What is Order to Cash and how did it come to be?

You have to make a product or service, get people to buy it, and then collect money from them.

– When people order a product, you have to capture that order, then provide the service or good.

– You might have to ship something, if you’re an e-commerce company. Or you might have to create an account and send an email with login information if you’re a software service. And then you have to bill a customer. Sometimes this happens immediately. Sometimes it happens after the fact.

– You have to collect, ensure that your customer actually pay you. If they don’t (either right away or after trying multiple times), you have to write off that non-payment as bad debt.

– Next you have to post the cash to your bank account. But you’re not done yet…

– Finally, you might have to deal with disputes and have funds withdrawn, or issue credits or discounts for future purchases.

If you look back in business history 30 or 40 years, Order to Cash (OTC) wasn’t a common framework. It came into common usage in the 1990s with the growth of Enterprise Resource Planning (ERP) systems. They were designed to integrate and automate various business processes, including sales, order management, inventory management, and accounting. As companies began to adopt ERP systems, they, along with their ERP vendors and consultants, realized the value of standardizing these processes. This led to massive digital transformation initiatives to optimize OTC everywhere, which continue to this day.

What are the steps of Order to Cash and what do they mean for Finance?

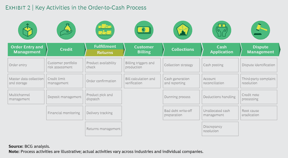

Below is a generic Order to Cash process from Boston Consulting Group. Every company’s and industry’s OTC process is a bit different, but overall, similar.

The traditional role of Order to Cash in Finance: keeping score

Finance teams have been steeped in Order to Cash as an orienting process framework for decades, because so many of the process activities generate data with finance implications. For example:

– Finance teams have to apply complex rules to recognize revenue for orders. For goods that are shipped, the shipping or delivery date in the fulfillment step is often the trigger for recognizing revenue.

– Billing affects Finance because not all bills are paid immediately, and payment platforms take a cut of revenue.

– Bills that aren’t paid at all end up incurring bad debt expenses in the collections phase

– At the cash phase, Finance has to reconcile bank accounts against expected payments.

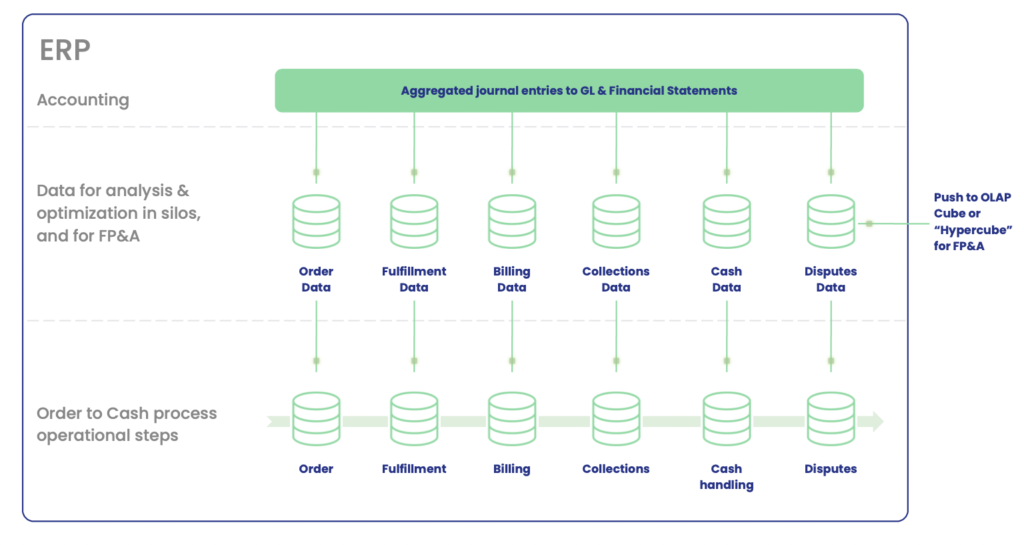

In the past 30 years, Order to Cash operational processes like creating an order, handling the cash, and managing disputes, were handled inside the ERP. Each step generated data that Finance used.

Sometimes you’d pipe that data into a system for your FP&A team to use in an OLAP Cube (see our article on why OLAP cubes just aren’t enough these days).

And accounting sat on top and translated that data into the general ledger and financial reporting.

In that traditional world, all of these steps were tied to one data model, tracked in a single ERP system, and the primary focus — necessarily and correctly – was on how to make the actual Order to Cash process as efficient as possible. Running the actual processing of orders, fulfillment, payments, collections, and cash was the game, and finance data powered the scoreboard.

The score keeping model for Finance in OTC is utterly broken

But for digital companies, this approach, while still very common as a mental model, is in actual fact, gone. Completely. Irreversibly. Irretrievably. Dead and gone.

Because while the mental model of a nice, clean Order to Cash framework has lived on, the actual systems that power each step of that process are no longer the ERP: They’re no longer a single system. It’s now a mishmash of homegrown or stand-alone billing and order management systems, numerous payment processors, app stores, and so on.

Digital businesses grow faster, and are more operationally flexible, than any that came before. They might start as a subscription business in one country, but within a few years, operate in dozens of countries with different payment infrastructures and currencies, and have added marketplace or merchandise revenue streams.

A single ERP isn’t set up to handle so much complexity and to change so fast, so like in many other business domains, technologists have unbundled once highly-ridgid monolithic systems function by function into a vast array of software services. In fact the ERP has been kicked out of the Order to Cash game completely. Now it’s just there to report final scores in the sports section of the newspaper the next day.

In order to fulfill the core function of offering goods and services and getting paid for them, engineering teams have rightly focused on stitching the OTC process together with APIs and other integration methods.

But something absolutely essential got left behind in the process. In the urgency to adopt new payment processors, create new product functionality, introduce new business models, and more, the finance data produced in every step got completely disconnected, just like the operations data. And while engineering rightly focused on connecting the operations data together to be able to run the business (job #1), finance was largely left alone to figure out how to connect the dots itself. And that has made for an unholy mess.

Imagine a basketball game where every player keeps their own score, rebound count, and shot clock, and the scorekeeper collects slips of paper with illegible handwriting from every player with their self-reported stats at the end of the game and tries to figure out the final score, and you get a small window into the challenges that finance teams face figuring this all out.

Now imagine a tournament where, as soon as one game is finished, the next one starts. But there’s still only one scorekeeper. So during each game, they’re frantically trying to finish figuring out the score for the last game and can’t pay attention to the current game right in front of them. And the players from the last game are getting antsy because they want to know the result and which team to prepare to play next based on the bracket.

That’s one stressed out scorekeeper!

The finance team, which wants desperately to be engaged in the game right in front of them — to coach, to referee, and even to play — is so consumed trying to reconcile the stats for the last game, they never have a chance.

Each operational system product and engineering teams uses to support high-volume transaction processing — from taking an order, accepting a payment, fulfilling / shipping, handling disputes, and so on — only tells a part of the transaction story.

To generate financial reports, finance teams need to extract the relevant data from these systems, often downloading huge CSV data files one by one, tie and reconcile it all together, analyze it, and then build reports. The business logic they’re using to generate journal entries isn’t in a standardized, controlled system, it’s now in innumerable spreadsheets, one typo away from a disaster.

With every additional nuance of the transaction data and every new data source, accountants risk making more manual errors, struggle even more to trace back from financial reports to source data, and undertake greater contortions to reconcile accounts and close the books. As they get pulled deeper into spreadsheet acrobatics, financial analysts get farther away from advising and driving business.

These challenges slow business decisions and month-end close, reduce confidence in reporting and projections, create unholy levels of stress when auditors ask to see how the reporting relates to the source data from the operational systems, and make it impossible to devote time to higher value work to root out waste, optimize accounting policies, or strategize with the business leaders about deploying financial resources to boost the bottom line.

Put yourself in the shoes of the controller in the midst of an audit, and they get asked, “Why did last month’s numbers change each time you pulled the data?” “How did you generate this journal entry from fulfillment data, shipping date, and dispute information from three separate data sources?” These are terrifying questions.

What’s worse, for digital businesses with high transaction volumes, Excel isn’t even viable, and more programmatic data processing methods also get stretched to the point of failure, where all the data doesn’t get processed in time (or at all).

Perhaps worst of all, all the manual work means you aren’t maintaining the data at a transaction level and lose fidelity and detail with every step of the process. That detail, if you had it at your fingertips, would be enormously valuable to optimize the business. For example:

– Finding customer segments that have higher return or dispute rates and avoiding them.

– Choosing the right shipping partner for every shipment during the all-important holiday season in e-commerce to prevent margin erosion.

– Tweaking product offerings or pricing to encourage customers to chose more profitable products.

It’s impossible to do these kinds of analyses accurately without a complete view of every single transaction. And in today’s world of unbundled Order to Cash and manual Finance acrobatics, that view is just plain missing.

It’s no wonder you feel frustrated. Stuck working harder and harder each month while delivering less and less value.

A call to action: stop optimizing process and start optimizing data

We’re calling for Finance teams to recognize the incredible disconnect between the beautiful vision of OTC you’ve been working toward for thirty years, realize that it’s no longer viable, and shift your mindset.

We’re calling on Finance leaders like you to pivot your thinking from a horizontal view of Order to Cash – a view focused on process — to a vertical view, oriented around the data flows that are causing you so much heartache. In the vertical view, the focus is on taking operational data and translating and transforming it into finance data.

From OTC to OTF

Shifting your mindset from thinking about Finance as pulling data after the fact from an OTC process not designed for that, to thinking about how Finance can have all the data at its fingertips all the time, is incredibly liberating.

It’s how you can get out from under the incredible weight of the process you have to manage now just to keep score, and unleash your analytical and strategic firepower on being a key player in the strategic game of your business. It’s how you go from Finance being an afterthought and consequence of the operational activity of the business, to being a driver of the choices that lead to operational success. It’s about how you go from being reactive to leading the business.

In today’s market, Finance can’t afford to be on the sidelines anymore. High growth digital companies today no longer have the luxury of seemingly unlimited and free capital. Finance leaders have to make sure every dollar is spent smartly. You have to find pockets of profit degradation from operational decisions made in a vacuum, and they have to do it immediately.

It’s time for a revolution in Finance thinking. Join us on the OTC to OTF journey. Let’s go!

See how Leapfin works

Get a feel for the ease and power of Leapfin with our interactive demo.