There are lots of systems out there that can help transform your financial data.

And there are lots of accounting automation tools.

But until now, until Leapfin, there’s never been a system that could do both.

And then on top, add the ability to support reconciliation and testing of changes in a transparent way that builds trust with the system?

Forget about it! Sounds like a unicorn to me. 🦄

Not to toot my own horn, but I should know. I spent several years in the CFO’s chair. I hired and fired several fintech solutions. I was part of companies and teams that built our own systems. None could do what I mentioned above.

Fast forward, and I’d finally had enough. I needed to get away from the daily grind of the monthly close. If I’m being honest, it was hell. And it still is for far too many professionals in the industry.

So twelve years ago, I began my second career. I was really keen to work on technology products that could make accounting more interesting and easier. I thought I was uniquely suited to help companies understand what accountants really wanted and then help build the tools that would deliver.

And what do accountants really want? They want to spend their time differently. They want to be evaluating business plans and analyzing the efficiency of operating groups. They don’t want to be toiling away in dozens of spreadsheets, manually performing the same tedious, repetitive tasks for days – sometimes weeks – at a time. Every. Single. Month.

But in my product/market/target audience research, I quickly found that most accountants weren’t using their fancy (and often expensive) tools. They were reverting to spreadsheets. They did this for two primary reasons:

- Because the available tools didn't understand what they really needed to accomplish

- Or because the tools hid critical information so accountants needed to validate their data outside the system anyway

So with my experience, and with a new appreciation of what it would take to truly change the way accounting gets done, I landed at Leapfin about a year ago. Our founders, Ray and Eric, had built powerful technology to connect and make sense of the intricate web of business transactions that contribute to a company’s overall financial picture. I immediately started to focus on how we could provide our customers with a new level of end-to-end data transparency and control to augment and differentiate our technology.

What we came up with was the concept of the Universal Accounting Record. The Universal Accounting Record, or UAR, provides a comprehensive view of every transaction, what happened to it, and what other records impacted the way we accounted for it.

For example, a UAR has the details of an invoice linked to its payment, subsequent disputes, and the resolution, so that an accountant can see the whole life of that transaction including how the data changed and how that impacted accounting. In fact, they can see each and every journal entry, thus being able to quickly trace every scenario.

This was a major leap forward (no pun intended. Or maybe it was. Not sure.). But it still wasn't enough for our team. We knew that in order for accountants to really get comfortable and to “show their work,” they need to be able to evaluate the overall completeness and accuracy of the system. And, they need to be able to test every change to ensure the system is producing good, reliable results.

So, recently, we made more improvements to Leapfin. Significant ones. Now…

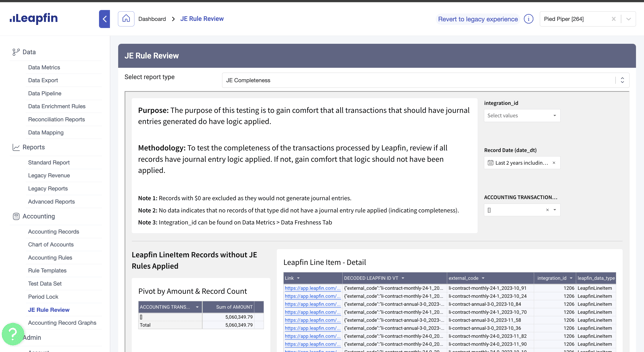

- Leapfin reconciles the data that streams in so we can assure customers that we’ve captured it all.

- And, Leapfin performs another reconciliation to determine if all those transactions actually result in Journal Entries.

- And, when our customers are satisfied with the completeness of their data, Leapfin lets them evaluate the accuracy of their configuration. This helps them clearly see every type of scenario possible with their transactions. Here’s an example: let’s say 80% of your sales are straightforward and have a sale and payment. What about the rest? What are those scenarios? And can you prove that each one is accounted for correctly? Leapfin gives you tools to do that so even if you have millions of transactions (which most of our customers do), you can review all the various things that happen, from chargebacks in eCommerce, to mid-deferral subscription adjustments for SaaS products.

What does this all mean? It means that Leapfin's customers' numbers are more accurate, more auditable, and readily available every day!

Now tell me, how many finance systems can do that?

See how Leapfin works

Get a feel for the ease and power of Leapfin with our interactive demo.