[Note: This post was originally published on Reddit by Leapfin’s Chief Architect Jason Berwanger]

ASC 606 and FASB revenue recognition standards were a big benefit to financial statements but a huge pain for accounting folks in the last few years. Accounting leaders I chat with are still finding ways to access clean data and automate the five step process.

ASC 326 (better known as CECL – Current Expected Credit Loss) will have a similar effect on both financial statements and accountants. The rollout finishes up this year in 2023. While it initially impacted financial institutions, if you have receivables or revenue on your balance sheet, this will affect you!

Decoupling performance from payment makes a ton of sense and it makes income statements much more meaningful to read….but I had one question after seeing the ASC 606 standard implemented: “What happens if you perform revenue but you never get paid?”.

Well, here’s an example that demonstrates what happens for a single order on a P&L:

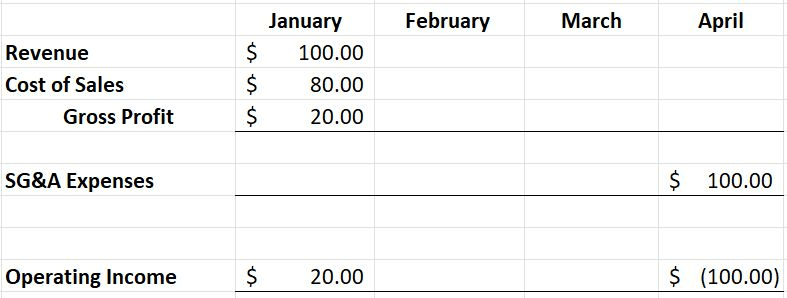

Let’s say you have an order (contract) for selling a widget for $100 with COGS of $80 on January 15th. Your receivables write-off policy is 90 days and the invoice is never paid. Below is what the P&L for that customer and order looks (image below!).

As you can see, there can be a nasty timing difference in matching your revenue to the expense from writing off unpaid revenue. The revenue is in January but the expense for that same revenue is in April. If every month is equal in performance, the inaccuracy isn’t a huge deal (still wrong at a transaction level though), but we know there is seasonality and the last few years have been anything but consistent!

That’s what I love about ASC 326. If you have trade receivables, you need to get granular with your customers’ risk and book an estimated bad debt to cure the matching above and move a best estimate for that $100 to January, when the revenue was performed and booked. It solves the matching problem created by ASC 606.

The downside of this, much like ASC 606, is that it means Accounting needs more data. It makes their process of bucketing customers into risk pools, booking a reversing bad debt entry AND having detailed visibility into customer write-offs to book them and offset the original estimate…. Which is a lot of extra data processing that you and your Accounting need to own in a new process!

Thoughts!?

See how Leapfin works

Get a feel for the ease and power of Leapfin with our interactive demo.