AI isn’t coming for accounting. It’s here. No more hype. No clickbait. Real solutions and value. So what does it actually look like right now?

At Transform 2025 (see on-demand talks), our recent virtual conference for finance and accounting leaders, we asked that question – and got real answers. Across six sessions, finance and accounting leaders, systems experts, and AI builders showed how AI is already reshaping everything from reconciliation to audit prep to technical accounting research.

Yes, ChatGPT can help you write your audit memos. But we're well past that simple use-case now. Today, right now, AI is delivering repeatable workflows helping teams get faster, more accurate, and be more impactful for their Finance and Accounting org, and the entire business.

Let’s walk through what AI in accounting really looks like today – and where it’s headed next.

See how AI can accelerate your rev rec and reduce hours of manual effort.

AI isn’t just “coming” for Finance and Accounting– it’s being mandated

In many organizations, AI adoption is becoming a board-level objective within the Office of the CFO.

“We’re hearing an increasing number of customers share that their leadership teams are mandating adoption of AI.” -Erik Yao, CTO, Leapfin

That’s because AI is proving itself – not just in theoretical forecasting models, but in the messy, daily grind of finance operations.

What AI is already doing today for Finance teams

At Transform, Erik introduced Luca, our AI agent built specifically for Accounting and Finance teams and their needs. Luca isn’t just generating summaries – it’s answering audit queries, performing reconciliations, and analyzing transactional data with speed and accuracy.

Here’s what teams are already doing with Leapfin's AI:

Reconciliation at warp speed

One Controller used Luca to tie over 100 revenue recognition events to a single prepayment – in seconds.

“We had a customer reconciling 100+ revenue events. With Luca, it took one natural-language prompt. Seconds later, done.” -Erik Yao

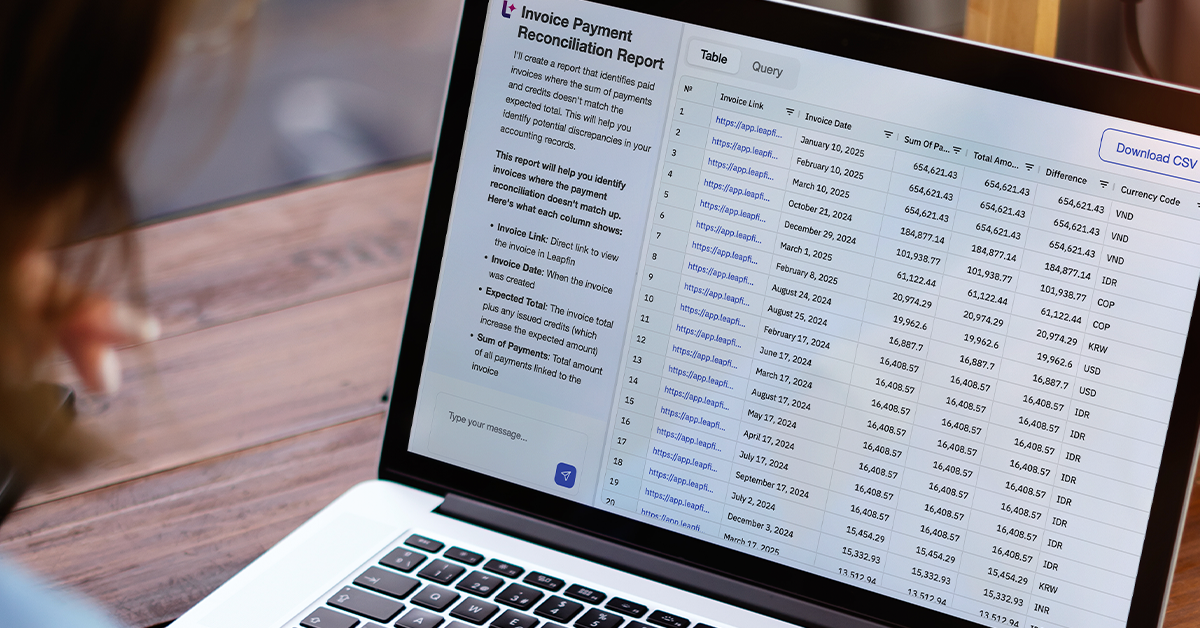

In another example, a user asked Luca whether an invoice had been fully paid. Luca automatically analyzed the invoice amount, matched it with related payments, credits, and adjustments, and returned a clear answer with supporting detail.

“We told Luca: check whether this invoice has been fully paid. It looked at payments, credits, and adjustments. Then confirmed the match – and flagged one where it didn’t.”

Audit requests with zero spreadsheets

Instead of submitting BI tickets and digging through spreadsheets, another user pulled test transactions on demand.

“One customer said, ‘Can we just give the auditors access to Luca so we don’t have to deal with them?’” -Erik Yao

Dynamic analysis and drill-downs

Structured reports are just the beginning with Luca. Erik prompted it to generate a year-over-year revenue flux analysis comparing January 2023 to January 2024. In seconds, Luca translated the plain-text prompt into a SQL query and returned a chart showing the variance.

“When we asked for a YoY revenue analysis, Luca built the query, grouped the data, calculated the deltas, and flagged where January revenue had spiked. Then we drilled in.”

Erik followed up by asking Luca what transactions were driving that January increase. Immediately, Luca returned a list of individual transactions, labeled by type (e.g. invoice, refund, usage), revealing the underlying drivers of change.

“Luca shows you the numbers – and then it helps you understand what’s behind them.”

Technical accounting research

Outside of Leapfin, teams are using AI for another high-impact use case: summarizing regulatory guidance.

“Using Gemini or ChatGPT to summarize technical accounting research saves us a lot of time. It’s faster than flipping through every firm’s memo.” -Rebecca Wang, VP Finance Corporate Controller, Guideline

So why hasn’t every Finance and Accounting team adopted AI yet?

Here’s the surprising part: despite the clear use cases, many teams are still hesitant to lean in.

“I predicted AI would be more powerful a year from now – and I was right. But I also thought more teams would be using it by now, and I was wrong.” -Rodrigo Brumana, CFO, Poshmark

Why? Fear, inertia, lack of bandwidth. Some worry it will replace jobs. Others think their data is too messy. Most simply don’t know where to start. We talk more about this in a related article, “What’s Holding Back Your Automation Strategy? Real Talk From Controllers in the Trenches.” Read it here

But for teams who do get started, the benefits aren’t just technical – they’re cultural.

AI doesn’t hide your data problems – it reveals them

This was one of the most important truths shared at Transform: AI will force you to confront what’s broken.

“The tools expose where you have data gaps or data issues that need to be addressed.” -Alicia Arntson, Controller, Eight Sleep

For teams that are serious about improving, that’s a gift of an opportunity. Luca and other AI tools shine a spotlight on process inconsistencies, missing fields, and logic breakdowns that would otherwise go unnoticed.

Where this is all going: automatic validation and vertical integration

Erik sees where this AI journey leads: toward intelligent systems that not only fetch data and answer questions, but validate, monitor, and manage themselves.

“Validation is central to this process. The way we're building Luca, it can verify the results of each process it’s performing – ensuring accuracy and compliance. When you manually double check the work and get the same results, that’s how you build trust in AI.” -Erik Yao

Meanwhile, Poshmark's Rodrigo Brumana pointed out that AI won’t just change workflows – it will change org charts.

“You could see a blending of accountants, analysts, and business intelligence engineers. Plain-English prompt engineering may be the new skillset.” -Rodrigo Brumana

In other words, the finance pro of the future won't just know debits and credits. They’ll know data structures, system flows, and how to get instant insights from tools like Luca. In fact, modern finance leaders and Controllers are already there. Read Rise of the System-Savvy Financial Controller.

Getting started: 3 realistic first moves

AI doesn’t need to be a moonshot. Here are three ways to start now:

- Pick one monthly task to prototype with an AI tool Try pulling a report or answering a common audit question with Luca or a prompt-based agent.

- Use AI for research, not just reporting Ask Gemini or GPT to summarize a complex accounting memo or recent FASB guidance. Test the accuracy.

- Inventory your recurring reconciliation pain points Where do you spend the most manual hours each month? Start there.

Final thought: The teams who adopt AI aren’t just faster – they’re smarter

AI won’t replace your team. But it will widen the gap between teams that embrace change and those that fear it.

“AI isn’t going to replace you. People who know how to use AI are going to replace you.” -Rodrigo Brumana

The difference is no longer about tools. It’s about mindset. And for Finance and Accounting teams that are ready to lead, AI is already here to help.

Watch all Transform talks on-demand here, including Rodrigo's keynote fireside chat, Leapfin CTO Erik Yao's AI talk, and Rise of the Super-Controller featuring three exceptional VP Controllers.

Want a closer look at Luca to see how it can help your team explore and report on revenue data? Request a demo here.

Did you know?

- Only 28% of companies have begun using AI in accounting; 72% haven’t taken the plunge yet, meaning early adopters have a huge head start.

- Overall trust in AI is growing: 56% of finance pros are comfortable letting AI handle accounting processes.

- 19% of systems specialists already see AI skills as required for career advancement (and 43‑46 % of execs & controllers call AI skills “very important”).

This data is from our State of Accounting Automation report.

See how Leapfin works

Get a feel for the ease and power of Leapfin with our interactive demo.