Financial audits help ensure an organization’s financial reporting integrity, accuracy and compliance. But, they can be complex and challenging. Increasingly creative and flexible business models and the time and detail required for the auditors to get comfortable can drive up the cost, and challenges may result in unfavorable results.

Many Accounting leaders exiting audit season are looking ahead and working to ensure that they come into their next financial audit more confident of their compliance and more prepared, saving time and minimizing the exhaustion of their team.

Book a consultation with Jason Berwanger by clicking here or using the link at the end of the video above!

What you can expect to learn in this guide

In this guide, Corporate Accounting leaders will learn:

- 10 recommendations to make their audit process more efficient and effective.

- A checklist of key tactics to implement each recommendation

- Why each recommendation is challenging to follow

- The importance of each recommendation to key stakeholders inside and outside Finance

Table of contents:

- Recommendation 1. Documentation

- Recommendation 2. Clarify your industry’s unique audit requirements

- Recommendation 3. Document and ensure consistent accounting policies

- Recommendation 4. Regular, scheduled, and well-designed reconciliation

- Recommendation 5. Good Internal Control

- Recommendation 6. Use of Reliable Accounting Software

- Recommendation 7. Maintain continuous audit readiness and self check

- Recommendation 8. Training and Development

- Recommendation 9. Collaborate with Auditors

- Recommendation 10. Use of External Expertise

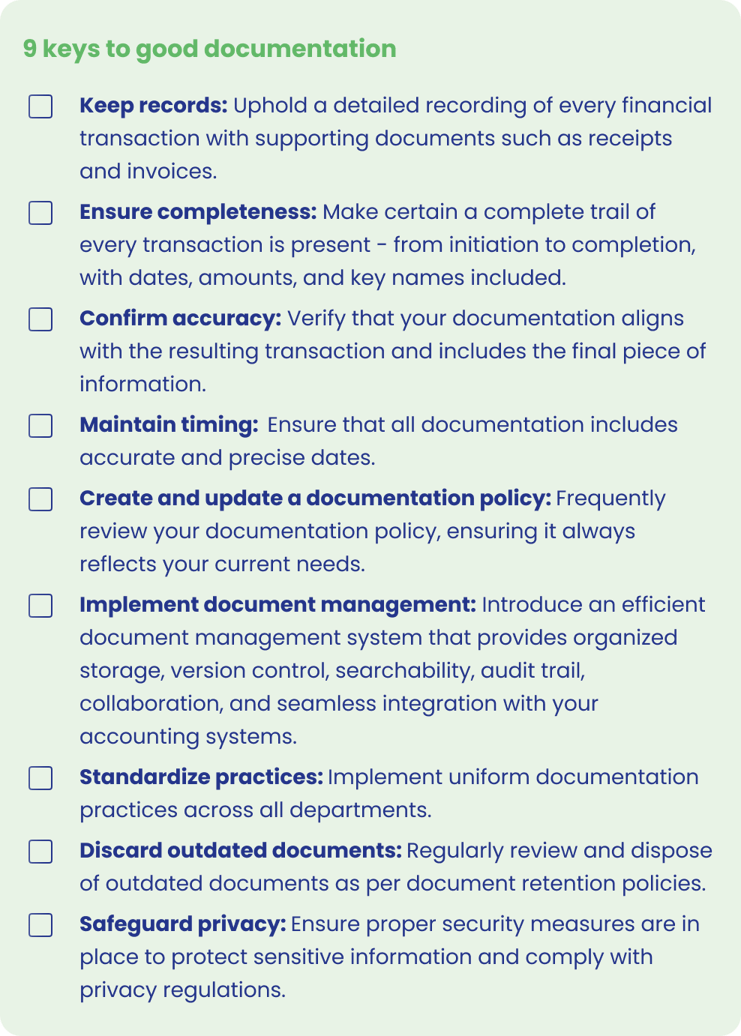

1. Documentation

Make sure that all financial transactions are adequately documented. This includes keeping invoices, receipts, and other proof of all financial activities. Not only does this make it easier to provide evidence during an audit, but it also reduces the likelihood of errors or discrepancies.

Why you might struggle to keep good documentation

Fast-growing businesses are typically busy and can easily overlook maintaining comprehensive documentation, especially if the accounting systems haven’t scaled with the growth of the business. Staff might be overwhelmed and unable to keep up with the necessary paperwork. However, if you don’t set up a system for good documentation, it may have disastrous impacts on your role, team, and the rest of the organization.

Why poor transaction documentation hurts Finance, the organization, and its stakeholders

Here’s how poor documentation affects key stakeholders in the Finance organization.

- Accounting team: The burden of maintaining accurate and comprehensive documentation primarily falls on Accounting. This task can be labor-intensive, leading to increased workload and potential burnout if not managed well.

- Controller: The Controller may need to devote additional resources and time to oversee the documentation process and ensure completeness and accuracy. This diversion of time and resources can hinder other strategic tasks, such as spending time with business leaders to help them understand the numbers.

- Chief Accounting Officer (CAO): The CAO must ensure the company’s overall compliance, which includes the documentation process. A lack of proper documentation can increase risks and cause complications in audits, thereby putting a strain on the CAO’s role.

- Chief Financial Officer (CFO): Without accurate documentation, the CFO’s ability to make strategic decisions can be impaired, as these are often based on financial reports. Increased audit risks due to poor documentation can also lead to reputational and financial costs for the company, ultimately affecting the CFO’s role.

And here’s the impact on other stakeholders across the business:

- Operations: Without proper documentation, the Operations team can face difficulties in planning, managing inventory, and delivering services. It can lead to inefficiencies and disruptions in the supply chain, which could harm customer satisfaction and profitability.

- Sales and Marketing: The Sales and Marketing teams rely on accurate financial data to plan and execute strategies, measure performance, set targets, and determine pricing. Inaccurate or incomplete data can lead to misguided strategies or misaligned targets.

- Information Technology team: If transactions aren’t properly documented, the IT team will struggle to maintain and update financial systems. This could compromise data integrity and security and create inefficiencies or errors in system operations.

- CEO and Board of Directors: Inaccurate or incomplete financial documentation can prevent these key decision-makers from getting an accurate view of the company’s financial health leading to misguided strategic decisions.

- Investors and shareholders: These stakeholders rely on financial reports to assess the company’s performance and determine its value. Inaccurate or incomplete documentation can misrepresent the company’s financial status, leading to a loss of investor trust and potential legal repercussions.

- Customers: Ultimately, any financial missteps can impact the company’s ability to provide its products or services, leading to a loss of customer trust and potential harm to the company’s reputation.

- Regulatory bodies: Failure to accurately document transactions can lead to non-compliance with regulatory requirements, which can result in hefty fines, legal trouble, and damage to the company’s reputation.

- Employees: The consequences of inaccurate financial documentation, such as cost-cutting measures, layoffs, or even bankruptcy, can have a profound impact on employee morale, job security, and trust in the company’s leadership.

In sum, the importance of proper transaction documentation extends far beyond the Accounting and Finance departments and has numerous downstream impacts across the organization and its stakeholders. It’s critical to the overall health, success, and longevity of the business.

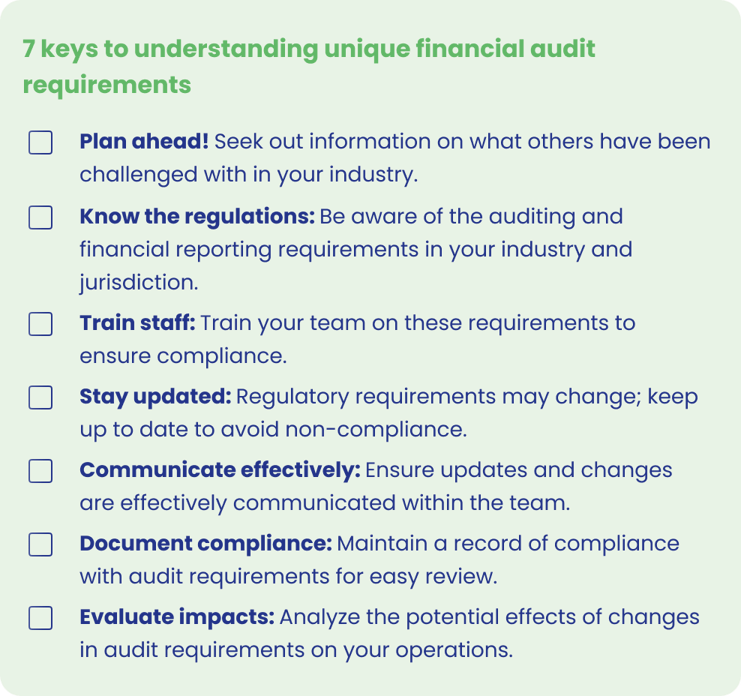

2. Clarify your industry’s unique audit requirements

Knowing your industry and jurisdiction’s specific requirements can help ensure your financial records are compliant and will pass an audit without issue.

Why you might struggle to keep up with industry- and jurisdiction-specific audit requirements

Rapidly expanding businesses, particularly those growing into new markets or industries, might struggle to keep up with differing audit requirements. It can be challenging to understand and stay updated with the various regulations that apply to each jurisdiction or industry.

Misunderstanding audit requirements specific to your industry and jurisdiction hurts Finance and the rest of the organization

Misunderstanding unique financial audit requirements can have serious implications inside the Finance organization. Here are some risks to keep in mind:

- Accountants:

- Increased workload and stress from errors that require time-consuming corrections, increasing workload, and stress levels within the team.

- Decreased efficiency and output that’s not fit for purpose.

- Cramped professional development opportunities for team members who aren’t trained correctly, won’t be able to progress in their careers, and will be more likely to turn over.

- Controller:

- Compliance risk: Controllers ensure accounting practices comply with relevant regulations. Misunderstanding these requirements can expose the organization to compliance risks, including potential fines and sanctions.

- Operational inefficiency: If accounting systems and processes are set up based on a flawed understanding of the requirements, this can lead to inefficiencies in accounting operations and lead to rework.

- Confidence erosion: Repeated errors arising from misunderstandings can erode confidence in the Controller’s oversight from both internal and external stakeholders.

- CAO:

- Reputation risk: As the Accounting function’s head, the CAO ensures regulatory compliance. Any misunderstandings can affect the CAO’s professional reputation and credibility.

- Strategic impact: Misunderstanding audit requirements can lead to flawed financial information, negatively impacting strategic decision-making and resource allocation.

- The cost of rework: Retroactive corrections may require staff time and financial resources to address instead of directing these resources towards productive ends.

- CFO:

- Strategic risk: The CFO relies on accurate financial information for strategic planning and decision-making. Misunderstanding audit requirements can lead to inaccurate information, increasing the risk of poor strategic decisions.

- Investor relations: The CFO’s job is to ensure investors know the company’s financial situation and what to expect from the company. If the CFO doesn’t understand the industry and jurisdiction’s regulatory requirements, which leads to a failed audit, this could hurt the company’s stock price, access to money, and, ultimately, the CFO’s credibility.

- Risk management: The CFO is responsible for overall financial risk management. Misunderstanding audit requirements can lead to increased financial and operational risks that the CFO must manage.

Misunderstanding audit requirements can lead to a cascade of negative effects on the entire financial leadership hurting the company’s performance, reputation, and bottom line.

But it can also reverberate beyond the Accounting department, affecting several aspects of the business and various stakeholders:

- Regulatory compliance: Non-compliance with industry-specific audit requirements can lead to regulatory penalties, fines, or legal action, which could disrupt operations, incur additional costs, and damage the organization’s reputation.

- Operational efficiency: Various operational aspects, including procurement, production, and supply chain, can be negatively impacted due to incorrect financial information. This might lead to faulty strategic planning and operational decisions.

- Investor relations: Investors place trust in audited financial statements to make investment decisions. Inaccurate audits due to misunderstood industry requirements can undermine investor confidence affecting the company’s ability to attract investment and impacting the market value of the company.

- Management decision-making: Accurate audited financial statements are crucial for strategic decisions made by management and the board of directors. Misinterpretation of industry-specific audit requirements could lead to flawed financial statements resulting in poor strategic decisions.

- Customer relationships: If customers perceive the company as failing to meet industry-specific audit requirements, it could impact their trust and may lead to loss of business, especially if compliance is a key factor for them.

- Employee morale: Non-compliance can result in internal upheaval, impact job security, and affect employee trust in the company, leading to decreased morale and productivity.

- Strategic partners: Non-compliance with industry-specific audit requirements may affect relationships with strategic partners such as lenders, suppliers, or other collaborators, who may reconsider their association with the company due to perceived risk.

- Reputation: The company’s public image could take a hit, affecting brand value and leading to loss of business. This is particularly true in industries where compliance is a key determinant of reputation, such as healthcare or financial services.

Nailing your audit requirements, including those specific to your industry and the places where you operate, will keep your Finance team humming and help maintain the overall health and functioning of your business, from strategic decision-making to investor relations and the company’s reputation.

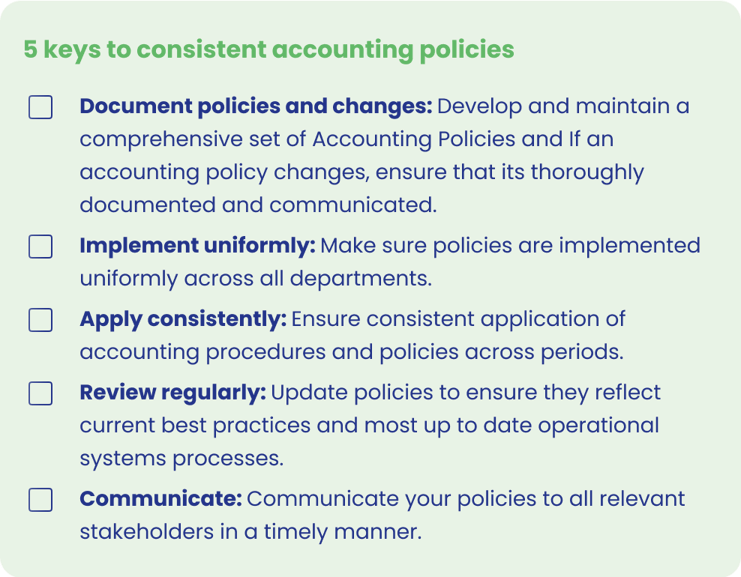

3. Document and ensure consistent accounting policies

Changes in accounting policies can create inconsistencies in financial records, which can complicate audits. Document your policies and ensure consistency where possible, and if changes must be made, document those clearly and thoroughly, too.

Why you might struggle to maintain consistent accounting policies

Amid rapid growth, a company may undergo changes that require shifts in accounting policies, such as entering new markets, diversifying products or services, or acquiring other businesses. These changes can result in inconsistent accounting policies and can often lead to discrepancies in what is written and what is currently in practice.

Inconsistent accounting policies hurt Finance and the rest of the organization and stakeholders

Here’s how inconsistency impacts the Finance team:

- Accounting team: It may be difficult for the Accounting team to keep up with policy changes, leading to confusion and potential errors. Frequent changes could also demotivate the team and disrupt their workflow.

- Controller: The Controller has to spend additional time overseeing changes and ensuring they’re properly communicated and implemented, thereby straining their time and resources.

- CAO: Consistent accounting policies are key to a CAO’s role in maintaining accurate financial reports and overall compliance. The CAO will need to devote more time to oversee changes and manage associated risks.

- CFO: Inconsistent accounting policies can lead to inaccurate financial reporting, which hampers the CFO’s ability to make strategic decisions. They also risk non-compliance with financial regulations, which could lead to fines and damage to the company’s reputation.

Inconsistent accounting policies also have profound negative ramifications on the business beyond the Finance organization:

- Management decision-making: Managers use financial data to make operational, strategic, and investment decisions. Inconsistent accounting policies can lead to unreliable financial data, making it difficult for managers to accurately assess performance and make informed decisions.

- Investor confidence: Investors rely on consistent financial statements to analyze a company’s performance and make investment decisions. Inconsistent accounting policies can make financial statements confusing, eroding investor confidence and affecting the company’s share price.

- Regulatory compliance: If inconsistencies in accounting policies lead to non-compliance with financial reporting standards, it can result in fines, penalties, and reputational damage.

- Creditworthiness: Inconsistent accounting policies can impact the company’s perceived creditworthiness, making it harder to obtain financing on favorable terms. It might make lenders skeptical of the company’s financial stability and management.

- Supplier and customer relations: Suppliers and customers might become wary if they perceive financial instability suggested by inconsistent financial statements affecting the company’s ability to negotiate favorable terms, win contracts, or retain customers.

- Employee morale: Inconsistent financial reporting may create an impression of instability, which can affect employee morale and retention.

- Business planning and forecasting: Inconsistent accounting practices can lead to inaccurate financial forecasts, complicating budgeting, and long-term business planning.

- Strategic partnerships: Potential partners may hesitate to enter into strategic alliances or business partnerships with a company whose financial statements are inconsistent, viewing it as a risk.

In short, maintaining consistent accounting policies is fundamental for accurate financial reporting and a healthy business. It influences decision-making at all levels and can impact relationships with stakeholders, including investors, lenders, partners, employees, and customers.

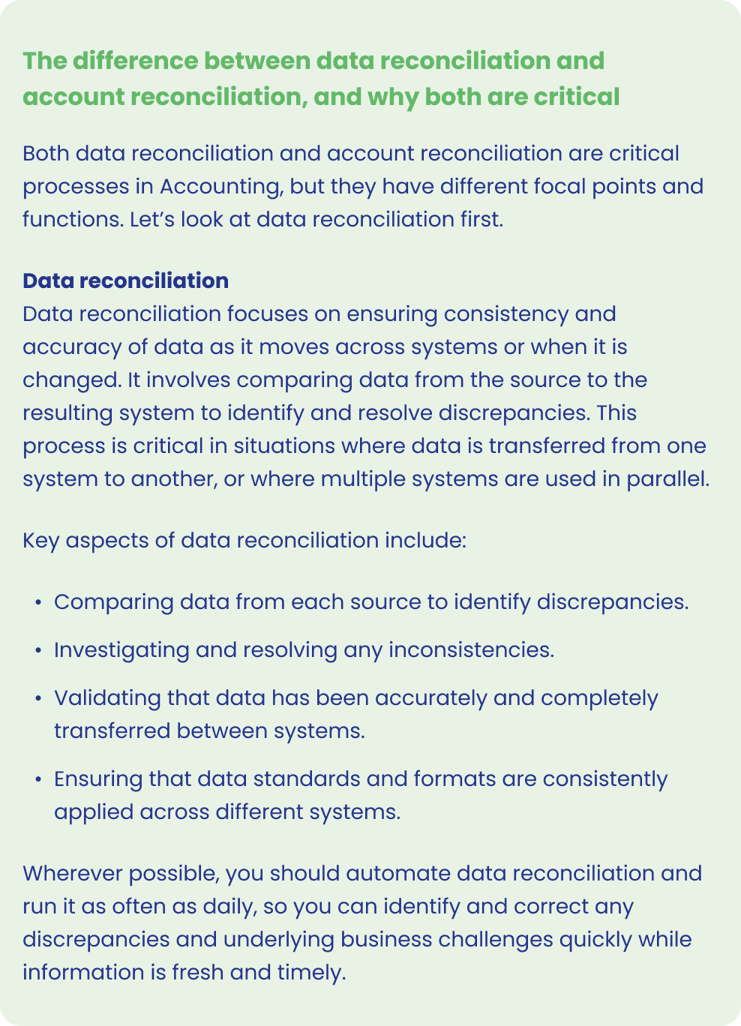

4. Regular, scheduled, and well-designed reconciliations

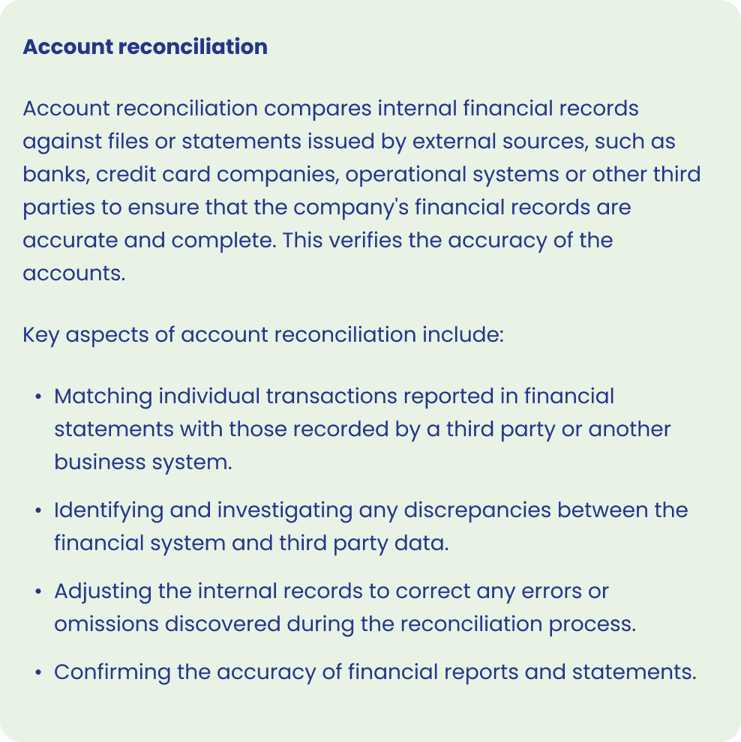

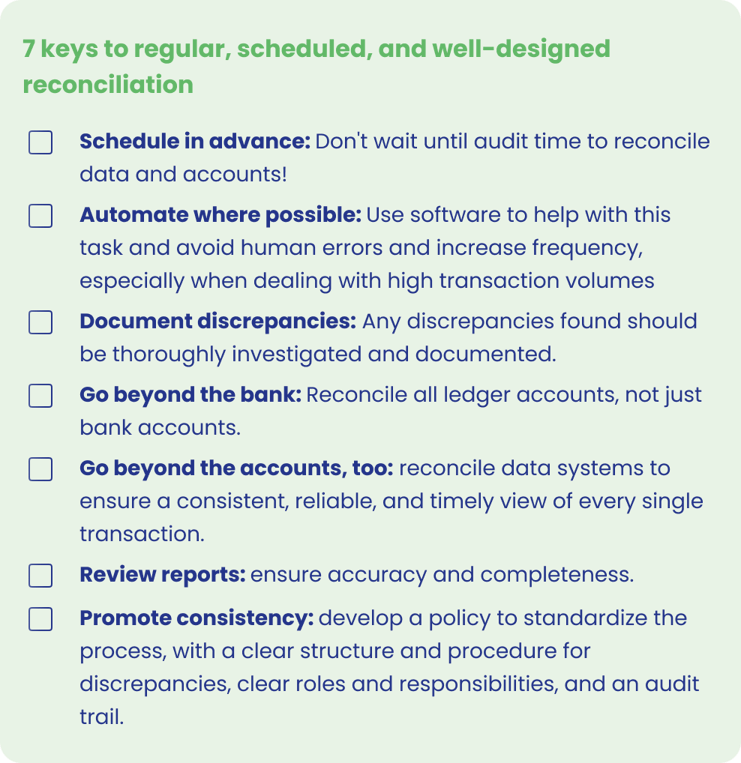

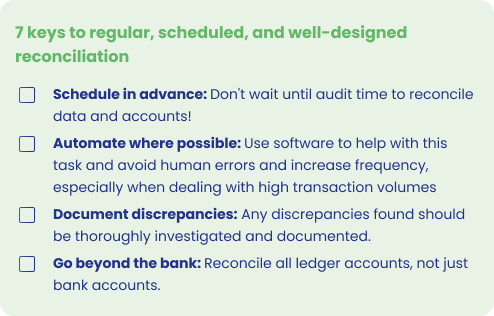

The reconciliation process ensures that your accounting records accurately reflect all financial transactions, a crucial factor for successful audits. Scheduled reconciliation is a key component of maintaining audit readiness.

You can identify and address discrepancies promptly by scheduling and performing data and account reconciliation activities regularly, be it daily, weekly, or monthly.

Consider applying a cycle count process where reconciliations are planned and conducted frequently, depending on their importance.

This enhances the accuracy of your financial statements and reduces the effort required during the audit period. Instead of dealing with a year’s worth of discrepancies, regular reconciliation allows you to spread this effort over time, making the audit process more manageable.

A well-designed reconciliation process is equally important. It should have a clear structure and procedure to handle discrepancies, create an audit trail, and assign roles and responsibilities. This promotes consistency in handling discrepancies, facilitates the review process during audits, and ensures accountability within the team.

Furthermore, a well-designed process leverages automation to improve accuracy and efficiency. Automated reconciliation tools can handle large volumes of data, reducing manual errors and freeing your team’s time for more complex tasks. When auditors knock, your team is prepared with accurate, well-documented, and readily reviewable financial records.

Regular, scheduled, and well-designed reconciliation processes enhance the accuracy and reliability of your financial data and make the financial audit process smoother, more efficient, and more effective. This can lead to fewer audit adjustments, less stressful audit periods, and a stronger financial control environment, reflecting positively on your accounting team and the organization.

Why you might struggle with reconciliation

Accounting leaders often struggle to design, schedule, and run regular reconciliations. One common underlying culprit is the data environment: availability, provenance, and lineage.

- Data Availability: For successful reconciliation, you need timely and complete data. However, data may often be scattered across various systems, databases, and formats, making collecting and organizing data a significant challenge. The sheer volume of transactions can make the task even more daunting in fast-paced business environments.

- Data Provenance: Understanding where your data comes from and how it’s been processed is critical to reconciliation. If there are questions about the integrity or accuracy of the data, this can throw off your entire reconciliation process. But tracing the data origins and transformations can be complex, particularly in larger organizations where multiple people or teams handle data or where data flows through various systems before it reaches the Accounting team.

- Data Lineage: Data lineage outlines the journey of data from its source to its destination, including all the transformations it undergoes. To reconcile accounts accurately, you need to understand this journey, but it can be an enormous challenge. Complex IT infrastructures, multiple data processing steps, and changes in data storage and management practices can make tracking data lineage exceedingly challenging.

Irregular, unscheduled, and poorly designed reconciliations hurt everyone, inside and outside of Finance

Reconciliation is much more than a clerical task; it’s a vital control measure to ensure financial integrity, financial accuracy, and compliance with regulatory requirements.

Conversely, irregular, unscheduled, or poorly designed reconciliations can negatively impact nearly everyone in the organization. Let’s look at the Finance organization first:

1. Accounting team:

- Stress and burnout: Irregular and unscheduled reconciliations can lead to significant workload spikes, causing stress and potential burnout.

- Errors and omissions: Poorly designed reconciliations may not capture all necessary data or lead to errors, reducing the team’s effectiveness and accuracy.

- Reduced efficiency: The team may spend unnecessary time grappling with poorly designed systems or manual processes, reducing overall productivity.

2. Controller:

- Risk of non-compliance: If reconciliations aren’t performed regularly, the risk of non-compliance with accounting standards and regulatory requirements increases.

- Inaccurate financial reports: Inaccurate or outdated financial data due to poor reconciliations can compromise the reliability of financial reports.

- Increased audit risk: The irregularity and poor design can lead to a more challenging audit process resulting in audit adjustments, qualifications, or fines.

3. CAO:

- Damage to reputation: Poorly managed reconciliations can personally harm the Accounting function’s reputation and the CAO.

- Increased oversight: The CAO might have to invest more time overseeing and troubleshooting the reconciliation process, detracting from other strategic responsibilities.

- Uncertainty in decision-making: Unreliable financial data can create uncertainty in strategic decision-making, hindering the CAO’s effectiveness.

4. CFO:

- Strategic risk: Inaccurate or outdated financial information can compromise the CFO’s ability to make sound strategic decisions impacting the company’s financial health.

- Investor relations: If financial reports are unreliable due to poor reconciliations, this can harm investor confidence and relationships.

- Regulatory and legal implications: The CFO, like the Controller, faces increased risks regarding compliance with financial reporting standards and regulations. This could lead to legal implications and potential personal liability for the CFO.

The harm of not doing reconciliations correctly goes way beyond the Finance team. Let’s take a look:

1. CEO and Executive Management:

- Strategic decision-making: Inaccurate or unreliable financial data can impact the CEO and executive management’s ability to make informed strategic decisions about the business’s direction.

- Reputational risk: Financial errors or discrepancies can harm the company’s reputation, damaging relationships with partners, customers, and shareholders.

2. Board of Directors:

- Governance: The Board relies on accurate financial reports to fulfill its governance responsibilities. If reconciliations are poorly managed, this could undermine the Board’s ability to oversee the business effectively.

- Risk management: Financial discrepancies may signal larger systemic issues, increasing the business’s risk profile and raising concerns for the Board.

3. Operational teams (Sales, Marketing, Production, etc.):

- Budgeting: Operational teams rely on accurate financial data for budgeting and performance measurement. Inaccurate data due to poor reconciliations can hinder planning and performance evaluation.

- Operational efficiency: Financial inaccuracies can cause unnecessary disputes or confusion, slowing business operations and reducing overall efficiency.

4. Investors and shareholders:

- Confidence: Discrepancies in financial reporting can undermine investor confidence affecting the company’s share price and access to capital.

- Decision-making: Investors and shareholders rely on accurate financial reports for decision-making. If these reports are unreliable, they can lead to misinformed investment decisions.

5. Customers and suppliers:

- Trust: Financial discrepancies can damage the trust of customers and suppliers, affecting the company’s relationships and leading to lost business.

- Financial stability: If financial discrepancies suggest instability, suppliers may tighten credit terms, and customers may reconsider doing business with the company.

6. Regulatory bodies:

- Compliance: Financial inaccuracies can attract increased scrutiny from regulatory bodies, leading to potential fines or other regulatory actions.

- Legal implications: Serious financial discrepancies can lead to legal consequences, damaging the company’s reputation and resulting in financial penalties.

Designing, scheduling, and running regular reconciliations isn’t only crucial for Finance but impacts the wider business and its stakeholders significantly.

5. Good Internal Controls

Establish and maintain strong internal control policies and procedures to prevent fraud and error in financial reporting. Doing this well will make financial audits go smoothly by demonstrating how seriously your company takes financial accuracy and compliance.

Why you might struggle with internal controls

Establishing robust internal controls often takes time and involves a learning curve. A fast-growing company may not have the necessary resources to focus on building and maintaining a strong internal control system.

Poor internal controls hurt Finance, the rest of the organization, and its stakeholders

Poorly designed, maintained, or communicated internal controls hurt everyone. They can lead to inaccurate financial reporting, inefficient operations, and increased risk of fraud or compliance breaches, affecting various stakeholders.

- Accounting Function: Poor internal controls often lead to more errors and irregularities in the accounting records. This results in increased time and resources spent identifying and rectifying these mistakes during the audit process. The increased workload can overburden the Accounting team, leading to stress, low morale, and potential burnout.

- Controller: The Controller, responsible for the accuracy and timeliness of financial reports, is adversely affected by weak internal controls. The potential increase in inaccuracies might lead to substantial revisions in financial reports, making them less reliable. This could increase the controller’s scrutiny from auditors and upper management, thus adding undue stress and further complexity to their role.

- CAO: For the CAO, weak internal controls increase the risk of material misstatement in the financial statements. This could undermine the CAO’s credibility and even lead to legal and regulatory implications if the financial reports are significantly inaccurate or misleading.

- CFO: The CFO relies on accurate financial reporting for strategic decision-making. Poor internal controls can result in unreliable financial data, leading to flawed decisions that harm the company’s financial health and strategic direction. Moreover, any perceived financial control and reporting weaknesses can damage the CFO’s standing with investors, regulators, and other external stakeholders.

Let’s take a closer look at the stakeholders outside Finance and the impact on them:

- CEO and executive management:

- Strategic decision making: Inaccurate or delayed financial reports due to faulty software can misinform decisions and strategic planning.

- Business efficiency: Unreliable accounting software can slow down processes, impacting overall business efficiency.

- Board of directors:

- Oversight: The Board relies on accurate financial information for oversight purposes; unreliable software can compromise the reliability of this information.

- Risk management: Faulty software increases operational and financial risks, something the Board will be concerned about.

- Operational teams (Sales, Marketing, HR, etc.):

- Efficiency: Poor software can delay financial processes delaying budgets, targets, and compensation calculations for these teams.

- Reporting: Teams require financial information for planning and reporting; unreliable software can disrupt these processes.

- Investors and shareholders:

- Trust: Frequent corrections and restatements due to software issues can undermine investor confidence in the company’s financial reporting.

- Financial performance: Share prices can be negatively impacted if financial reporting is perceived as unreliable.

- Customers and suppliers:

- Relationships: Invoicing and payment errors due to faulty software can strain relationships with customers and suppliers.

- Service: Disruptions in financial operations can indirectly affect the delivery of services or goods to customers.

- Regulatory bodies:

- Compliance: If accounting software doesn’t follow regulatory standards, it can lead to reporting inaccuracies and potential fines.

- Legal implications: Serious issues due to unreliable software could have legal implications and damage the company’s reputation.

Poor internal controls not only affect the financial integrity of a company but also its operational efficiency, reputation, and relationships with key stakeholders. Therefore, it’s crucial to maintain robust, effective, and consistent internal controls within the organization.

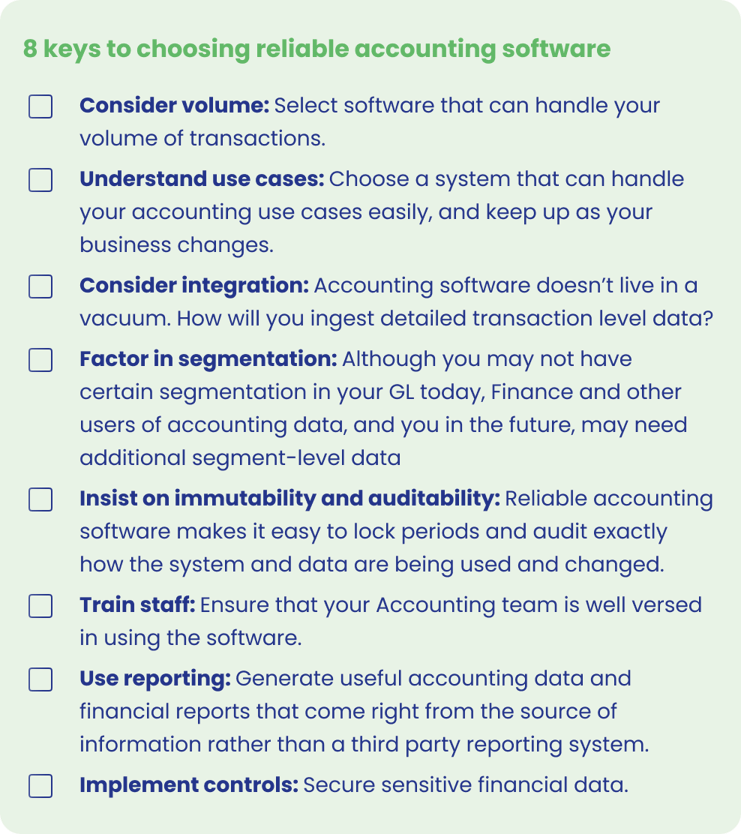

6. Use of Reliable Accounting Software

Using reliable accounting software can improve the accuracy of financial reporting and make it easier to generate the necessary reports for an audit.

Why you might struggle to choose reliable accounting software

While a wide array of accounting software is available, choosing the right one to scale with the business can be challenging. Upgrading to more advanced systems can be a complex process, leading to potential resistance from the team or a temporary disruption in business operations.

Unsuccessful adoption of reliable accounting software (or not even trying!) hurts Finance and the rest of the organization and its stakeholders, as well

An unsuccessful adoption of reliable accounting software poses significant challenges for various roles during a financial audit:

1. Accounting Team:

- Increased workload: Faulty software can produce errors that the team must manually correct, increasing their workload.

- Stress: Constant software issues can induce stress and dissatisfaction, potentially leading to lower team morale and productivity.

- Time Consumption: Manual processes due to software failures can be time-consuming, reducing the time available for analysis and strategic tasks.

2. Controller:

- Inaccurate reports: The Controller is responsible for ensuring accurate financial reports. Unreliable software may produce inaccurate data, affecting the controller’s ability to fulfill this responsibility.

- Compliance issues: Software that doesn’t meet regulatory standards can cause compliance issues, putting the Controller in a challenging position.

- Internal control weaknesses: The Controller oversees the company’s internal controls. If software problems lead to control weaknesses, it’s the Controller’s responsibility to address these issues.

3. CAO:

- Strategic impact: The CAO plays a key role in strategic decision-making. Faulty software can result in inaccurate financial information, leading to misinformed decisions.

- Reputational damage: As the head of the Accounting function, the CAO’s reputation can suffer due to software failures, especially during an audit.

- Compliance: The CAO is ultimately responsible for the company’s financial compliance. Non-compliant software can cause significant compliance issues, leading to potential fines and penalties.

4. CFO:

- Risk management: The CFO is responsible for financial risk management. Faulty software increases financial and operational risks.

- Stakeholder relations: Unreliable software can lead to inaccurate financial reporting, damaging the CFO’s relationships with stakeholders, including investors, board members, and regulators.

- Strategic planning: The CFO uses financial data for strategic planning. Inaccurate data due to software issues can lead to poor strategic decisions.

In summary, the unsuccessful adoption of reliable accounting software hampers the financial audit process and negatively impacts the roles and responsibilities of the Accounting team, Controller, CAO, and CFO.

But Finance isn’t alone in the consequences. Here are the impacts across the broader organization:

- CEO and executive management:

- Strategic decision making: Inaccurate or delayed financial reports due to faulty software can misinform decisions and strategic planning.

- Business efficiency: Unreliable accounting software can slow down processes, impacting overall business efficiency.

- Board of directors:

- Oversight: The Board relies on accurate financial information for oversight purposes; unreliable software can compromise the reliability of this information.

- Risk management: Faulty software increases operational and financial risks, something the Board will be concerned about.

- Operational teams (Sales, Marketing, HR, etc.):

- Efficiency: Poor software can delay financial processes delaying budgets, targets, and compensation calculations for these teams.

- Reporting: Teams require financial information for planning and reporting; unreliable software can disrupt these processes.

- Investors and shareholders:

- Trust: Frequent corrections and restatements due to software issues can undermine investor confidence in the company’s financial reporting.

- Financial performance: Share prices can be negatively impacted if financial reporting is perceived as unreliable.

- Customers and Suppliers:

- Relationships: Invoicing and payment errors due to faulty software can strain relationships with customers and suppliers.

- Service: Disruptions in financial operations can indirectly affect the delivery of services or goods to customers.

- Regulatory Bodies:

- Compliance: If accounting software doesn’t follow regulatory standards, it can lead to reporting inaccuracies and potential fines.

- Legal Implications: Serious issues due to unreliable software could have legal implications and damage the company’s reputation.

Successful adoption of reliable accounting software is critical for efficient financial operations and maintaining the trust and confidence of various stakeholders outside the Finance organization.

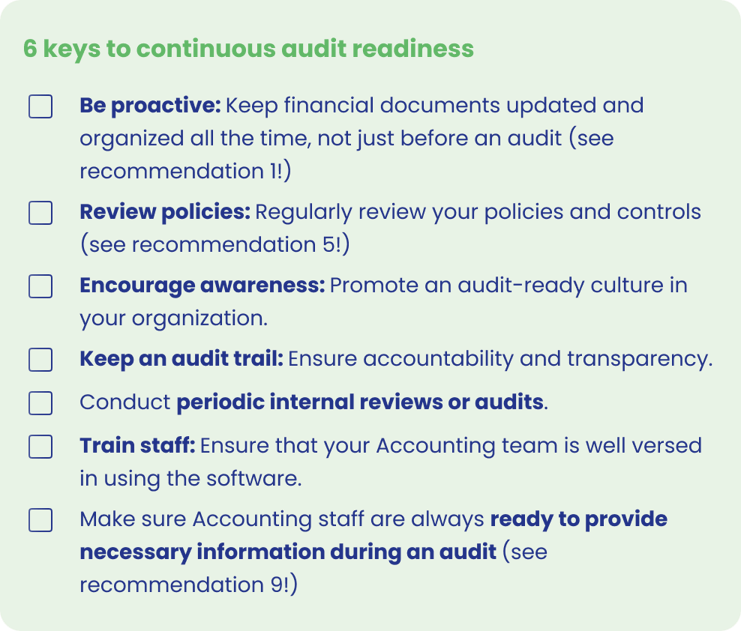

7. Maintain continuous audit readiness and review

Instead of rushing to prepare when an audit is due, maintain a state of constant readiness. This includes keeping all financial documents up-to-date and organized, regularly reviewing policies and controls, and ensuring that all staff understand their roles in maintaining financial accuracy.

Why you might struggle to maintain continuous audit readiness

Fast-growing businesses often face a perpetual time crunch. They might prioritize growth activities over keeping their financial house in perfect order at all times, leading to a scramble when an audit is due.

Not maintaining and self-checking your audit readiness continuously? Here’s how that will hurt your Finance team — and beyond.

Failing to maintain continuous audit readiness can put additional stress on Finance leaders and impact stakeholders outside the Finance function.

- Accounting Team: Failing to maintain a continuous state of audit readiness can lead to a significant increase in workload for the Accounting team come audit time. Accounting must scramble to gather all the necessary information, often involving long hours and added stress. It also increases the risk of errors and inaccuracies in financial records, given the rush to prepare the documents. This places extra pressure on the team, which could lead to decreased job satisfaction and productivity.

- Controller: Controllers are responsible for ensuring the company’s financial reports are accurate and timely. If a company isn’t in a constant state of audit readiness, this creates additional work and pressure for the Controller, who must oversee the scramble to get everything in order. Discrepancies or errors in reporting exposed through the audit process can put the company at risk.

- CAO: The CAO is directly responsible for the Accounting function and attests to the fairness of the financial statements. A lack of continuous audit readiness might place the CAO in a difficult position if discrepancies are found , questioning their integrity and undermining their leadership role.

- CFO: The CFO relies heavily on accurate financial information for strategic planning, investor relations, and other decision-making. A financial audit that uncovers inconsistencies or inaccuracies can disrupt these activities and harm the company’s financial position. Moreover, if the CFO needs to divert resources to an audit at unexpected times, it can inhibit forward-looking financial planning and strategic initiatives.

A lack of continuous audit readiness also impacts stakeholders outside of the Finance organization. Here’s an overview:

- Sales and Marketing teams: These teams plan their strategies and campaigns based on budget allocations. If an audit uncovers financial discrepancies that lead to budget cuts or adjustments, it could disrupt ongoing projects or plans. This disruption could lead to missed sales targets or ineffective marketing campaigns, ultimately affecting the company’s top line.

- Procurement and Supply Chain teams: Financial discrepancies can affect a company’s ability to make timely payments to suppliers, which could disrupt the supply chain. This might lead to delays in the production or delivery of services, affecting the company’s operations and customer commitments.

- Human resources and employees: Financial health is critical for employee salaries, benefits, and overall job security. Any perceived instability can lead to decreased morale and productivity, increased turnover, and difficulty attracting new talent.

- Customers and partners: If financial irregularities lead to operational disruptions, it can affect the company’s ability to serve its customers effectively or meet partnership agreements. This could harm the company’s reputation and customer relationships leading to a loss of business.

- Regulatory bodies: Inaccurate financial reporting can lead to serious regulatory issues. If non-compliance is found during an audit, it could lead to fines or sanctions, affecting the company’s reputation and operations. This could also invite more scrutiny in future audits, increasing regulatory compliance costs.

- Investors and shareholders: Investors rely on accurate financial statements to make informed decisions. If an audit uncovers inconsistencies, it can lead to a loss of confidence and affect the company’s stock price or ability to raise additional capital. Sudden changes in financial health can lead to volatility in investment and skepticism among shareholders.

Thus, maintaining a continuous state of financial audit readiness isn’t just an accounting practice; it’s a business imperative. It ensures the integrity of your financials, strengthens your standing with investors, and enables smoother operation of the entire organization. It allows the Accounting and Finance teams to stay focused on their roles and enhances the overall credibility of the organization.

8. Training and Development

Regularly train and develop the Accounting staff. This includes updates on any changes to accounting standards, regulatory requirements, and best practices for financial reporting.

Why you might struggle to train and develop the Accounting staff

Rapid growth can lead to frequent changes within the business, and it can be difficult to provide timely training and development for Accounting staff. Furthermore, ensuring that everyone is properly trained becomes increasingly challenging as the team grows rapidly.

If you don’t train and develop your Accounting staff, the entire Finance organization and your overall organization will feel the consequences

Inadequate training and development of Accounting staff can be a major impediment to the successful completion of a financial audit. For Finance leaders, including the Accounting function, Controller, CAO, and CFO, this lack of staff preparedness could translate into several issues:

- Increased errors: Without proper training, the likelihood of mistakes in accounting increases. These errors, whether caused by snafus in data entry, interpretation of regulations, or application of accounting principles, can make audits more challenging and time-consuming as they require additional effort to identify and correct.

- Delays in the audit process: Untrained staff may not understand the process of an audit, leading to delays. They might struggle to gather the necessary documentation, reconcile accounts, or understand the auditors’ requests.

- Risk of non-compliance: Regulatory compliance requires a solid understanding of complex financial regulations and standards. Inadequate training can increase the risk of non-compliance leading to significant financial penalties and reputational damage.

- Decreased efficiency: An untrained Accounting staff could lack knowledge about efficient procedures and software, thus leading to slower processes and increased overtime during audits.

- Increased dependence on external auditors: If the internal team lacks training, you may rely more heavily on external auditors, which could result in higher costs.

- Lower morale: A lack of training can lead to frustration and lower morale among the accounting staff, particularly during the pressure of an audit. This can lead to turnover, further compounding the challenges faced during an audit.

Beyond Finance, other stakeholders can also feel the impact of inadequate training and development of your Accounting staff:

- Investors and shareholders: They rely on accurate financial statements to make informed decisions. Increased errors and non-compliance risk could diminish investor confidence and affect the company’s value.

- Regulatory bodies: Errors and non-compliance could lead to fines, sanctions, and increased scrutiny from these entities, adding to the company’s compliance costs.

- Customers and partners: Financial irregularities and delayed financial reporting can affect the company’s credibility, impacting customer trust and business relationships.

- Employees: Uncertainty about the company’s financial health can create unease among employees, affecting morale and productivity.

- Suppliers: If financial reporting errors disrupt payment processes, this could strain supplier relationships and impact the company’s operations.

Investing in the training and development of your accounting staff is essential for smoother audits and the business’s overall financial health and stability. Properly trained staff can ensure accuracy, efficiency, and compliance, supporting the company’s growth.

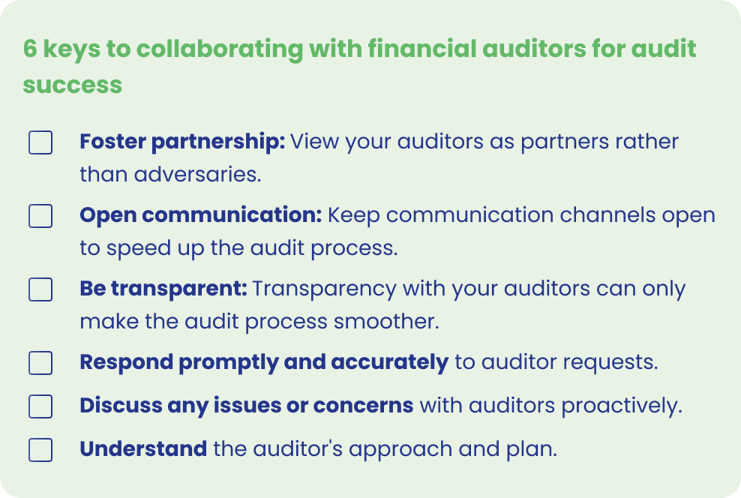

9. Collaborate with Auditors

Maintain open and transparent communication with the auditors. Treat them as partners rather than adversaries — ask for clarification, and push back on their findings (they aren’t always right!). This can help speed up the audit process and make it less stressful for everyone involved.

Why you might struggle to collaborate with auditors

When a business rapidly expands, the relationship with auditors can sometimes be overlooked. The focus on growth might lead to less communication and collaboration with auditors, making the audit process more challenging when it occurs.

Not collaborating with auditors hurts the whole Finance organization, as well as the rest of the organization

The impacts of a lack of collaboration are far-reaching and can place an undue burden on Finance leaders, including those in Accounting roles, the controller, the CAO, and the CFO:

- Difficulty in uncovering and addressing issues: Without active collaboration, it becomes difficult to uncover potential issues early in the audit process. This can lead to surprises late in the audit, causing last-minute scrambles and stress on the Finance team.

- Increased risk of errors: If auditors aren’t closely collaborating with the company’s Finance team, there’s a greater chance they may misunderstand certain transactions or operations , leading to errors in the audit report. This increases the risk for the CAO and CFO, who are responsible for the accuracy of financial statements.

- Inefficient use of time and resources: Lack of collaboration often results in more back-and-forth communication, as questions and issues that could have been addressed upfront surface during the audit. This wastes valuable time and resources for both the accounting function and the auditors, stretching the audit timeline and straining the Finance team.

- Lack of trust: Lack of collaboration can lead to a lack of trust between the auditors and the Finance team. This can create an adversarial environment, making the audit process more difficult and time-consuming and harming the reputation of the CFO, CAO, and controller.

- Potential for audit qualifications: If auditors aren’t getting the information they need due to lack of cooperation, they may be unable to express an unqualified opinion, which can have significant consequences for the company’s financial reputation and credibility with stakeholders.

- Inadequate improvement of processes: A collaborative relationship with auditors often results in helpful suggestions for improving accounting processes and controls. Without this collaboration, Finance leaders lose these insights, making it more difficult to enhance efficiency and accuracy in the long run.

Let’s unpack the potential impacts of not fostering a collaborative relationship with financial auditors on stakeholders outside the Finance function.

- Investors and shareholders: These stakeholders are interested in the accuracy of financial reports and the company’s financial health. Lack of collaboration with auditors can lead to delayed or qualified audit reports eroding investor confidence and impacting stock prices.

- Regulatory bodies: These entities expect full transparency and compliance with financial reporting standards. Not collaborating with auditors can lead to a lack of compliance, fines, or sanctions, damaging the company’s reputation.

- Customers and business partners: Trust is fundamental in these relationships, and it can be impacted negatively by financial misstatements or irregularities that might arise from not collaborating with auditors. It could also lead to uncertainty about the company’s financial stability affecting contracts, partnerships, and overall business relationships.

- Suppliers: If an audit reveals significant financial issues or if the company fails to provide a timely audited financial statement due to a lack of partnership with auditors, suppliers may question the company’s ability to pay for goods and services. This could lead to changes in payment terms or even a supply disruption.

- Employees: They’re indirectly affected as well. Negative financial publicity or concerns about the company’s financial stability could affect employee morale and productivity. It might also affect the company’s ability to attract and retain top talent.

- Potential investors and acquirers: Not collaborating with auditors can be a serious roadblock for businesses looking to attract additional investment or even position themselves for acquisition. It can lead to questions about financial management and overall corporate governance, making the company less attractive to potential investors or acquirers.

Fostering a collaborative relationship with auditors isn’t merely facilitating the audit process itself; it is a strategic move that enhances transparency, credibility, and trust in the company’s financial integrity. The impacts of not collaborating adequately with auditors reverberate far beyond the Finance department, touching every stakeholder associated with the company.

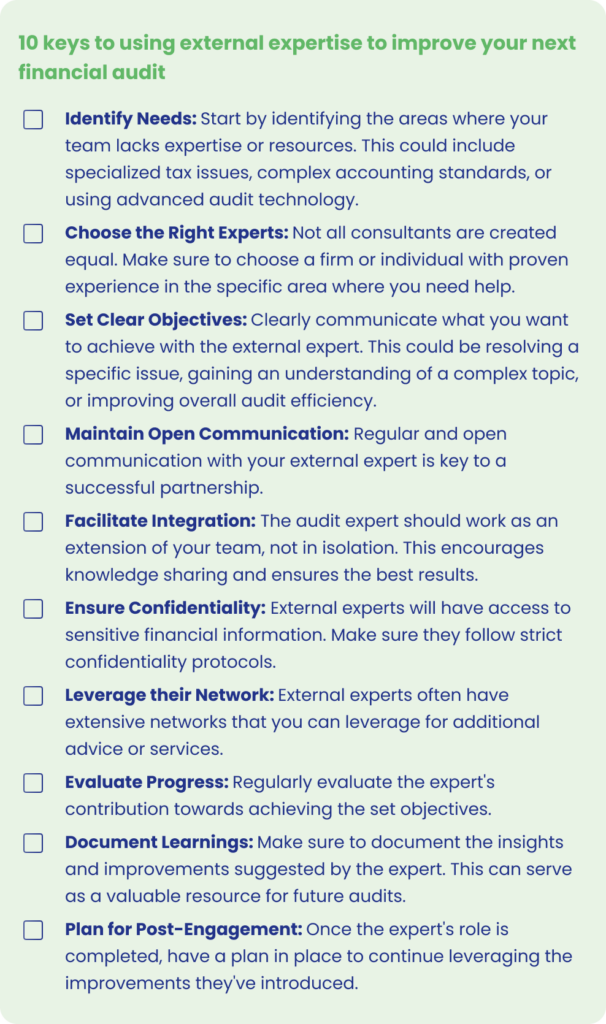

10. Use of External Expertise

Sometimes, certain areas of the audit process might require specialized knowledge. Don’t hesitate to seek external help, such as consulting a tax expert for complex tax issues.

Why you might find using external expertise challenging

Fast-growing businesses might be hesitant to spend money on external consultants due to perceived cost. They might also be so focused on growth activities that they overlook the potential benefits of getting outside help for complex auditing and financial issues.

Not making use of external experts hurts Finance and the broader organization, too

Neglecting external experts when you’re navigating financial audits can be penny-wise and pound-foolish: you’ll end up with a less efficient and effective audit process that’ll negatively impact all your Finance leadership:

- Limited knowledge base: Despite the expertise within your team, financial regulations and standards are complex and continually evolving. External experts often specialize in particular areas of Finance and are up-to-date with the latest changes, ensuring you’re always operating within the correct framework.

- Potential misinterpretation of complex transactions: Complex business transactions may require specialized knowledge to reflect in financial statements accurately. Avoiding external experts can lead to misinterpretation or misrepresentation of these transactions, leading to audit complications.

- Increased risk of non-compliance: Expert consultants understand the nuances of regulatory compliance in different industries and jurisdictions. Their absence might increase non-compliance risk, leading to fines and reputational damage.

- Inefficient audit process: External experts can provide guidance and assistance to make the audit process smoother and faster. Without their help, the audit might take longer, requiring more of the Finance team’s time and resources.

- Limited perspective: External experts can provide a fresh perspective on your company’s financial processes, identifying inefficiencies or risks that may have been overlooked internally. Avoiding their input can limit opportunities for process improvement.

Regarding stakeholders outside the Finance organization:

- Investors and shareholders: They expect accurate and timely financial statements to make informed decisions. Any delay or discrepancy caused by a lack of external expertise can negatively affect their trust in the company.

- Regulatory bodies: They ensure that companies meet the necessary financial reporting standards. Non-compliance due to a lack of external expertise can lead to legal implications and possible sanctions.

- Customers and partners: They expect to do business with a company that is financially transparent and compliant. Any compliance issues can tarnish the company’s reputation, affecting customer trust and partnership relationships.

- Employees: They expect to work in a financially secure and compliant organization. Financial irregularities can affect employee morale and confidence in leadership.

Engaging external expertise isn’t a sign of weakness but a strategic move that strengthens your audit process and reinforces stakeholder trust. It supports Finance leaders and the overall health of the business.

Following these 10 steps for audit efficiency and effectiveness can help your team achieve financial excellence by ensuring everyone is rowing in the same direction, your company is compliant with regulatory standards, and you pass audits that stand in the way of your strategic goals.

Book a consultation with Jason Berwanger by clicking here or using the link at the end of the video above!

See how Leapfin works

Get a feel for the ease and power of Leapfin with our interactive demo.