Fast-Track Your Path to IPO Success

Start your IPO-readiness process on the right foot with accurate, compliant financials in Leapfin.

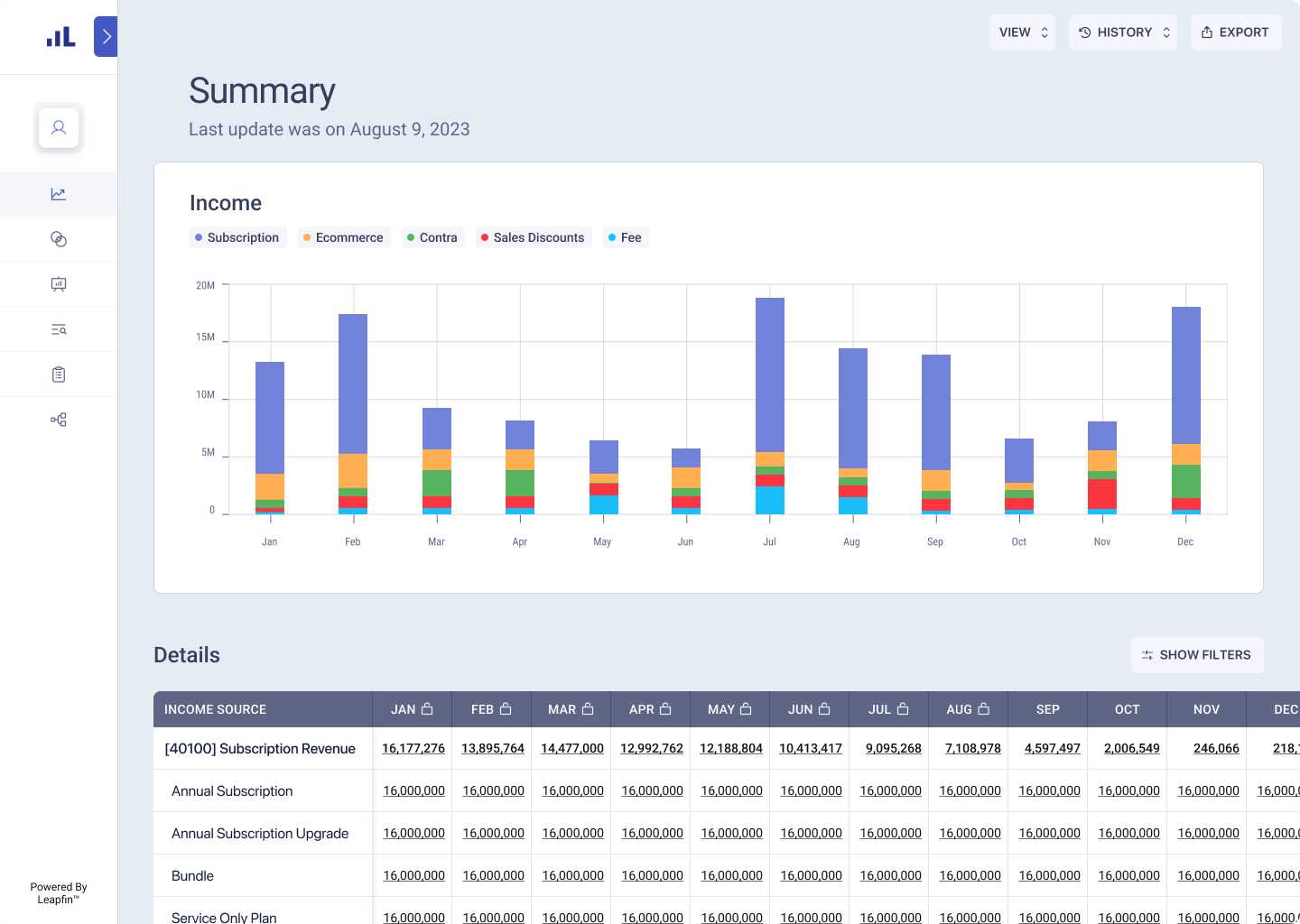

Start on the right foot with investors with accurate financials

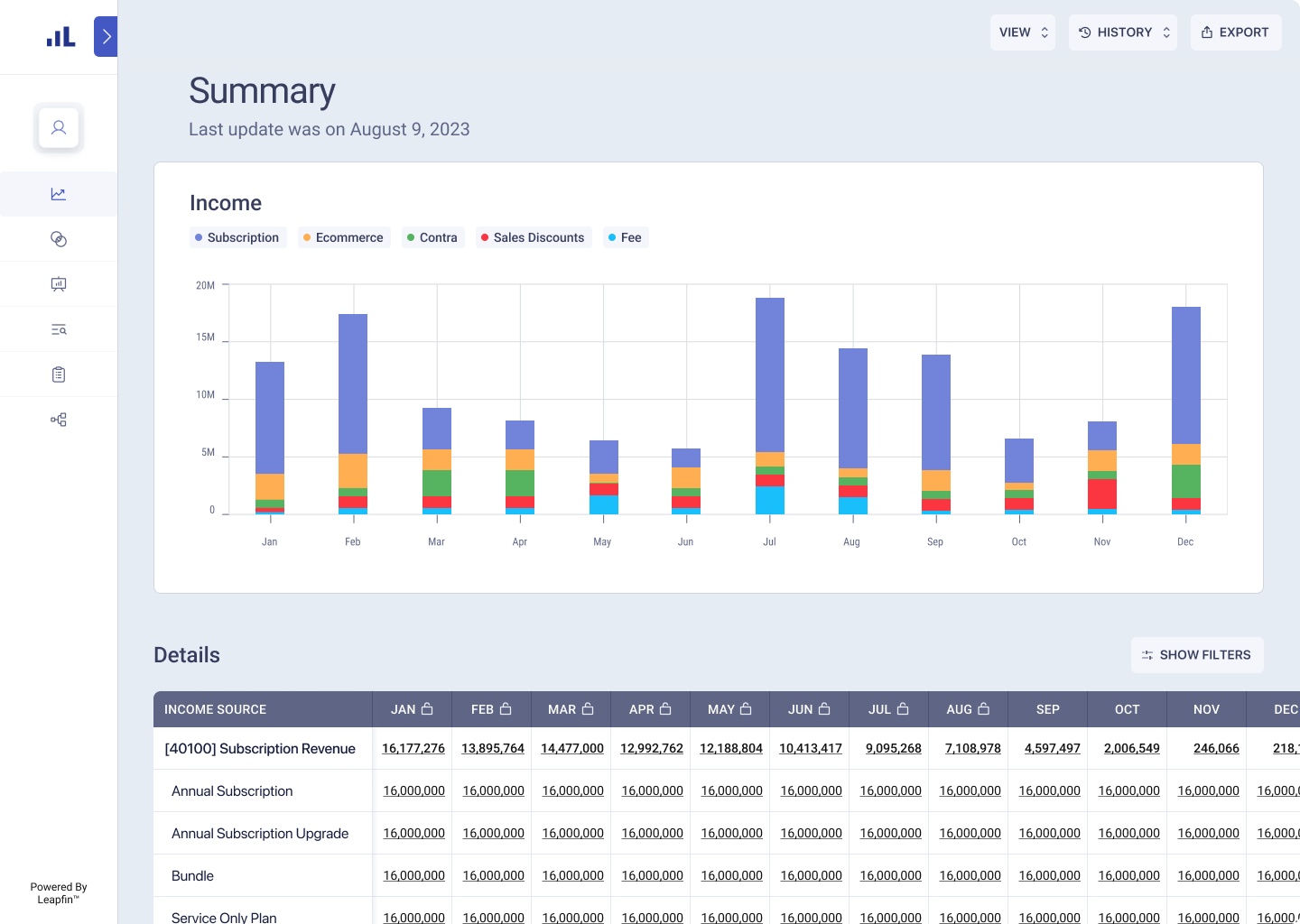

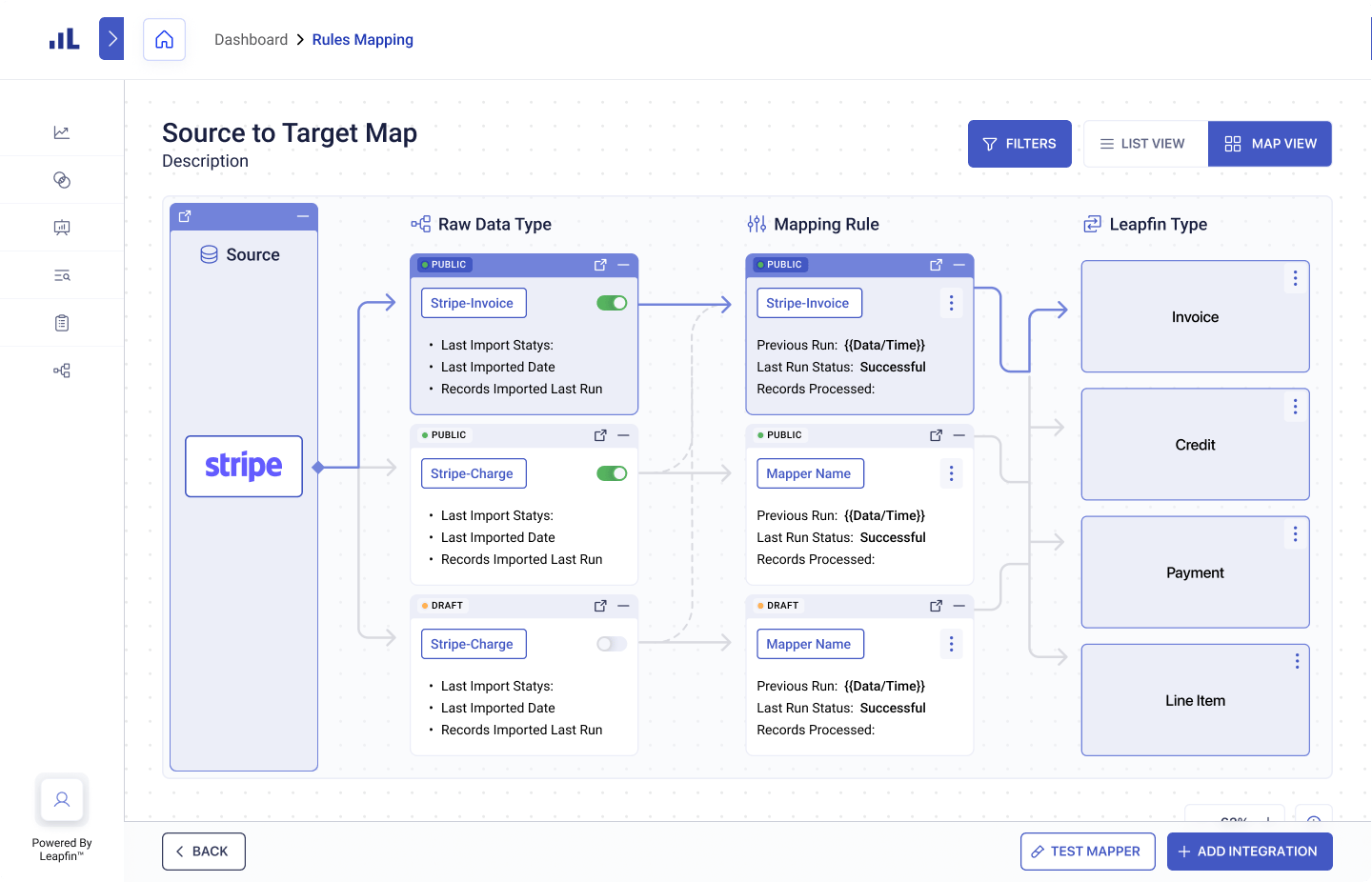

Report accurate numbers by centralizing the revenue accounting in Leapfin. Unify and standardize raw transaction data across multiple systems to ensure the data feeding your financials is accurate and complete. Automate revenue recognition and subledger creation in Leapfin to avoid manual errors and misstatements. Present investors with an accurate view of your business.

Correct errors in financials to avoid misstatement

Restating historical revenues doesn’t have to be a manual ordeal. Process historical transactions in Leapfin to automatically recognize past revenues and create an updated subledger that corrects past accounting errors. Avoid misstatements and paint an accurate picture of your historical performance.

Transition to GAAP and SOX compliance with ease

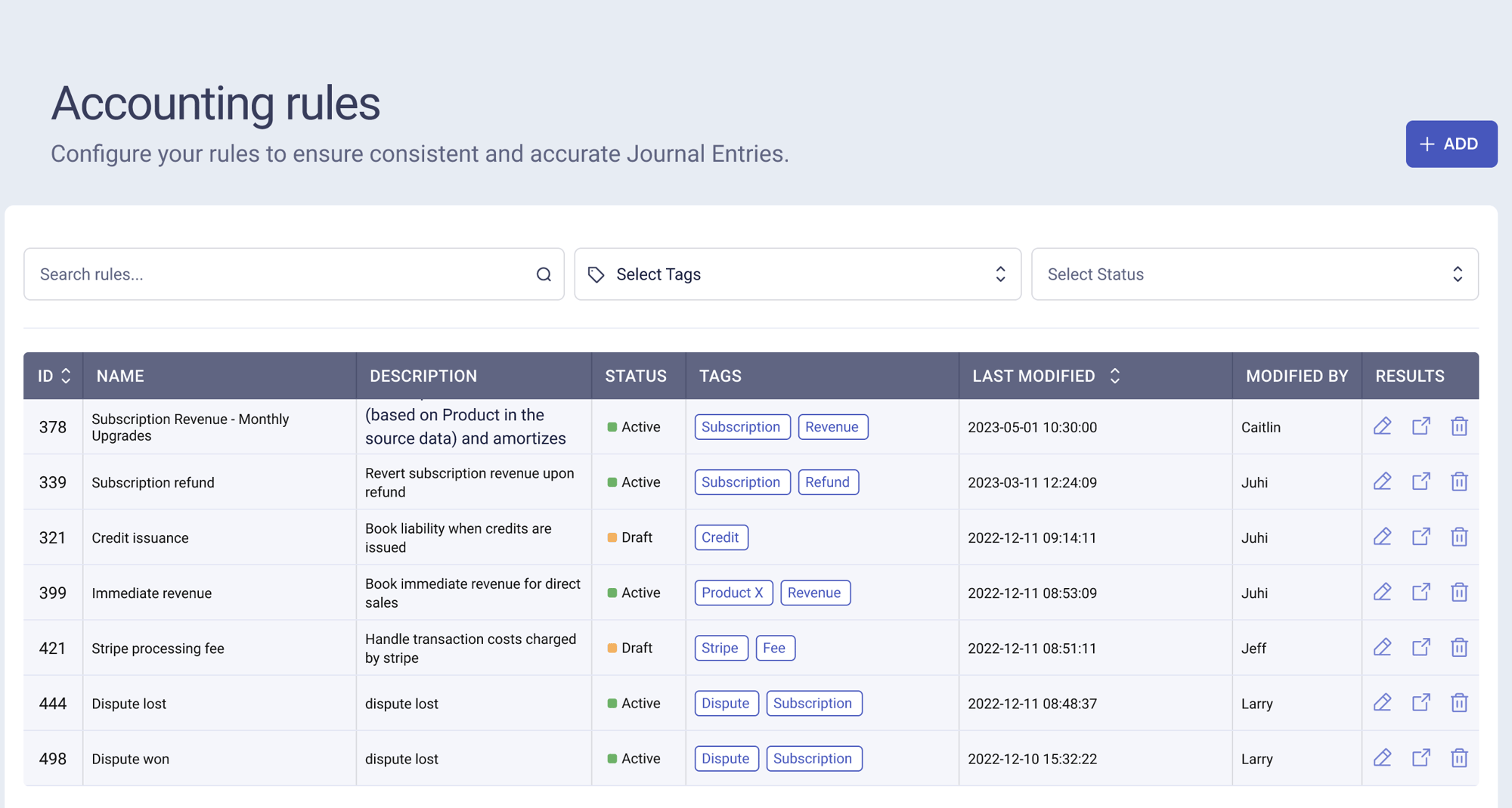

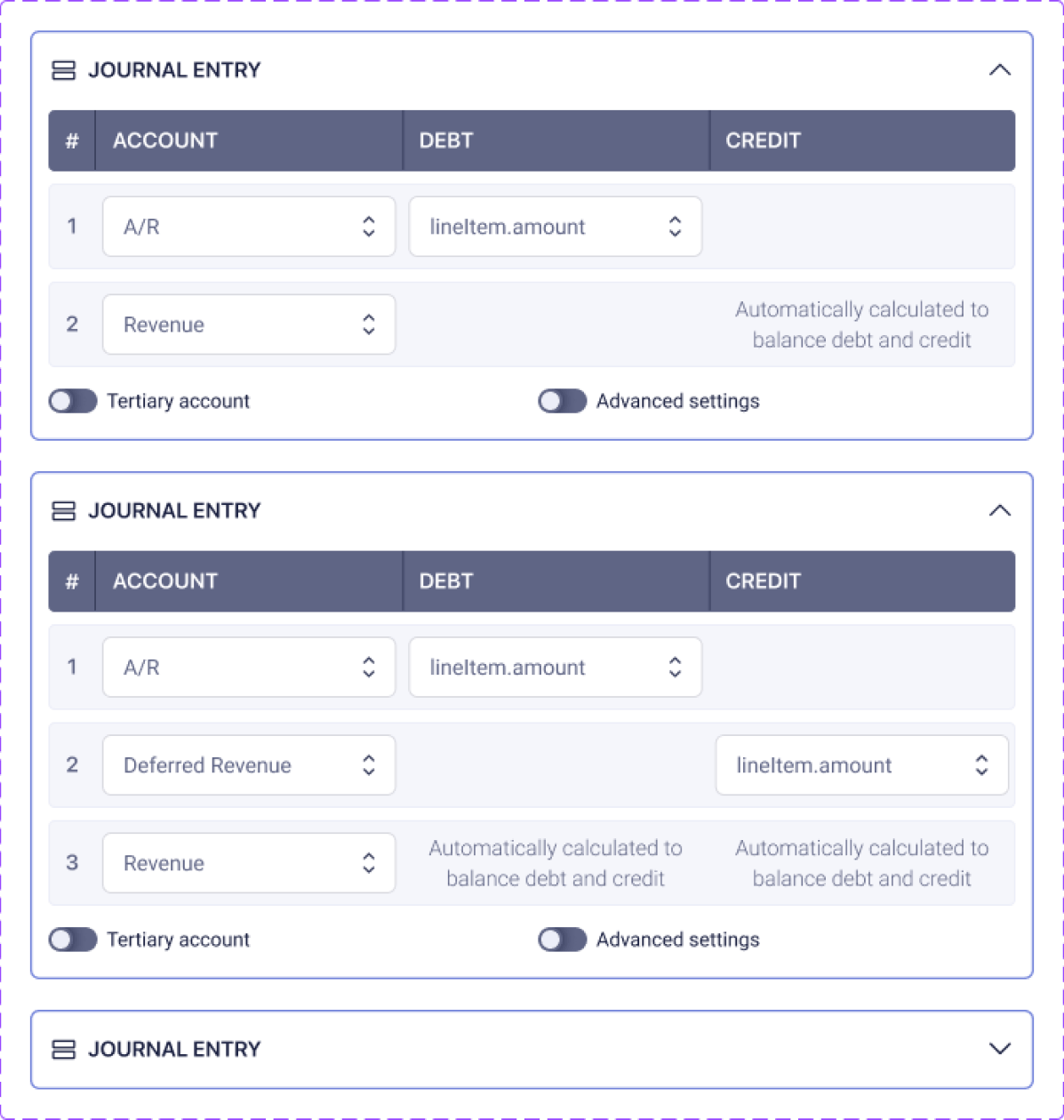

Staying on top of IPO requirements already puts enough stress on your Accounting team. Automate your transition to GAAP and SOX compliance with pre-built revenue rules in Leapfin consistently applied across all accounting records, even historical data. Let Leapfin button up your financials so you can focus on the strategic side of your IPO.

Conduct seamless audits

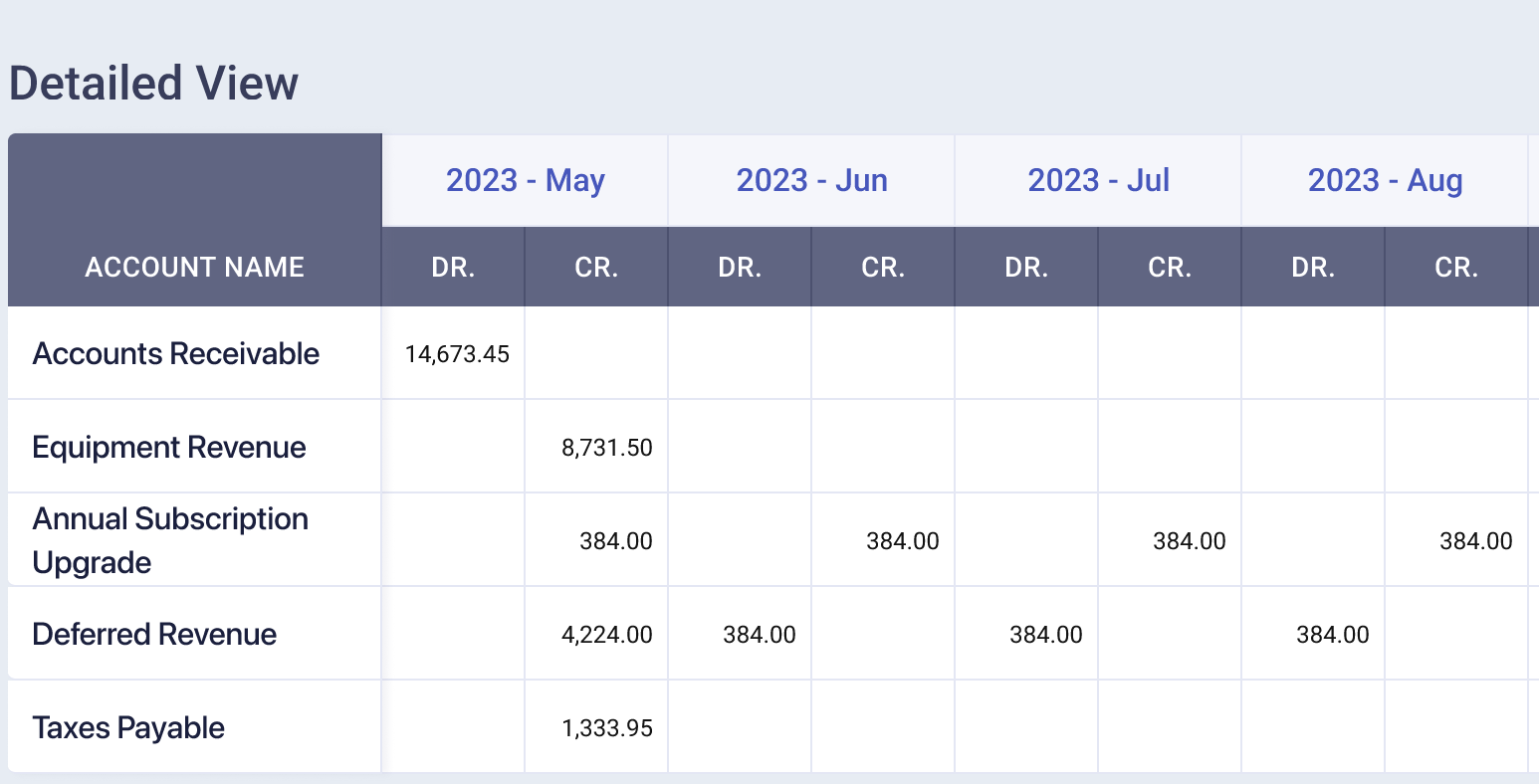

Streamline your IPO audit process with accurate, verifiable, compliant financials in Leapfin. Centralize your entire revenue accounting process in Leapfin for unmatched transparency and documentation of every turn of the revenue data. Drill into subledger records to view source data, the calculations involved in recognition, and the accounting rules applied. Power your audit process with Leapfin to answer auditor questions faster so you can focus on the next thing.

Forecast future performance with unbeatable precision

Creating pro-forma forecasts using last month’s data in rapidly evolving public markets can put your business at a disadvantage. Power future predictions with real-time, complete, accurate, disaggregated transaction data in Leapfin. Plan for the future and inspire investors with today’s revenue data at the ready.

Increase visibility with financial system consolidation

Centralize accounting in Leapfin to streamline close, increase transparency, and achieve data accuracy. Leapfin provides one view of a transaction’s journey across all transactions, journal entries, and subledger providing new insights into activities that boost and drain revenues.

Streamline accounting processes and accelerate close

Empower your accounting team with one system to do it all automatically – Leapfin – from consolidating transaction data to creating a subledger. Align across teams on the correct revenue data with a single source of truth. Automate manual accounting tasks to help accountants focus more on strategy.

Proven results, essential to your bottom line

Unparalleled accuracy

Report accurate, auditable revenue numbers every time with an automated, end-to-end revenue accounting platform.

Full transaction insight

Audit-ready and traceable

Drill into subledger accounts to the source data – journal entries, revenue rules, transactions, and source systems.

Transaction agnostic

Integrate any transaction type or format from any and all systems and unify them into a unified, consistent, reportable format – the Universal Accounting Record.

Built-in support

We personalize onboarding to your needs, market, and regulatory requirements, getting you up and running, fast. After launch, we’ll stay with you every step of the way with product trainings, ongoing support, and a dedicated specialist.

Secure and reliable

Trust the data and the systems behind it. Leapfin is compliant with SOC 1 & SOC 2 Type 1 standards and operates at 99% uptime. Lock transactions to the period in which they occur to accurately reflect adjustments without fear of overwritten or lost data.

-

I finally feel like I can fully support the numbers I’m posting to NetSuite every month. If someone asks, I don’t need to explain assumptions – I just pull the report in Leapfin.Brian Cheung Sr. Manager, Accounting, GoodRx

I finally feel like I can fully support the numbers I’m posting to NetSuite every month. If someone asks, I don’t need to explain assumptions – I just pull the report in Leapfin.Brian Cheung Sr. Manager, Accounting, GoodRx -

Leapfin is like our digital glue. It connects all of our financial data sources together so our team isn’t spending time manually tying everything out.Rebecca Wang VP Finance Corporate Controller, Guideline

Leapfin is like our digital glue. It connects all of our financial data sources together so our team isn’t spending time manually tying everything out.Rebecca Wang VP Finance Corporate Controller, Guideline -

With Leapfin, we are faster, we are more accurate, and we are drama-free. It's transformed our close process. No surprises, no last-minute scrambles. Everything just runs smoothly.Rodrigo Brumana CFO, Poshmark

With Leapfin, we are faster, we are more accurate, and we are drama-free. It's transformed our close process. No surprises, no last-minute scrambles. Everything just runs smoothly.Rodrigo Brumana CFO, Poshmark -

The feed from Leapfin to NetSuite works seamlessly. It's something that we don't have to worry about anymore.Lindsay Remigio Sr. Manager, Revenue Accounting, Reddit

The feed from Leapfin to NetSuite works seamlessly. It's something that we don't have to worry about anymore.Lindsay Remigio Sr. Manager, Revenue Accounting, Reddit -

The consolidated view of our revenue in Leapfin is fantastic. In literally one click we can easily see change month to month. And, because every single transaction is right there, we can dig into details for any explanation we may need.Melissa Tuttle Director of Accounting Systems, Outside

The consolidated view of our revenue in Leapfin is fantastic. In literally one click we can easily see change month to month. And, because every single transaction is right there, we can dig into details for any explanation we may need.Melissa Tuttle Director of Accounting Systems, Outside -

Leapfin helped parse out and make sense of the data that already existed. Simple searches in Leapfin make it easy to track things like refunds, revenue stream trends, and month-to-month movements. Without reporting bottlenecks, Canva is no longer vulnerable to surprises at month-end.Melissa Lee Corporate Controller, Canva

Leapfin helped parse out and make sense of the data that already existed. Simple searches in Leapfin make it easy to track things like refunds, revenue stream trends, and month-to-month movements. Without reporting bottlenecks, Canva is no longer vulnerable to surprises at month-end.Melissa Lee Corporate Controller, Canva -

With Leapfin, we didn’t need to increase headcount significantly to account for our growth. We were able to double transactions, especially during peak seasons, without growing the accounting team.Ian Booler VP of Finance, Altitude Sports

With Leapfin, we didn’t need to increase headcount significantly to account for our growth. We were able to double transactions, especially during peak seasons, without growing the accounting team.Ian Booler VP of Finance, Altitude Sports -

Before Leapfin, our reporting processes relied heavily on Excel, and close took up to 90 days. Now, we can close in just 5 days because Leapfin automates our entire data process and revenue reporting so that we can report accurate, validated financials at the end of the month.Minnie Luo CPA, Director of Revenue Operations, Top Hat

Before Leapfin, our reporting processes relied heavily on Excel, and close took up to 90 days. Now, we can close in just 5 days because Leapfin automates our entire data process and revenue reporting so that we can report accurate, validated financials at the end of the month.Minnie Luo CPA, Director of Revenue Operations, Top Hat -

If you’re a high complexity high transaction volume business, Leapfin is a no brainer.Damien Singh CFO, Canva

If you’re a high complexity high transaction volume business, Leapfin is a no brainer.Damien Singh CFO, Canva -

Leapfin has completely transformed our month-end close process, eliminating 4 days of manual work, with its ability to handle hundreds of millions of transactions and transform them into a subledger.Joe Blanchett Director, Business Systems, SeatGeek

Leapfin has completely transformed our month-end close process, eliminating 4 days of manual work, with its ability to handle hundreds of millions of transactions and transform them into a subledger.Joe Blanchett Director, Business Systems, SeatGeek -

The consistency and quality of data we get with Leapfin is excellent. The reduction in our month-end close time has freed up our team to focus on meaningful analysis, driving better business decisions.Jason Grenier CFO, Altitude Sports

The consistency and quality of data we get with Leapfin is excellent. The reduction in our month-end close time has freed up our team to focus on meaningful analysis, driving better business decisions.Jason Grenier CFO, Altitude Sports