singh CFO, Canva

If you’re a high complexity high transaction volume business, Leapfin is a no brainer.Damien Singh CFO, Canva -

Leapfin has completely transformed our month-end close process, eliminating 4 days of manual work, with its ability to handle hundreds of millions of transactions and transform them into a subledger.Joe Blanchett Director, Business Systems, SeatGeek

Leapfin has completely transformed our month-end close process, eliminating 4 days of manual work, with its ability to handle hundreds of millions of transactions and transform them into a subledger.Joe Blanchett Director, Business Systems, SeatGeek -

The consistency and quality of data we get with Leapfin is excellent. The reduction in our month-end close time has freed up our team to focus on meaningful analysis, driving better business decisions.Jason Grenier CFO, Altitude Sports

The consistency and quality of data we get with Leapfin is excellent. The reduction in our month-end close time has freed up our team to focus on meaningful analysis, driving better business decisions.Jason Grenier CFO, Altitude Sports

FAQs

Leapfin supports ASC 606, GAAP, SOX, and IFRS 15 compliance. It offers flexibility that enables teams to stay compliant with industry standards, as well as meet internal business requirements. The platform consolidates and prepares accounting-ready data that meets evolving standards, so Finance teams can adapt to changes and deliver accurate revenue reports faster with confidence.

Leapfin improves the audit process by automating time-consuming processes, tracking transactions and data treatment, and logging changes as they happen. More specifically, Leapfin helps streamline the audit process in the following ways:

- Automation that reduces risk of human error, enforcing consistency and establishing standardized workflows to be documented, tested, and monitored.

- Audit trails for every transaction, including time stamps and user activity.

- Reconciliation of data across disparate systems (e.g., billing, CRM, ERP) to ensure completeness.

- Automated, centralized logs that document how revenue was calculated and recognized.

- Role-based access control, which is key for maintaining auditability and minimizing risks from unauthorized changes.

- Workflow approvals that ensure that no single person can manipulate both the data and its recognition logic.

- Versioning of recognition rules, which show how and when policies were changed, enabling traceability and controls over the revenue recognition methodology, especially as contracts evolve.

- Scalability for complex revenue models to account for changes – like global expansion – reducing the risk of misstatements that could trigger SOX compliance issues.

- AI-powered data exploration that enables simple, natural-language questions for fast investigation of revenue data.

Manual compliance processes increase the risk of errors, inconsistencies, and missing audit trails. As companies grow, there are more factors to consider – more systems, high volume of transactions, changing business model, new products and pricing – that increase complexity in meeting compliance standards potentially exposing companies to financial restatements, audit issues, and compliance penalties.