Table of contents

- Introduction

- Acknowledge your reality

- Embrace automation

- Stay ahead of compliance

- Redefine roles

- Build trust and anticipate resistance

- Conclusion

Introduction

Economic volatility and personnel reductions underscore the significance of maintaining robust, efficient financial operations. For Accounting leaders handling high transaction volumes, particularly with slimmed-down teams due to layoffs or budget cuts, the task might seem formidable. However, these challenging circumstances also present opportunities for profound transformation. Strategic automation can equip your lean team to manage the demands of efficient and compliant financial operations.

Get the tools to lead your accounting team through change.

Accounting leaders who read this guide will learn:

- How to recognize and address the challenges and opportunities that emerge from managing high transaction volumes with a lean team.

- The critical role of automation in managing high transaction volumes efficiently and accurately, especially with a lean team.

- Strategies for maintaining high compliance standards amidst staff reductions and other changes.

- The importance of leadership in fostering a culture of change, essential for transitioning to a more automated environment.

- How to future-proof your accounting function by leveraging emerging technologies and methodologies.

This guide will provide practical and actionable advice to help Accounting leaders like you transform these challenges into opportunities for growth and efficiency.

More related content from Leapfin:

Acknowledge your reality

Face the challenge

Running an Accounting team during a time of hiring freezes, staff reductions, or layoffs is difficult. When the team becomes smaller or budgets are tighter, it becomes harder to manage the challenges that come with high transaction volumes. However, challenges also bring opportunities. The first step towards finding a solution is recognizing the seriousness of the situation.

Finance leaders need to confront reality directly. With a smaller team, you’ll often face more risks related to following regulations, issues with data accuracy, and problems with workflow efficiency. It can feel overwhelming, like juggling too many tasks at once, where one mistake can lead to many problems.

But instead of feeling hopeless, view this acknowledgment as a call to action. Use it as an opportunity to review and improve your operations. Let it inspire you to adopt new and more efficient practices, rather than letting it block your progress.

Reducing team size gives you a chance to carefully assess your current processes, find areas of inefficiency, and identify ways to improve. It’s also an opportunity to consider automating how you handle high transaction volumes accurately and efficiently. Lastly, it allows you to redefine the roles of your staff members, moving them into more strategic positions as you automate routine tasks.

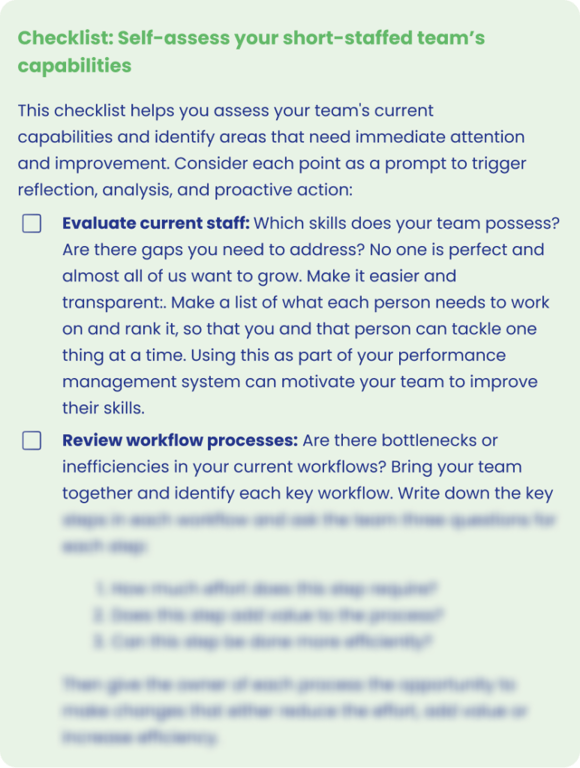

Checklist: Self-assess your short-staffed team’s capabilities

Note: You can access the full checklist as a PDF by clicking here.

Embrace automation

The role of automation in a lean team

When your team is lean, automation becomes a must-have to cope with high transaction volumes and maintain the integrity of financial operations.

Automation isn’t just about not doing repetitive tasks manually. Automation also improves data accuracy by reducing the chance of manual errors. That’ll save you a lot of time downstream on data reconciliation. Especially on a small team, automation frees you from repetitive and low-value tasks so they can focus on strategic responsibilities that might otherwise not get done at all.

Automation also helps you scale as your company grows. With an effective automation strategy in place, increasing transactional activity won’t overwhelm your team or require you to hire as quickly.

More related content from Leapfin:

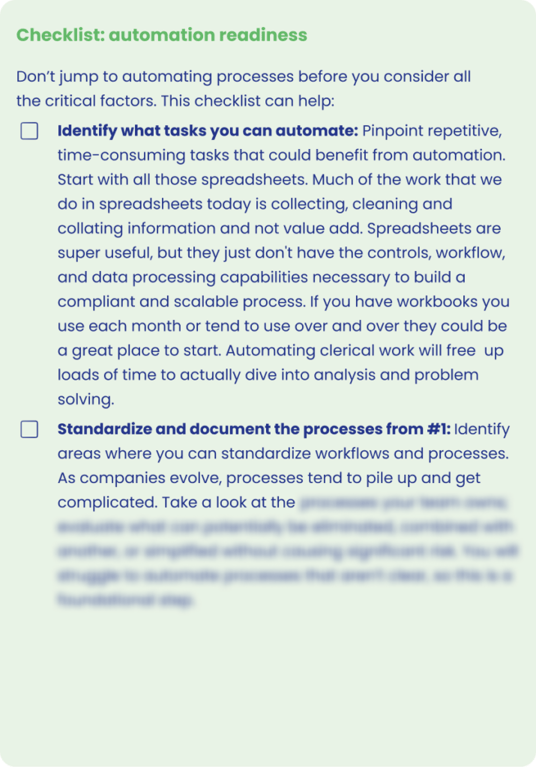

Checklist: automation readiness

Note: You can access the full checklist as a PDF by clicking here.

Stay ahead of compliance

Automate compliance for continued confidence

Maintaining compliance with the plethora of accounting rules, tax requirements, debt covenants, and contractual obligations is challenging enough in normal times. When your staff is under pressure, it’s only harder. The complexity intensifies further when dealing with high transaction volumes. But you can uphold high compliance standards, even in times of change, by using automation and enforcing clear compliance procedures.

Regulatory compliance is an area where you can’t afford to make mistakes. While lean teams may struggle with the increased workload, automation can be the key to staying ahead. Automated systems can handle repetitive, rule-based tasks with precision, ensuring consistent adherence to compliance requirements. Moreover, they can provide detailed audit trails, making it easier to demonstrate compliance during audits. And, the best part? Once your automated systems have demonstrated compliance during an audit, they’ll be trusted in the future as well! That’s one less thing to worry about in your next audit.

Automation also provides improved visibility into financial operations. By having an automated system handle high transaction volumes, you can better track transactions, identify anomalies, and fix potential issues before they escalate.

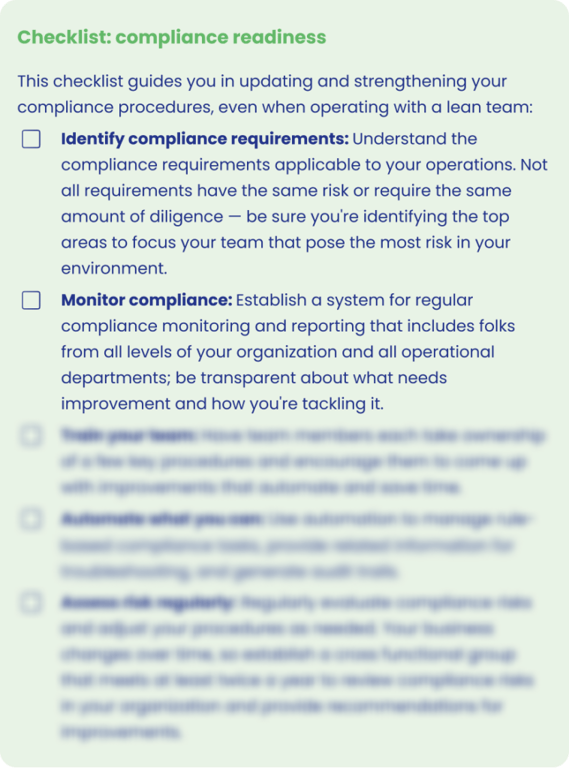

Checklist: compliance readiness

Note: You can access the full checklist as a PDF by clicking here.

Redefine roles

Empower your lean team

Operating with a lean team isn’t about doing more with less — it’s about doing things differently. When a staff reduction occurs, focus on redefining roles within your Accounting team, not just reallocating tasks. With automation taking care of high-volume transactions, your team members can step into more strategic roles.

Start by considering your team’s skills and talents. Each member likely has unique competencies that extend beyond their routine responsibilities. As automation takes over repetitive tasks, you can reallocate your team members to roles that maximize their potential and contribute more significantly to the organization.

This strategy not only boosts overall productivity but also can improve job satisfaction. Team members will feel more engaged when they can use their skills effectively and make a meaningful contribution to the organization’s success.

More related content from Leapfin:

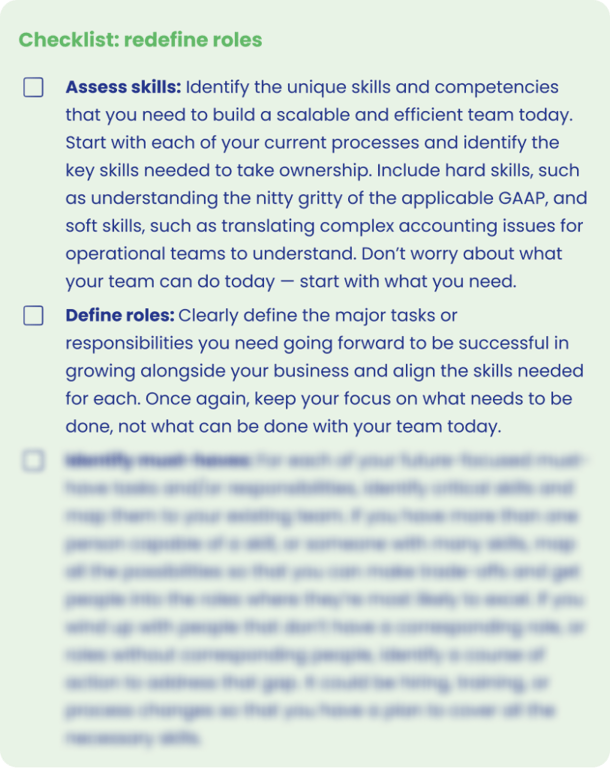

Checklist: redefine roles

Note: You can access the full checklist as a PDF by clicking here.

Build trust and anticipate resistance

Involve your team so they feel a sense of control

One of the greatest challenges in implementing automation is overcoming resistance to change. This is especially true when introducing new technologies to an already lean and overworked team. However, by building trust in automation, you can ensure a smoother transition and greater acceptance of the new systems.

Trust in automation comes from understanding its benefits and seeing its positive impacts. When team members can see how automation makes their jobs easier and how it improves overall operations, they’re more likely to embrace it.

Furthermore, by involving team members in the automation implementation process, you allow them to gain a sense of ownership and control. This active involvement not only aids in successful implementation but also contributes to building trust in the new system.

More related content from Leapfin:

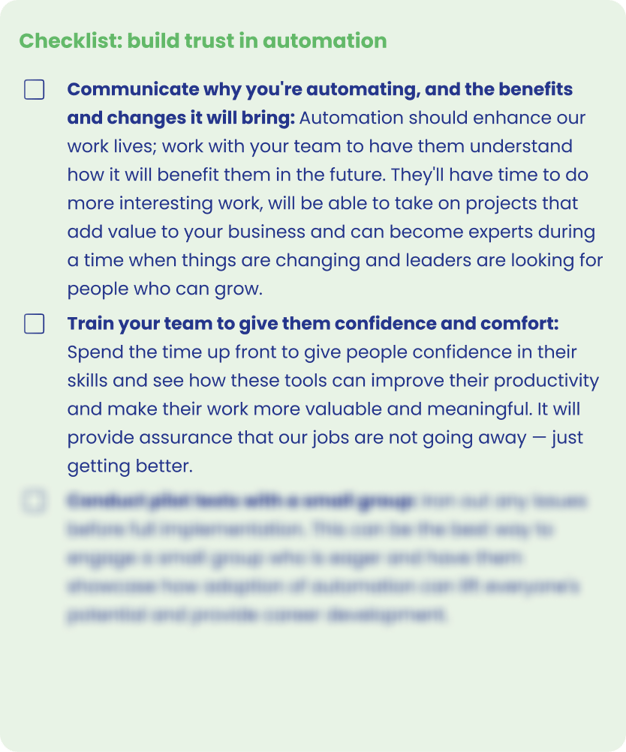

Checklist: build trust in automation

Note: You can access the full checklist as a PDF by clicking here.

Conclusion

Adapting to a lean team structure in an era of high transaction volumes can be challenging, but it isn’t impossible. By acknowledging the reality of your situation, embracing automation, maintaining compliance, redefining roles, and building trust in technology, you can transform these challenges into opportunities.

This transformation doesn’t happen overnight, but with strategic planning and implementation, you can succeed. Through it all, remember that change isn’t a journey that you need to undertake alone. The right partners and tools can make your path smoother and your destination achievable.

Leapfin, your trusted partner in automation, is ready to help you every step of the way. Together, we can integrate disparate operational data sources, turn operational data into financial records, and automate the generation of journal entries at a transaction level daily. We publish them directly into your ERP system, offering you the level of detail you desire, as frequently as you need.

We hope this guide has been a useful tool in navigating your current challenges. For further assistance or to discuss personalized strategies for your situation, please reach out to us.

See how Leapfin works

Get a feel for the ease and power of Leapfin with our interactive demo.