NetSuite PayPal integration in Leapfin

View the end-to-end journey of every transaction by combining PayPal events with other operational data — like other PSPs, order management, billing, and other systems — in Leapfin, your single source of truth for every financial transaction.

Accurately recognize revenue and automate ledger entries into NetSuite’s general ledger. Say goodbye to half-baked APIs, third-party connectors, or homegrown integrations creating a messy business process. Leapfin turbocharges your PayPal transactions for faster analysis and close.

Here's how Leapfin makes your NetSuite PayPal integration easier

Accurate reporting and analysis with real-time transaction insights

Without an accurate view of every transaction’s journey, you can’t uncover ways to increase profits. How much tax are you remitting for disputed transactions? Are you offering too many discounts

Answer these questions with Leapfin. Leapfin combines PayPal events with other operational data, converts the transaction data into a universal Financial Record for easy segmentation and analysis, and automates ledger entry creation for reporting. So, when you integrate it into NetSuite, you capture and analyze every dollar without missing a cent.

Reconcile differences automatically

Dozens of events flow through PayPal daily – from payments to disputes to disbursements. But you still have irreconcilable differences and mistimed transaction reporting.

Why? Because part of the transaction lives in other systems which don’t observe similar immutability, the transaction might fall into the wrong period.

Leapfin automatically combines PayPal events with other transaction activities, assigns each activity to the correct period, and pushes fully reconciled entries into NetSuite. No more funky accounting or manual workarounds.

Pre-built logic for accurate financials

Sure, you can manually calculate foreign exchange rates or different tax rates across multiple journal entries.

Or, you could use Leapfin to apply these calculations, automatically create ledger entries, and push them into NetSuite, all without any manual effort. It’s up to you.

Easy, pain-free audits with traceable transaction linking

Remember when audits meant filling in the gaps in the transaction story between billing and payment? What happens if you invoiced a user a few months ago and reinvoiced them a week ago because of a dispute?

Leap into the future, track transaction data changes, and link related activities together and back to their source. Answer auditor questions in minutes, not days.

What you get with Leapfin, PayPal, and NetSuite Automation

Synchronize PayPal payments and charges with data in other operational systems and view a unified Financial Record that shows the whole transaction journey.

Apply custom business logic like tax, foreign exchange, adjustments, and revenue recognition for quick segmentation and analysis.

Access a streamlined, single source of truth for all your transactions and financial data in Leapfin.

View real-time transaction data updated daily, weekly, or monthly and automatically upload Financial Records into NetSuite, no spreadsheets required.

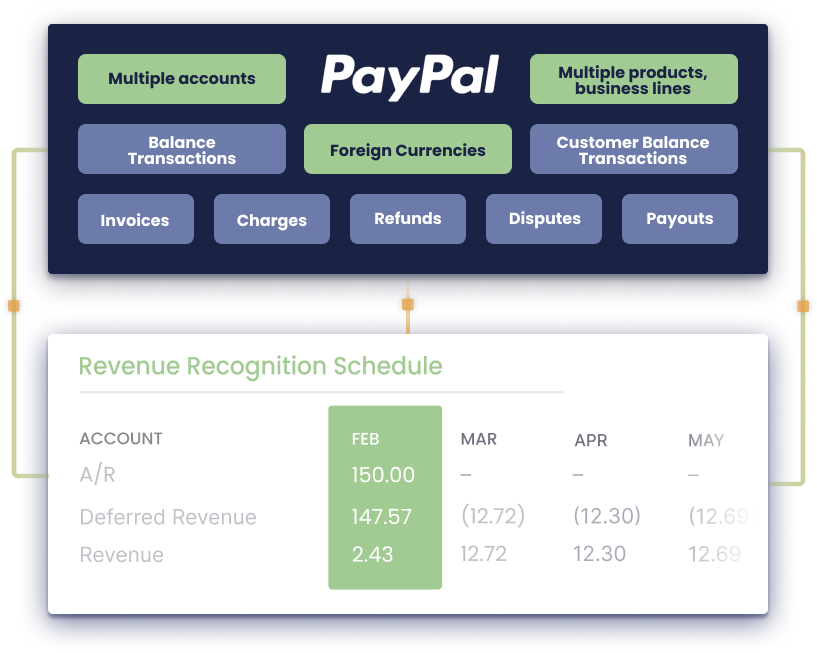

Extract the following objects from PayPal and push them into Leapfin: invoices, tax, credit card and other fees, fee refunds, currencies and exchange rates, refunds, disputes, and payouts.

Set immutable accounting period parameters and apply them to PayPal data to ease reporting.

Connect multiple PayPal accounts to Leapfin.

See PayPal data processes in real-time, automatically detect data errors, such as missing fields and invalid values, and view recommendations on fixing them.

View all sales orders across multiple subsidiaries, business models, and currencies in an extensible platform that handles thousands of daily transactions, even during peak seasons.

Automate away the hassles of your business process to pull PayPal transactions into your ERP

Track data sources in Leapfin for easy audit.

-

Leapfin is our valued partner for revenue recognition. All of the PSP data that we need for the month-end close lives in Leapfin and gets updated in real-time.Emily Eagon Controller @ Medium

Automate your journal entries at scale with Leapfin

FAQs about the NetSuite PayPal integration in Leapfin

Leapfin offers a native PayPal integration, fully configurable to the data you want to pull, whether it’s charges, refunds, disputes, payouts, or anything else. Leapfin integrates PayPal with NetSuite using a four-step automated process:

1. Leapfin synchronizes PayPal payments and charges with data in other operational systems, creating a unified Financial Record that tells the whole transaction story. Leapfin turns this data into automated journal entries.

2. Leapfin applies business logic, like tax rates, foreign exchange rates, or linear revenue recognition schedules to the entries.

3. Leapfin automatically converts journal entries into ledger entries.

4. Leapfin pushes those entries into NetSuite ERP using Leapfin’s native NetSuite integration without additional APIs or connectors.

Use Leapfin data linking to trace ERP general ledger entries to the PayPal reports and related transaction activities in other systems (order management, billing, etc.).

Leapfin retrieves the following events from PayPal: invoices, tax, fees, fee refunds, currencies and exchange rates, refunds, disputes, and payouts.

By integrating PayPal with Leapfin, rather than directly with NetSuite using an API or connector, your team can achieve the following benefits:

1. Make sure everything is reconciled automatically with Leapfin before it goes into the ERP.

2. Create a clean revenue subledger in Leapfin that’s flexible and immutable, letting the NetSuite general ledger summarize the dimensions that matter.

3. Save millions of dollars by not pushing thousands of transactions into NetSuite storage. Store the individual transactions in Leapfin and then create ledger entries that you can push into NetSuite to save money.

4. Avoid slowing down NetSuite’s ERP with large data volumes by using Leapfin’s extensible graph architecture. Leapfin can handle millions of transactions without slowing processing.

5. Avoid dealing with common errors associated with a high transaction volume integration, like blocked transactions, data re-runs to complete a transaction record, and API warnings. If Leapfin spots an error in your data, it will flag it for you and recommend how to fix it without re-running your data.

6. Support your digital business with a flexible platform built on graph architecture with Leapfin. Avoid friction caused by mapping complex product system data models to NetSuite objects since NetSuite‘s relational database can’t support them.

7. Create an immutable record for PayPal source data to avoid risk issues between periods. Also, avoid the risk of posting transactions to the wrong period. Leapfin automatically allocates transaction activities in the period in which they occurred.

8 .Eliminate the pain and delay of running a manual business process

How? In four steps:

1. Leapfin enriches PayPal data with transaction data from other operational tools, providing the journey for every transaction in a unified, immutable Financial Record.

2. Leapfin creates journal entries that reflect the journey of every transaction.

3. After applying accounting logic to the entries, Leapfin automatically converts them into ledger entries

4. Finally, Leapfin pushes these fully reconciled ledger entries into NetSuite general ledger

And the best part? Leapfin automates this process without extra manual effort, whereas APIs and connectors often require costly engineering resources to configure.

Integrating PayPal with Leapfin requires four easy steps. Here’s what you need to do:

1. Evaluate the number of PayPal instances your business has and connect your PayPal accounts to Leapfin.

2. Integrate PayPal events — like charges, disputes, and payments — into Leapfin to reflect every PayPal activity in Leapfin.

3. Integrate other operational tools — payment service providers, billing systems, order management systems, and mobile payment applications — with Leapfin to view the journey of every transaction.

4. To view this data in your ERP, integrate Leapfin with NetSuite.

That’s it!

Yes. Once Leapfin enriches PayPal transaction activity with other integrated operational data, Leapfin then converts this data into fully reconciled journal entries. Then, based on your business needs, you can apply different types of business logic — like foreign exchange rates, taxes, and event-based revenue recognition. Leapfin recognizes revenue accurately before pushing it into NetSuite ERP using the NetSuite integration. As a result, you can remove manual effort or custom-built workflows for your Finance team.

The PayPal-Leapfin integration covers an expansive, out-of-the-box list of scenarios and automation based on your business needs. See our documentation page to see the scenarios we can support.

The NetSuite API limits don’t constrain Leapfin. Leapfin captures and enriches data from PayPal with other transaction data using a flexible, expansive architecture. This architecture can support rapidly scaling transaction volumes without slowing data processing or involving extra engineering.

Also, the Leapfin – NetSuite integration reconciles journal entries daily. However, the increased volume doesn’t slow down data processing because Leapfin pushes the aggregated data to the trial balance in NetSuite.

Leapfin Finance Data Platform’s flexible graph architecture can support rapidly scaling transaction complexity without slowing data processing. As your business grows, you can easily add new product lines, business units, general ledger codes, and bundles to Leapfin without fully re-engineering the platform. We employ a graph data model to build Leapfin’s flexible architecture that incorporates linking logic which enhances the architecture’s flexibility.

See our Integrations page for our complete list of systems we can integrate. Leapfin’s flexible architecture can support multiple integrations with the following tools:

- Payment and billing tools like Shopify, Braintree, Amazon Pay, and Adyen

- Mobile app stores like Google Play and Apple App Store

- Subscription billing tools like Zuora, Chargify, and Recurly

- Homegrown custom solutions.

Most of our customers integrate Leapfin with more than one payment system. Then, you can easily integrate with downstream reporting and analysis systems like NetSuite, Looker, and Tableau.

You can use the PayPal-Leapfin integration for various industries, including eCommerce, SaaS, marketplaces, or any other high-transaction volume business. Leapfin’s extensive functionality and architecture can support multiple business models, international currencies, and products.

Any payments you can make with Adyen payment gateway can be used. Leapfin can capture any of the following: invoices, tax, credit card and other fees, fee refunds, currencies and exchange rates, refunds, disputes, chargebacks, and payouts.