Streamline month-end close

Streamline every close by automatically aggregating and preparing operational data for faster review and reconciliation.

AI-powered revenue recognition and reconciliation with Leapfin

Growing companies constantly change, and that makes month-end close harder every month. Operational data is scattered and often incomplete. Scaling data volume pushes spreadsheets past their limits. Packaging and pricing experiments impact how revenue gets accounted for. Compliance requirements and scrutiny increase. Leapfin automatically consolidates and prepares your operational data to empower your team with complete revenue results anytime, not just at the end of the month.

Benefits of Leapfin for month-end close

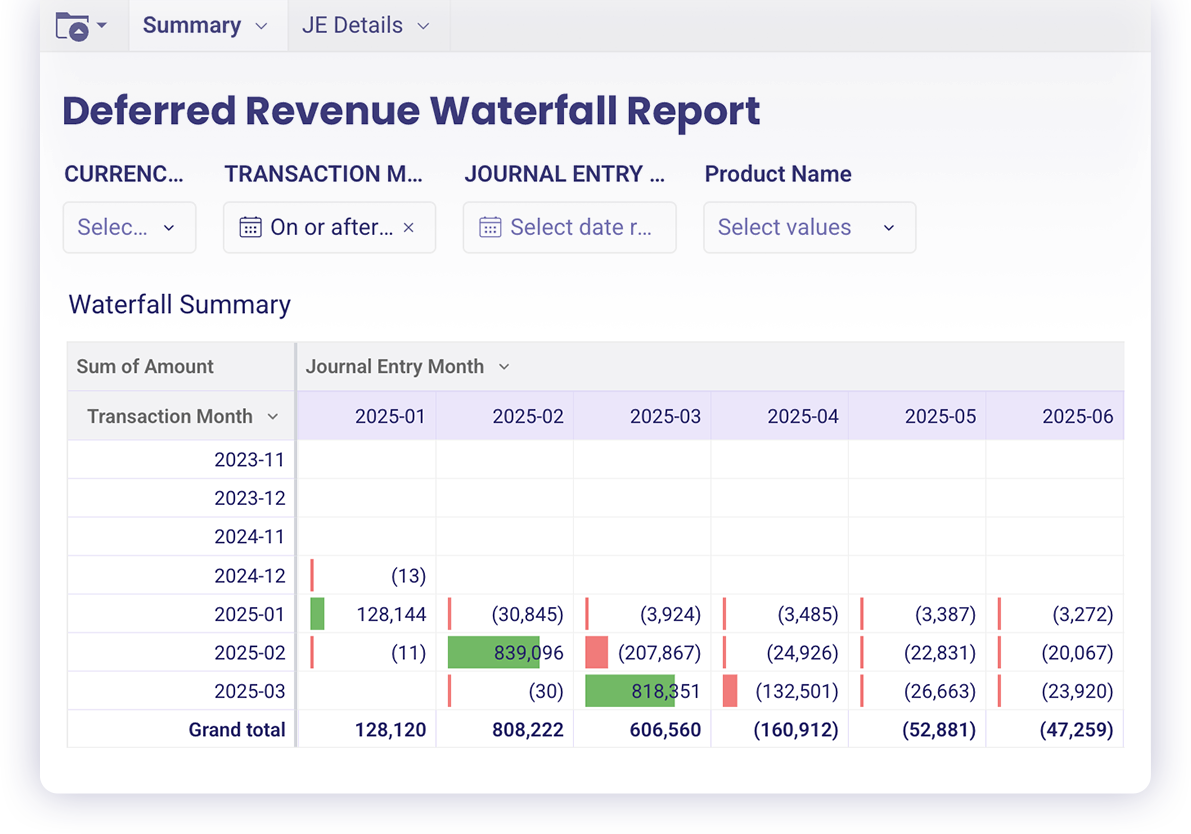

Turn fragmented operational data into accounting-ready data automatically

Reduce the number of steps to close the books by accessing accounting-ready revenue data that has been automatically consolidated and transformed in real-time.

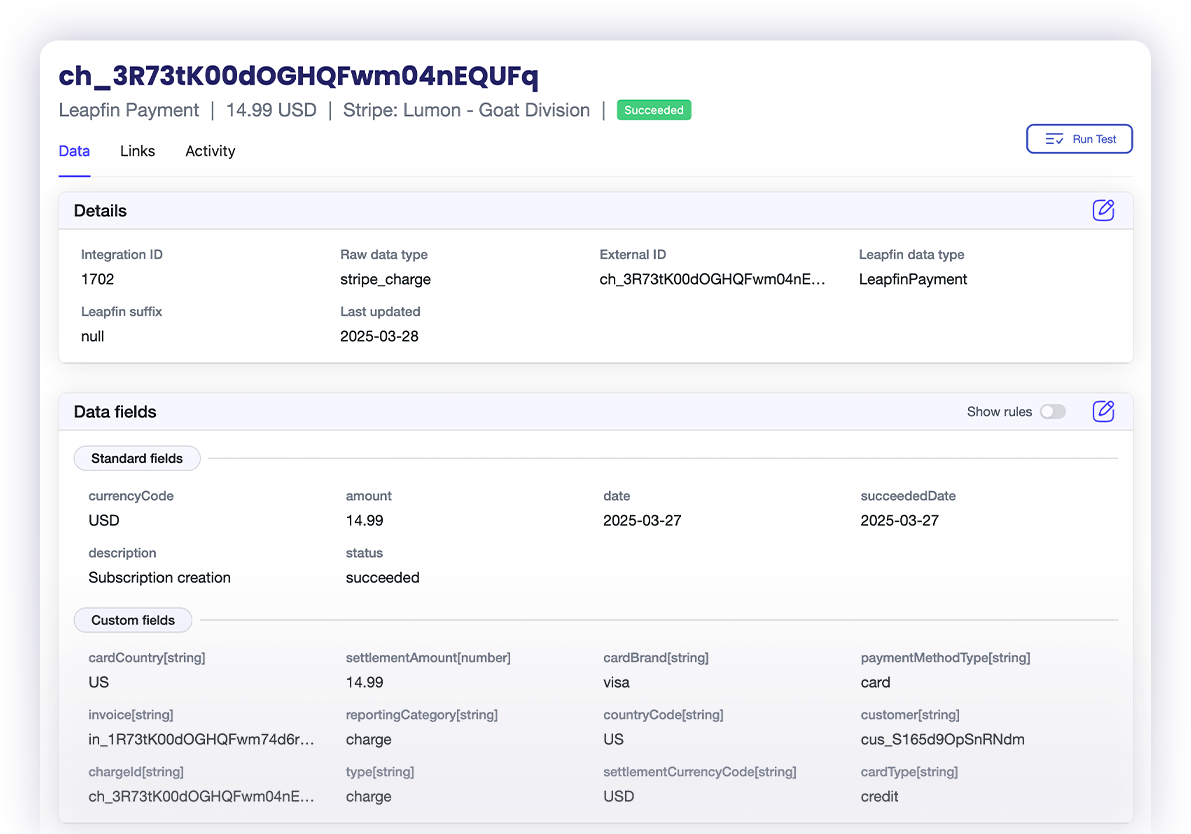

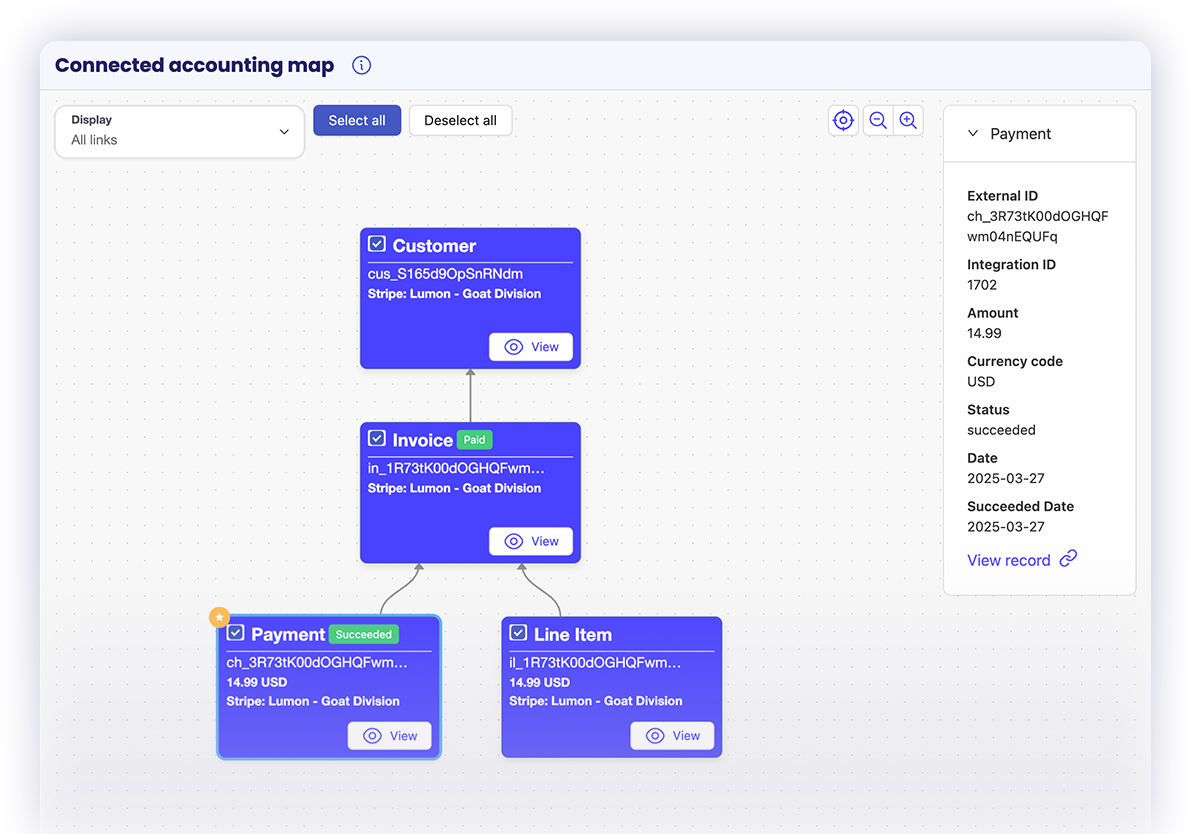

Drill into any transaction for details and links

Check for revenue data completeness and accuracy, and see the complete order-to-cash journey and all accounting treatments applied, all in a single system that eliminates the manual work of preparing your operational data for month-end close.

Scale finance operations as the business grows

As month-end close gets harder with more systems, larger volumes of transactions, billing and payment complexity, or changes that come with business growth, Leapfin is purpose-built to scale with you.

Empowering Finance and Accounting teams to account for and report on revenue at scale

Automatically ingest data from multiple sources

Raw data automatically prepared for accounting

Anytime access to your most valuable data

Track and link every type of revenue transaction

Streamline revenue reconciliation and reporting

Share reliable revenue data across your business

Resources for revenue accounting & payment reconciliation

Real-world examples of improving reconciliation and accounting efficiency

-

This isn’t just about automation. It’s about giving our team a system we trust, and the time and space to focus on higher-value work. I’m such a fan. I can’t say enough good things about Leapfin. It has been a huge win for us.Alicia Arntson, CPA VP, Controller, Eight Sleep

This isn’t just about automation. It’s about giving our team a system we trust, and the time and space to focus on higher-value work. I’m such a fan. I can’t say enough good things about Leapfin. It has been a huge win for us.Alicia Arntson, CPA VP, Controller, Eight Sleep -

I finally feel like I can fully support the numbers I’m posting to NetSuite every month. If someone asks, I don’t need to explain assumptions – I just pull the report in Leapfin.Brian Cheung Sr. Manager, Accounting, GoodRx

I finally feel like I can fully support the numbers I’m posting to NetSuite every month. If someone asks, I don’t need to explain assumptions – I just pull the report in Leapfin.Brian Cheung Sr. Manager, Accounting, GoodRx -

Leapfin is like our digital glue. It connects all of our financial data sources together so our team isn’t spending time manually tying everything out.Rebecca Wang VP Finance Corporate Controller, Guideline

Leapfin is like our digital glue. It connects all of our financial data sources together so our team isn’t spending time manually tying everything out.Rebecca Wang VP Finance Corporate Controller, Guideline -

With Leapfin, we are faster, we are more accurate, and we are drama-free. It's transformed our close process. No surprises, no last-minute scrambles. Everything just runs smoothly.Rodrigo Brumana CFO, Poshmark

With Leapfin, we are faster, we are more accurate, and we are drama-free. It's transformed our close process. No surprises, no last-minute scrambles. Everything just runs smoothly.Rodrigo Brumana CFO, Poshmark -

The feed from Leapfin to NetSuite works seamlessly. It's something that we don't have to worry about anymore.Lindsay Remigio Sr. Manager, Revenue Accounting, Reddit

The feed from Leapfin to NetSuite works seamlessly. It's something that we don't have to worry about anymore.Lindsay Remigio Sr. Manager, Revenue Accounting, Reddit -

The consolidated view of our revenue in Leapfin is fantastic. In literally one click we can easily see change month to month. And, because every single transaction is right there, we can dig into details for any explanation we may need.Melissa Tuttle Director of Accounting Systems, Outside

The consolidated view of our revenue in Leapfin is fantastic. In literally one click we can easily see change month to month. And, because every single transaction is right there, we can dig into details for any explanation we may need.Melissa Tuttle Director of Accounting Systems, Outside -

Leapfin helped parse out and make sense of the data that already existed. Simple searches in Leapfin make it easy to track things like refunds, revenue stream trends, and month-to-month movements. Without reporting bottlenecks, Canva is no longer vulnerable to surprises at month-end.Melissa Lee Corporate Controller, Canva

Leapfin helped parse out and make sense of the data that already existed. Simple searches in Leapfin make it easy to track things like refunds, revenue stream trends, and month-to-month movements. Without reporting bottlenecks, Canva is no longer vulnerable to surprises at month-end.Melissa Lee Corporate Controller, Canva -

With Leapfin, we didn’t need to increase headcount significantly to account for our growth. We were able to double transactions, especially during peak seasons, without growing the accounting team.Ian Booler VP of Finance, Altitude Sports

With Leapfin, we didn’t need to increase headcount significantly to account for our growth. We were able to double transactions, especially during peak seasons, without growing the accounting team.Ian Booler VP of Finance, Altitude Sports -

Before Leapfin, our reporting processes relied heavily on Excel, and close took up to 90 days. Now, we can close in just 5 days because Leapfin automates our entire data process and revenue reporting so that we can report accurate, validated financials at the end of the month.Minnie Luo CPA, Director of Revenue Operations, Top Hat

Before Leapfin, our reporting processes relied heavily on Excel, and close took up to 90 days. Now, we can close in just 5 days because Leapfin automates our entire data process and revenue reporting so that we can report accurate, validated financials at the end of the month.Minnie Luo CPA, Director of Revenue Operations, Top Hat -

If you’re a high complexity high transaction volume business, Leapfin is a no brainer.Damien Singh CFO, Canva

If you’re a high complexity high transaction volume business, Leapfin is a no brainer.Damien Singh CFO, Canva -

Leapfin has completely transformed our month-end close process, eliminating 4 days of manual work, with its ability to handle hundreds of millions of transactions and transform them into a subledger.Joe Blanchett Director, Business Systems, SeatGeek

Leapfin has completely transformed our month-end close process, eliminating 4 days of manual work, with its ability to handle hundreds of millions of transactions and transform them into a subledger.Joe Blanchett Director, Business Systems, SeatGeek -

The consistency and quality of data we get with Leapfin is excellent. The reduction in our month-end close time has freed up our team to focus on meaningful analysis, driving better business decisions.Jason Grenier CFO, Altitude Sports

The consistency and quality of data we get with Leapfin is excellent. The reduction in our month-end close time has freed up our team to focus on meaningful analysis, driving better business decisions.Jason Grenier CFO, Altitude Sports

FAQs

Leapfin automates the transformation of raw operational data into accounting-ready revenue data in real time. This reduces manual work, ensures accuracy, and speeds up reconciliation. Finance teams can access complete, auditable revenue insights anytime – not just at month-end – making close faster, smoother, and scalable as the business grows.

Automated revenue recognition helps Accounting teams streamline the month-end close by transforming raw operational data into compliant, accounting-ready revenue data in real time – eliminating manual work and reducing close time.

AI capabilities in revenue recognition software enable users to quickly and easily adapt to changes in the business – like new or updated pricing and packaging, new compliance requirements, or new products. AI also helps with data exploration, so that finance and accounting professionals can run detailed reports or analysis themselves without having to learn SQL to build queries or rely on engineering or BI teams or external consultants.

Yes. With real-time data transformation and a centralized system of record, Leapfin eliminates the need for manual spreadsheet work traditionally required to close the books. Users no longer have to run reports, consolidate data in spreadsheets, normalize that data, then prepare it for the GL – that all happens automatically in Leapfin.

Some signs that your manual accounting process has become problematic include: lengthy audit cycles, team burnout, frequent Excel delays or crashes due to maxed out spreadsheets, cross-functional friction (e.g. requiring too much support from engineering, BI, or other data teams), inability to answer revenue performance questions from internal stakeholders or investors. It’s also recommended to consider automating processes like month-end close when entering into diligence processes, like anticipating or preparing for an acquisition, IPO, or related event. When considering all the steps it takes to close the books, a practical approach to automating would be to focus on the most impactful problems – where there would be significant gain in time, efficiency, accuracy, scalability – and focusing effort on solving those first. Many teams realize the first, most important problem is fixing their data to ensure it’s complete, accurate, and accessible through a single system like Leapfin.