According to research from the CFO, the average FP&A employee spends 75% of their time gathering data and administering the process, leaving just 25% for providing value-added analysis to the business.

That grim statistic and many similar stories from our customers have prompted Leapfin to organize an event focused on uncovering the cause of this issue and what companies can do to overcome it.

Leapfin’s subject matter experts Caitlin Steel (VP of Product) and I (Customer Architect) talked about how to achieve finance transformation by reimagining the Order-to-Cash process.

Caitlin and I both noted that there has been a proliferation of operational tools in the past decade, however, finance tech stacks are trailing worryingly behind.

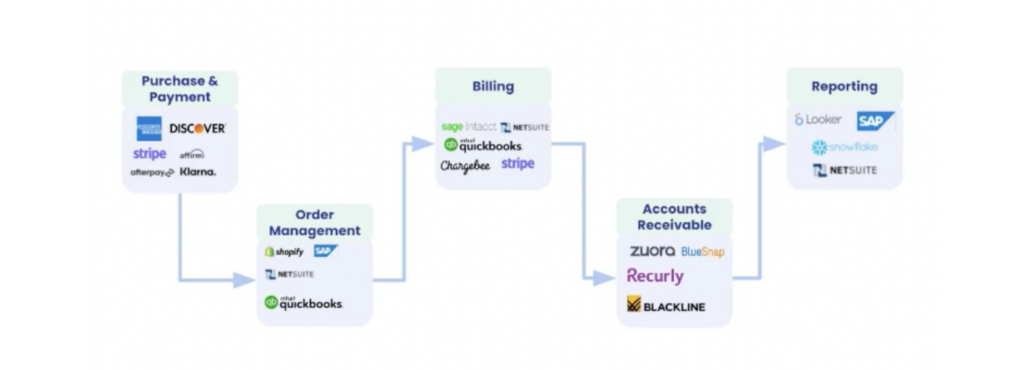

This has resulted in the “unbundling” of the OTC process, meaning that each step is documented in a disparate, disconnected tool. Consequently, Finance teams are left with incomplete, potentially inaccurate data, disaggregated across multiple systems. This leads to numerous reporting challenges for Finance and Accounting, leaving these teams to stitch the pieces together manually.

As Caitlin explains:

There are fantastic operational tools out there and they are designed to do a job and they do that job really well. But they don’t all necessarily consider Accounting and Finance perspectives and goals.

For example, say you want to pull a settlement date from a payment system. Do you know that the settlement date in Stripe isn’t the same as the settlement date in your general ledger? Now you have a record with different settlement dates, so which one is the right one? That’s why I still see people out there doing these reconciliations manually, mostly in spreadsheets.

You really have to navigate carefully to identify which of your operational systems are generating financial information. And it’s very difficult to manage things that way. There’s literally no control over how this information should flow from these tools into your finance systems.

I agreed:

In the last five to ten years with tech and innovation, you have so many advancements.

Now, there’s so much more flexibility for your customers, their invoice and their payment plans. And therefore customer experiences have gotten tremendously better. And that’s good news. Now the not-so-good news is there was a bit of an unintended outcome and a problem that’s been festering.

And that’s basically that data is all over the place. Financial data is not consistently modeled. And it’s become quite unmanageable for a lot of folks.

A lot of this is happening due to challenges with the modern finance tech stack (or a lack thereof):

Not only have we not had Finance and Accounting innovation, but operational innovation has left Finance and Accounting in the dust in some sense. You’ve got an operational view, maybe a financial view, an accounting view, and an analytics view.

And I think the reason that’s the case is because of this unbundling and this visual that you’re looking at. And this is basically the standard financial stack of folks today.

ERP systems like NetSuite have got great data tools. But working with them still means so much data processing. It requires cleaning it up and manipulating it before they can actually get into accounting policies or financial analysis.

But that’s not the only issue:

There’s also been a struggle in auditing financials. You’ve seen a lot of stories in the last few years around material misstatements. It almost seems like the trend is there’s been more material misstatements than prior.

And part of that is the OTC process is unraveled and there hasn’t been any innovation to help finance and accounting.

The answer to a disparate OTC process: The Leapfin Finance Data Platform

To overcome these challenges and help Finance teams gain access to accurate, real-time, detailed transaction data, accelerate close, conduct stress-free audits, and find the answer to increasing profitability, our team has created the Leapfin Finance Data Platform.

Leapfin Finance Data Platform is a single source of truth for your transaction data. Our platform provides an accurate, unified, real-time view of every financial transaction flowing through your business.

One of Leapfin’s core benefits is its ability to integrate with various operational tools. As I said:

The core concept of financial accounting is really around recording, classifying and summarizing operational events and transactions in the business. And the right way to solve that problem is to have a robust finance to operations integration. So Leapfin is taking this approach very intentionally.

And when we think about solving the problem, we start from the bottom up and say, where are all of these operational records? Let’s become experts in connecting with them. That’s why Leapfin has so many prebuilt integrations. And even with bespoke integrations, we have an approach that makes integration straightforward.

I continued by saying that integrations are just one piece of the puzzle. Leapfin then allows you to extract actionable insights from your data:

Leapfin can help you translate operational data into financial transactions and insights. You get real-time insights into product, location, business line performance, etc. This is important because it allows you to see changes in your customer behavior and cashflow pattersin your business, which are more and more important in this new zeitgeist that we’re in.

We also have a variety of apps that cater to various scenarios in different industries. For example, if you’re a subscription business and get a ton of disputes, revenue over time and need to amortize that daily, we have apps with purpose-built, custom logic to do that.

Caitlin added that Leapfin’s greatest strengths lie in connecting different bits of operational data and transforming it into strategic insights

Leapfin’s advantage is that it can create detailed financial transactions out of operational data, regardless of where it comes from and how it’s formatted. We can ensure that those transactions are consistent and reconciled every single day. This is how you have the most recent, cleanest data at your fingertips.

We’re talking about data that’s been checked back to the problem, the source. And we can properly recognize the journal entries derived from that data in a GAAP compliant way.

And then we give that to you so that you own this data in a single source of truth. This gives you back time to focus on being good business partners and driving your company to better results. You don’t want to do cutting and pasting when you’re worrying about profitability.

With Leapfin you’ll be connected in real time to a single source of the truth. And that your team can bring all that data to life for your business to solve these challenging problems.

Curious to learn more about the Leapfin Finance Data Platform? See our platform overview here. Or, if you’d like to learn how your team can improve your OTC process with Leapfin, schedule a consultation with me.

See how Leapfin works

Get a feel for the ease and power of Leapfin with our interactive demo.