Everyone's asking the wrong question about automating revenue recognition. They want to know: "Should we build or buy?" or "Which vendor has the best features?"

Here's the contrarian truth: You're not choosing between vendors. You're choosing between freedom and dependency.

Most finance leaders are unintentionally walking into a trap. The industry has convinced brilliant professionals that their core expertise – understanding and implementing revenue recognition logic – should be outsourced to someone else's black box.

Think about that for a second. You're paying premium prices to make yourself LESS capable at your own job.

Let me explain why this matters, and why the future belongs to AI-powered rule engines, not black box solutions.

The fatal flaw of out-of-the-box revenue recognition solutions

Out-of-the-box revenue recognition systems promise simplicity but deliver dependency.

Here's what these solutions typically offer:

- Pre-configured revenue recognition rules for "common" scenarios

- Built-in integrations with popular CRM and billing systems

- Dashboards and reporting that look impressive in demos

- Promise of "plug-and-play" implementation

The problem? Revenue recognition isn't a one-size-fits-all process. ASC 606 has five steps, but within those steps are hundreds of decision points that vary dramatically by industry, business model, and even individual contract terms.

When you hit an edge case – and every business has them – you're stuck. The vendor either can't accommodate your specific needs, or they charge you $$$ for "custom development" that takes months to implement.

Here's what's really happening: When vendors warn you that "rule engines can produce non-GAAP compliant outputs," they're making an audacious assumption. They're suggesting that understanding and implementing revenue recognition requirements – literally the core competency of finance professionals – should be outsourced to them instead of controlled by you.

You’re not incapable of handling this logic. You’re being told you are so vendors can justify charging premium prices for work you should own. The result: you end up paying someone else to interpret your contracts, understand your business model, and make accounting judgments on your behalf – while they’ll never understand your business as deeply as you do.

You've traded control for convenience, without realizing that the convenience was an illusion.

Why rule engines are the only serious foundation

A rule engine takes the opposite approach. Instead of pre-built vendor logic, you get a framework for encoding your exact revenue recognition requirements as executable rules that you control completely.

When a new contract comes in, the engine executes your precise logic – no interpretation, no approximation, no dependence on external parties to understand your business.

Here's why this architecture is essential for revenue recognition:

1. Mathematical precision

Revenue recognition affects your financial statements, SEC filings, and investor relations. Rule engines deliver exact results – the same input always produces the same output, every time. No "close enough" interpretations from external CPAs.

2. Complete audit transparency

Auditors want to trace every dollar back to a specific rule, applied to specific contract data, producing a specific journal entry. Rule engines create this paper trail automatically, with full visibility into your logic.

3. Regulatory adaptability

ASC 606 will evolve, and new guidance will emerge. When regulations change, you update your rules immediately – no waiting for vendor updates or external consultant interpretations.

4. True business complexity

Contracts are always complex: multi-year deals with variable pricing, performance bonuses, termination clauses, and modification rights. Rule engines handle this complexity precisely because you define exactly how each scenario should be processed.

5. Scale without compromise

Processing thousands of contracts monthly requires speed and consistency. Rule engines are optimized for high-volume, repetitive decision-making while maintaining your exact business logic at every step.

The game just changed: how AI eliminated every excuse for dependency

For decades, vendors had you trapped with three arguments against accounting rule engines. AI just obliterated all of those arguments.

Problem #1: "Rules are too technical for finance people"

The Old Scam: Vendors convinced you that writing business logic required a computer science degree. This keeps you dependent on their "expertise" while charging you six figures for basic customizations.

The Reality Check: Modern LLMs translate plain English into executable rules instantly. You tell the AI: "For SaaS contracts over $100K with payment terms longer than net-30, recognize revenue monthly with a 5% holdback until implementation is complete."

The AI writes the rule. Perfect syntax. Ready to execute.

The technical barrier that vendors used to justify their existence? Gone. Completely. Forever.

Problem #2: "Rule maintenance is a nightmare"

The Old Way: As business requirements evolved, rules became tangled webs of exceptions and edge cases. Nobody wanted to touch them because one change could break everything.

The AI Solution: AI agents can analyze rule dependencies, suggest optimizations, and even refactor rule sets for better maintainability. It's like having a brilliant systems architect who never sleeps, constantly cleaning up your logic.

Problem #3: "Rules can't handle ambiguity"

The Old Way: When contracts had ambiguous language or unusual terms, rule engines would fail. Humans had to intervene constantly.

The AI Solution: This is where the Architect-Builder model becomes revolutionary. The AI architect interprets ambiguous contract language and designs the approach. Then it hands clear instructions to the rule engine builder for execution.

Example: A contract says revenue should be recognized "when customer achieves meaningful value." The AI interprets this based on context, industry standards, and similar contracts, then creates specific rules: "Recognize 50% on go-live, 50% when customer processes 1,000 transactions."

The winning architecture: You're the pilot, AI is your co-pilot

This is the breakthrough moment. We're not choosing between AI and rule engines – we're combining them into something revolutionary.

You describe your revenue recognition approach in plain English. AI designs the logic. Rule engines execute with mathematical perfection. You maintain complete control while the system handles infinite complexity at scale. This isn't theory. I'm building this right now, and the results are mind-blowing.

Here's how the new model works:

- You Own the Logic: Your finance team defines the revenue recognition approach based on your business model, not generic vendor rules

- AI Writes the Rules: LLMs translate your plain English requirements into executable rule syntax instantly

- Rules Execute Precisely: The rule engine processes contracts with mathematical accuracy and complete audit trails

- AI Maintains and Optimizes: Continuous monitoring refines rules and suggests improvements as your business evolves

This gives you something revolutionary: complete control over your revenue recognition logic, without needing to become a programmer.

You're not dependent on external CPAs to interpret your contracts. You're not waiting for vendor updates when your business model changes. You're not stuck with "close enough" approximations of your actual requirements.

You have a system that thinks like your business, executes like a machine, and adapts as fast as you can speak.

Why this matters right now for finance

The finance function is at an inflection point. The choice isn't between manual and automated processes – it's between systems you control and systems that control you.

Companies using rule engines are becoming masters of their own revenue recognition destiny. They adapt instantly to new business models, handle complex contract terms, and maintain complete audit trails without begging vendors for updates or paying external CPAs to reinterpret their own contracts.

Meanwhile, capable finance teams locked into out-of-the-box solutions find themselves in a frustrating position they didn’t anticipate. When their business evolves, they fill out change request forms and wait. When regulations change, they cross their fingers and hope their vendor’s priorities align with theirs. You’ve been systematically moved away from strategic finance work toward vendor relationship management.

And here's the kicker: AI has just eliminated every traditional barrier to rule engine adoption. You no longer need technical expertise to write rules or maintain complex logic. The control advantage is now accessible to any finance team willing to take it.

Revenue recognition is just the beginning. This same control-versus-dependence pattern will determine winners and losers across every complex accounting process – lease accounting, hedge accounting, consolidations, transfer pricing.

The question isn't whether automation will transform finance. The question is whether your team will be in the driver's seat or spending your career managing vendor relationships while the actual accounting work gets outsourced away.

The revolution in finance isn't about better software. It's about who controls the logic that runs your business. Now that AI has eliminated the traditional downsides of rule engines, the teams who understand this control distinction will dominate their industries while others remain dependent on external gatekeepers.

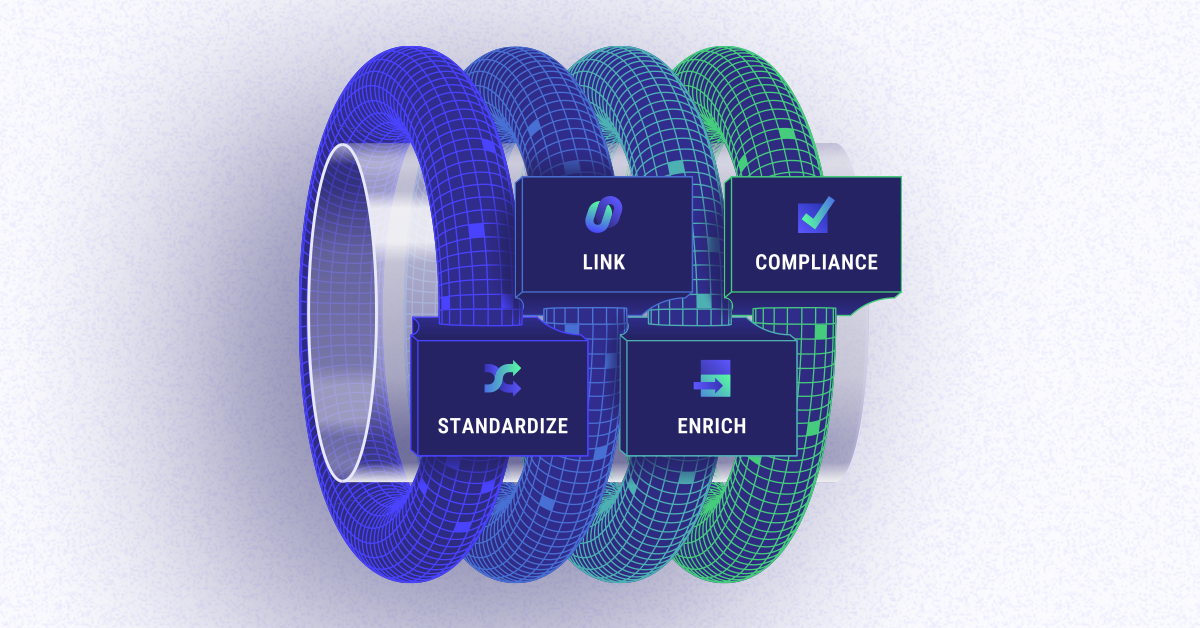

See how Leapfin works

Get a feel for the ease and power of Leapfin with our interactive demo.