Scale Sellers Without Slowing Your Close

Close revenues in less than 2 days, even with millions of pass-through transactions, with centralized revenue accounting automation.

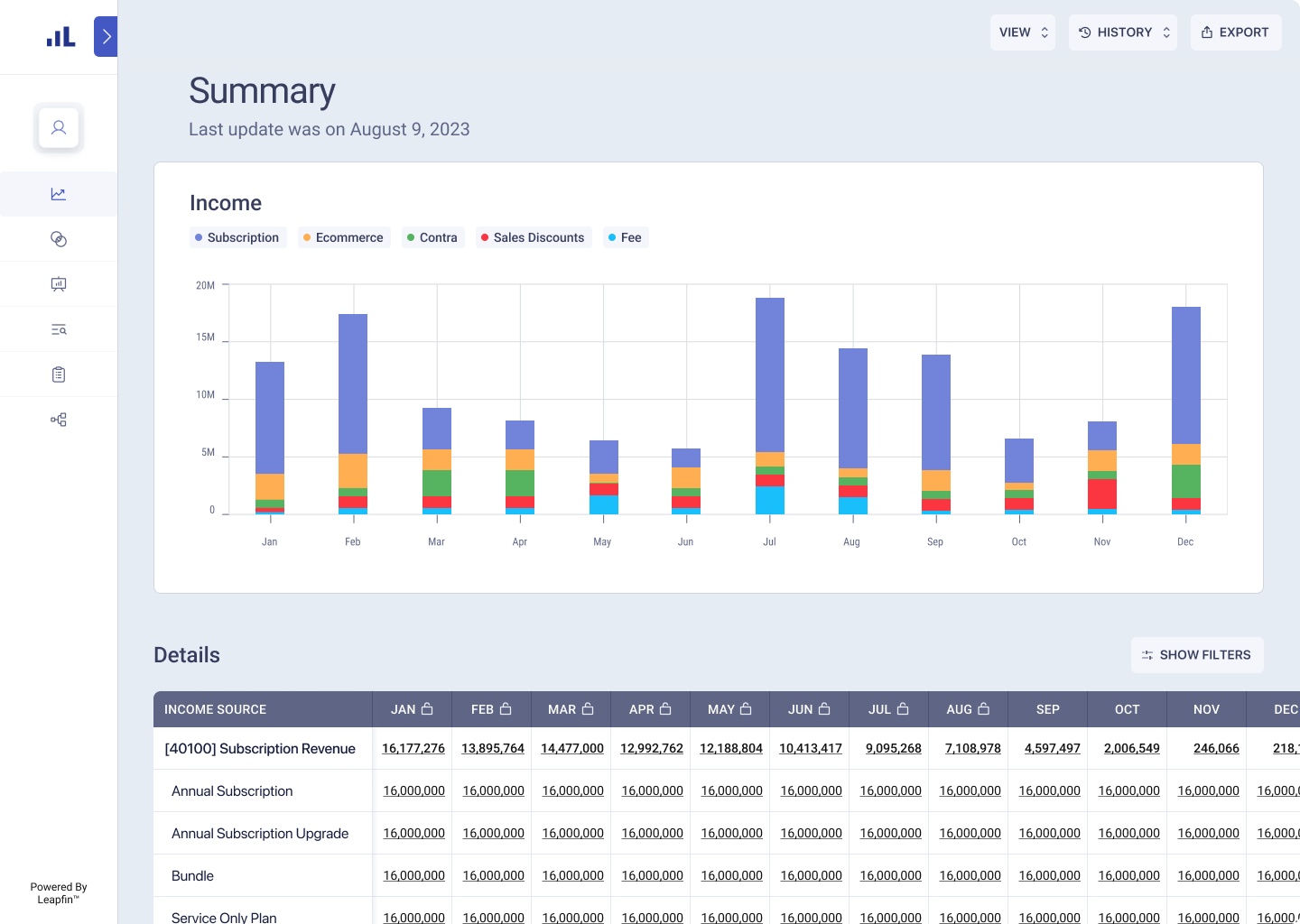

Close daily at scale

With millions of transactions passing through your marketplace daily, it can be hard to keep up and close books given their volume and complexity. Leapfin automates revenue accounting by consolidating and transforming transactions into a detailed, reportable format and layering revenue recognition and subledger workflows on top. Eliminate manual accounting so your team can focus on acting on the data.

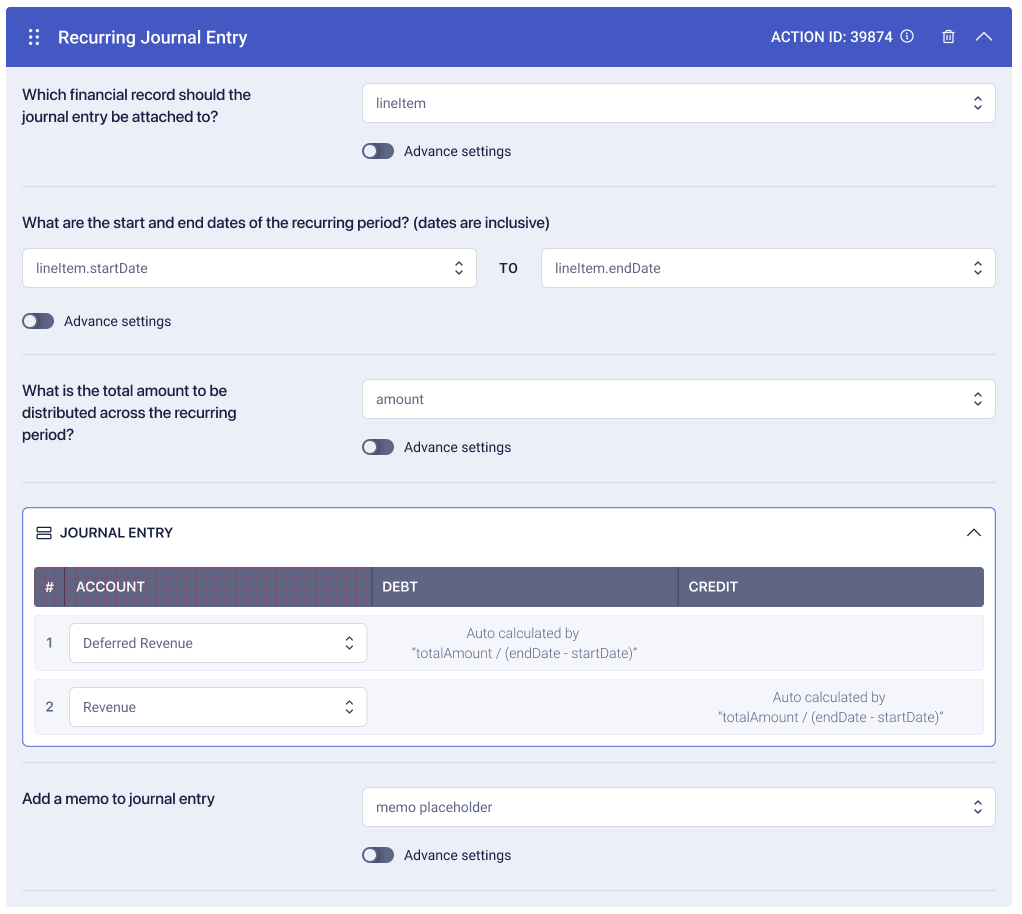

Report compliant numbers every time

Alleviate the headache of manually applying compliance standards to millions of complex transactions. Report consistent, accurate revenues in Leapfin with pre-built ASC-606 and IFRS-15 compliant revenue rules. Drill into the subledger to check for compliance and see the rules applied. Confidently report compliant revenues, without hefty spreadsheets.

Speed up audits with traceable data

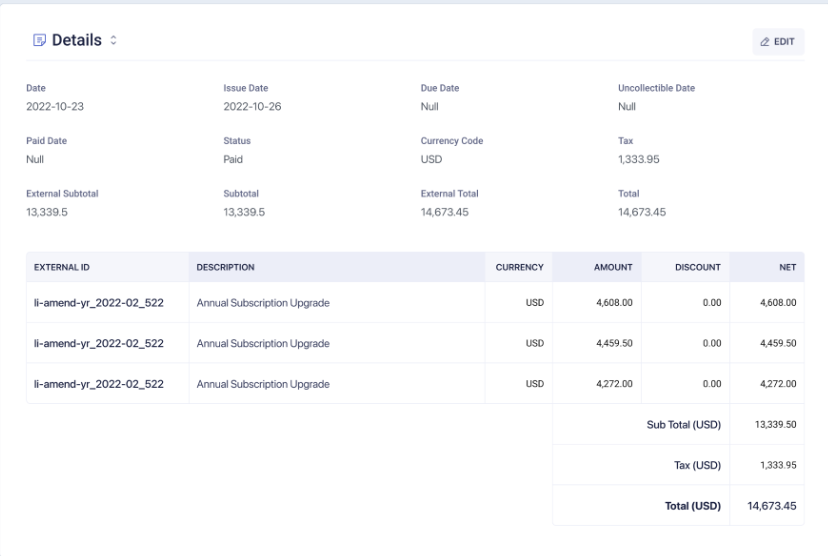

Help auditors easily follow the money and verify financial data accuracy, hand them Leapfin. Leapfin provides easy-to-validate, traceable, and accurate revenue numbers by centralizing the entire accounting process in one place. This way, auditors can see how dollars flow through your business from source data to the subledger.

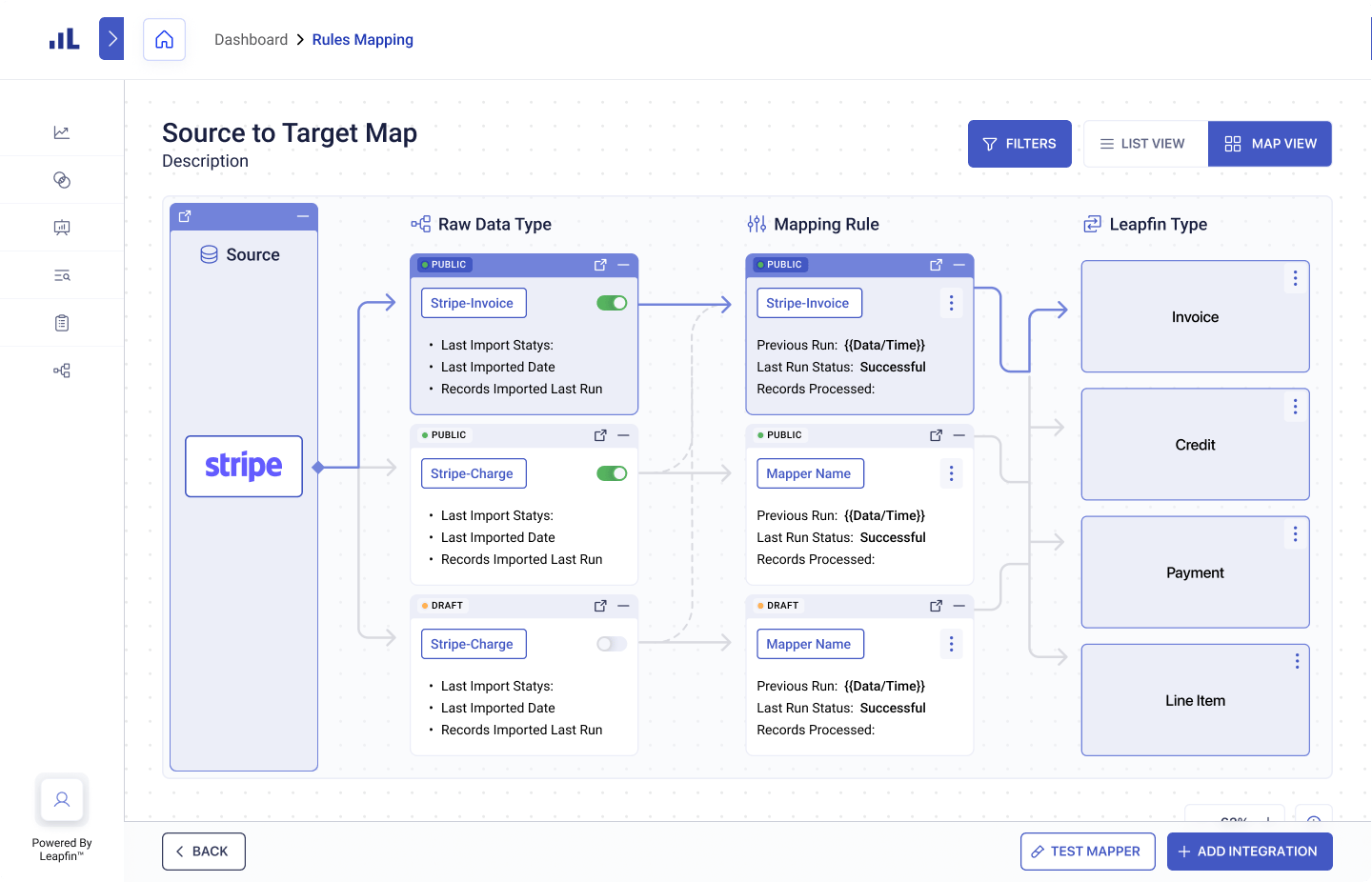

Add more offerings without overextending your ERP

Bring on more sellers and products without re-engineering your ERP or breaking your accounting software. Leapfin’s flexible architecture can easily expand to handle more complex transactions and hundreds of millions of transactions without slowing the close process. Report on revenues passing through your marketplace daily.

Increase transparency with a centralized revenue accounting platform

Demystify revenue data by consolidating your transactions and accounting processes into a single system of record – Leapfin. Help your organization gain a better, more complete understanding of customer behaviors and revenue trends with centralized transaction data. Help your business make better strategic decisions with easily accessible, complete, accurate, and detailed transaction data.

-

This isn’t just about automation. It’s about giving our team a system we trust, and the time and space to focus on higher-value work. I’m such a fan. I can’t say enough good things about Leapfin. It has been a huge win for us.Alicia Arntson, CPA VP, Controller, Eight Sleep

This isn’t just about automation. It’s about giving our team a system we trust, and the time and space to focus on higher-value work. I’m such a fan. I can’t say enough good things about Leapfin. It has been a huge win for us.Alicia Arntson, CPA VP, Controller, Eight Sleep -

I finally feel like I can fully support the numbers I’m posting to NetSuite every month. If someone asks, I don’t need to explain assumptions – I just pull the report in Leapfin.Brian Cheung Sr. Manager, Accounting, GoodRx

I finally feel like I can fully support the numbers I’m posting to NetSuite every month. If someone asks, I don’t need to explain assumptions – I just pull the report in Leapfin.Brian Cheung Sr. Manager, Accounting, GoodRx -

Leapfin is like our digital glue. It connects all of our financial data sources together so our team isn’t spending time manually tying everything out.Rebecca Wang VP Finance Corporate Controller, Guideline

Leapfin is like our digital glue. It connects all of our financial data sources together so our team isn’t spending time manually tying everything out.Rebecca Wang VP Finance Corporate Controller, Guideline -

With Leapfin, we are faster, we are more accurate, and we are drama-free. It's transformed our close process. No surprises, no last-minute scrambles. Everything just runs smoothly.Rodrigo Brumana CFO, Poshmark

With Leapfin, we are faster, we are more accurate, and we are drama-free. It's transformed our close process. No surprises, no last-minute scrambles. Everything just runs smoothly.Rodrigo Brumana CFO, Poshmark -

The feed from Leapfin to NetSuite works seamlessly. It's something that we don't have to worry about anymore.Lindsay Remigio Sr. Manager, Revenue Accounting, Reddit

The feed from Leapfin to NetSuite works seamlessly. It's something that we don't have to worry about anymore.Lindsay Remigio Sr. Manager, Revenue Accounting, Reddit -

The consolidated view of our revenue in Leapfin is fantastic. In literally one click we can easily see change month to month. And, because every single transaction is right there, we can dig into details for any explanation we may need.Melissa Tuttle Director of Accounting Systems, Outside

The consolidated view of our revenue in Leapfin is fantastic. In literally one click we can easily see change month to month. And, because every single transaction is right there, we can dig into details for any explanation we may need.Melissa Tuttle Director of Accounting Systems, Outside -

Leapfin helped parse out and make sense of the data that already existed. Simple searches in Leapfin make it easy to track things like refunds, revenue stream trends, and month-to-month movements. Without reporting bottlenecks, Canva is no longer vulnerable to surprises at month-end.Melissa Lee Corporate Controller, Canva

Leapfin helped parse out and make sense of the data that already existed. Simple searches in Leapfin make it easy to track things like refunds, revenue stream trends, and month-to-month movements. Without reporting bottlenecks, Canva is no longer vulnerable to surprises at month-end.Melissa Lee Corporate Controller, Canva -

With Leapfin, we didn’t need to increase headcount significantly to account for our growth. We were able to double transactions, especially during peak seasons, without growing the accounting team.Ian Booler VP of Finance, Altitude Sports

With Leapfin, we didn’t need to increase headcount significantly to account for our growth. We were able to double transactions, especially during peak seasons, without growing the accounting team.Ian Booler VP of Finance, Altitude Sports -

Before Leapfin, our reporting processes relied heavily on Excel, and close took up to 90 days. Now, we can close in just 5 days because Leapfin automates our entire data process and revenue reporting so that we can report accurate, validated financials at the end of the month.Minnie Luo CPA, Director of Revenue Operations, Top Hat

Before Leapfin, our reporting processes relied heavily on Excel, and close took up to 90 days. Now, we can close in just 5 days because Leapfin automates our entire data process and revenue reporting so that we can report accurate, validated financials at the end of the month.Minnie Luo CPA, Director of Revenue Operations, Top Hat -

If you’re a high complexity high transaction volume business, Leapfin is a no brainer.Damien Singh CFO, Canva

If you’re a high complexity high transaction volume business, Leapfin is a no brainer.Damien Singh CFO, Canva -

Leapfin has completely transformed our month-end close process, eliminating 4 days of manual work, with its ability to handle hundreds of millions of transactions and transform them into a subledger.Joe Blanchett Director, Business Systems, SeatGeek

Leapfin has completely transformed our month-end close process, eliminating 4 days of manual work, with its ability to handle hundreds of millions of transactions and transform them into a subledger.Joe Blanchett Director, Business Systems, SeatGeek -

The consistency and quality of data we get with Leapfin is excellent. The reduction in our month-end close time has freed up our team to focus on meaningful analysis, driving better business decisions.Jason Grenier CFO, Altitude Sports

The consistency and quality of data we get with Leapfin is excellent. The reduction in our month-end close time has freed up our team to focus on meaningful analysis, driving better business decisions.Jason Grenier CFO, Altitude Sports